Life Insurance Policy Info You Did Not Know |

Article by-Hodges Guy

Tragedy can strike at the most uninvited times. Leaving your family without money or benefits is out of the question. Life insurance helps take care of what you can't when you're no longer around. More and more people take on a life insurance policy everyday to help their families through a time of crisis. There are many questions that you may need to answer and companies to interview for your future life insurance. The tips below are there to help you make the right decisions.

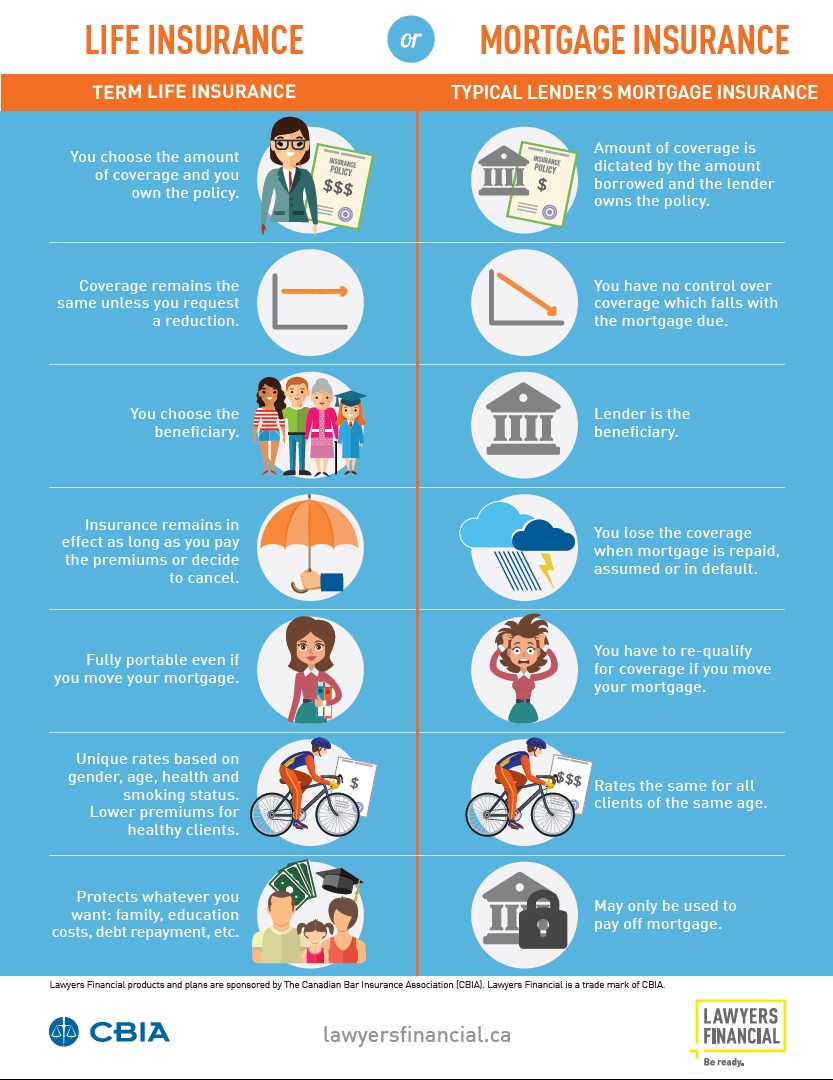

Understand the types of life insurance available before making a decision on which to purchase. Most insurance policies focus on Term Life or Whole Life and knowing the difference is key. Bear in mind that with both of these types of policy, they can be tailored to your specific needs and situations. Do your homework.

A term life insurance is cheaper but it will not last. Recommended Web-site purchase term life insurance because of its lower cost. But traditional life insurance policies are a permanent investment, as well as an asset that can be borrowed against. Term life insurance on the other hand, only lasts when you are making payments.

When considering life insurance, be sure to look outside what your employer provides. While this may be easier and you may assume they are providing what is best for you, it is not always the case. Make sure that they rates and coverage are competitive or better than other offers that you could go with.

Before shopping for life insurance, put together a budget to project the amount of financial coverage you might need. Include your mortgage payoff, college costs for the kids, money to pay any other large debt obligations, funds to cover funeral and medical expenses and enough money to supplement your remaining spouse's retirement funds.

Even if you do not provide an income to your family, a life insurance policy might be worth considering. If you are a stay at home parent, there would be costs associated with child care and house upkeep in the event of your death. Funeral costs can also be expensive. Talk to an insurance expert to decide how much insurance is right for you.

If you need more life insurance, try to get a rider instead of getting a new insurance policy. These are amendments or additions to existing insurance policies. They tend to be less expensive than purchasing a second insurance plan. If http://www.mondaq.com/canada/x/746816/Insurance/Ho...lly+Need+Third+Party+Liability is healthy, it is advisable for them to try to buy a second insurance policy, as it may be cheaper than a rider.

When you are looking in to life insurance, always remember to research the quality of the company. There are rating agencies for rating insurance companies, so check them out to help you decide which company offers what you need yet has a solid financial background and has been able to meet all its financial obligations.

If you want to have some control and decision-making power over the money you invest in your life insurance, consider a variable, universal life insurance policy. With these policies, you have the ability to invest part of your premium in the stock market. Depending on how wisely you invest this portion of your money, your death benefit can increase over time. You should have some knowledge of the stock market if purchasing this type of policy or enlist the aid of a financial professional.

If at all possible, you should try to avoid start-up companies and there life insurance policies. You just never know when a new company is going to bite the dust and take your investment with it. The insurance market is very unpredictable and there is a chance however small that you could be a casualty.

Before you purchase life insurance, determine what kind of coverage you will need. The internet contains a large number of online calculators that can help you figure out the amount of money your spouse or children would need in the event of your death. Using this type of tool will help ensure that you are purchasing only what you have to have.

If you have minor children, purchase enough life insurance to offset their expenses until adulthood. The loss of your income could have a significant impact on your children's lives, and life insurance can help close the financial gap. This affects not only day-to-day expenses, but also those larger ones like college costs.

To obtain your life insurance policy in the quickest and easiest manner, first decide the way in which you are going to purchase your policy. There are several different options, such as purchasing directly from the insurance company, or going through a financial planner or insurance agent. Deciding beforehand will save you time.

5 smart ways to save premium costs on your life insurance purchase

5 smart ways to save premium costs on your life insurance purchase Life insurance is undoubtedly one of the best possible ways to secure the future of your loved ones when you are no longer around. Your insurer makes sure to take care of your family in your absence and makes sure to provide them with the required financial support in days of need. As it involves your family, you must be smart enough to make this important investment of your life and also consider numerous factors to save on the premium costs. To help you better, here are some important tips to keep in mind when buying a life insurance cover. By following these tips, you can certainly make a correct decision and arrive at the right choice.

Never lie on your life insurance applications. Trying to hide smoking or other negative conditions or circumstances could cause your claim to be denied if something happens to you, because insurers do investigate if claims are suspicious. Your dependents could lose out on the money they need to cover expenses if you are not up-front with the insurance company.

When it is time to purchase life insurance, try to educate yourself on the many products available on the market, so that you can make a wise choice. Read your entire policy carefully and ask your insurance representative to explain everything that you don't understand. If you are uncomfortable with the policy, it is typical to have a ten day cancellation period, so that you may cancel the contract without penalty.

Did you know it's possible to use your life insurance to help fund your retirement? One such policy is a return of premium term life. You pay premiums for a set amount of time, then you get all of that money back when the policy expires, if you are still living. This can fund that special trip you dreamed of for your retirement!

Find out how to pay less for more when it comes to life insurance. Many companies give their customers a price break if they choose a certain amount of coverage. For example, you may pay less money for a policy that is worth $25,000 more than the one you were originally looking at.

You've realized by now that choosing the best life insurance policy for you and your family doesn't have to be difficult. Just use what you've learned from this article and you'll be able to find a policy that's right for you. Take care of your loved ones by keeping these tips in mind.

| Комментировать | « Пред. запись — К дневнику — След. запись » | Страницы: [1] [Новые] |