Exactly How To Expand Your Portfolio With A Gold Individual Retirement Account |

Content author-Alford Termansen

Numerous capitalists are looking to gold as a method to expand their portfolios. These capitalists usually do this by rolling over a portion of their IRA or company-managed 401( k) into a gold individual retirement account.

There are a few essential points to bear in mind when purchasing a gold IRA, such as selecting a custodian. The right option can make certain the security of your financial investments, as well as stay clear of future problems.

Money Metals Exchange

Cash Metals Exchange is a credible company that provides clients a variety of silver and gold bullion items. They supply coins, bars, fractionals, as well as starter kits for both beginners and also skilled investors.

The firm offers real-time pricing as well as does not conceal prices or mark them up for their own gain. This enables clients to buy rare-earth elements without surprises when the prices increase later on.

Clients can acquire gold bullion making use of the site or by phone. They can additionally use a wire transfer, check, credit scores or debit card, as well as cryptocurrencies.

Additionally, customers can send their purchased silver or gold to a high-security vault for safekeeping. This service prices just 0.46% per year, based upon the worth of the things, and also capitalists maintain complete control over their metals.

Cash Metals Exchange likewise provides a customer assistance team that is available to address all your questions and problems. They can be gotten to using phone or email Monday via Friday.

Gold Bullion

A Gold individual retirement account is a special pension that permits you to invest in physical gold bullion and also coins. It's a fantastic method to protect your cost savings versus economic concerns such as rising cost of living as well as the buck rise.

There are lots of firms that supply this kind of IRA. Related Site can discover a reliable one by looking online and also analysis testimonials from other clients.

You can select from a large range of coins as well as bars, consisting of qualified grades, semi-numismatic and gold IRA-approved. Their products are likewise really secure and also protected and also they have a solid track record of favorable client feedback.

The business has a group of experts that have years of experience in the rare-earth elements industry. They are committed to offering the best quality of service to their customers. They likewise use totally free safe and secure and insured shipment.

Monetary Gold

If you're seeking to purchase precious metals, you ought to think about opening up a gold individual retirement account. This is an excellent method to expand your portfolio as well as protect versus inflation.

The very best gold IRA firms have a well-staffed team of individual retirement account experts that can answer your inquiries and also help you through the process of establishing your account. They additionally obtain exceptional testimonials from clients on the numerous platforms we covered in this post.

You can open a gold IRA with Monetary Gold as well as pick from a vast array of IRS-approved coins, bars, and also bullion to buy. Unlike various other Individual Retirement Accounts, Monetary Gold permits you to get physical gold and silver with an affordable due to the fact that the intermediary is removed.

You can open a gold individual retirement account with either a traditional or Roth IRA. A conventional gold individual retirement account uses pre-tax dollars and also accepts rollovers from various other retirement accounts, while a Roth gold IRA utilizes after-tax money and supplies no immediate tax benefit.

Self Directed

A Self Directed Gold individual retirement account is a pension that enables people to purchase precious metals. These accounts have comparable payment as well as earnings constraints to conventional Individual retirement accounts, but they also permit financiers to diversify their portfolio.

Unlike typical Individual retirement accounts, which limit your capability to invest in paper assets, a gold individual retirement account lets you select the sorts of investments you want to make. This freedom of choice is specifically helpful for those seeking to hedge their profile versus unpredictable markets.

Nevertheless, https://writeablog.net/william69armand/right-here-...-individual-retirement-account is important to note that a gold IRA should be saved in a safe depository. just click the following webpage , there are several IRS-approved depositories in the U.S

. When you have actually selected a custodian, you'll need to set up your account. This can be done online, but it's best to book a consultation with a credible firm. This will certainly help ensure you don't wind up shedding cash if your administrator or vault declare bankruptcy. Having this added layer of protection will certainly make certain that you can maintain your cash risk-free for the long run.

|

Метки: Gold IRA Company Regal Assets Gold Investment Companies Precious Metals Gold Investment Kit Silver Investment Self Directed IRA Gold Precious Metals IRA Company |

Just how to Obtain a Gold Individual Retirement Account |

Authored by-Thorhauge Berry

The Gold IRA is an outstanding method to diversify your investment profile and also safeguard on your own versus sudden stock market declines. It is additionally a fantastic bush against rising cost of living as well as various other economic dangers.

A Gold individual retirement account is a simple and also tax-free means to invest in precious metals. Nevertheless, it is very important to look around for a reputable firm.

Money Metals Exchange

If you wish to buy gold bullion for your individual retirement account, Money Metals Exchange might be a great option. This business is an independent rare-earth elements dealership that functions straight with your IRA custodian to acquire the appropriate products for you.

Money Metals Exchange additionally supplies protected storage space choices for your precious metals. They have a partnership with the Delaware Depository to give secure storage space for their clients. They have a high-security structure with UL Class 3 safes and a Lloyds of London insurance policy that will certainly protect your investment.

The business has a credibility for giving affordable rates and outstanding client service. They are a member of the Bbb as well as have a great score on their web site.

They offer a number of one-of-a-kind offerings for their customers, consisting of the Monthly Saving Plan as well as financings against your rare-earth elements. They additionally have a conformity department that checks that all employees are operating in line with guidelines.

Augusta Prized Possession Metals

If you're searching for a trustworthy firm that supplies a self-directed gold individual retirement account, Augusta Valuable Metals is an exceptional option. They supply transparent rates, a good selection of rare-earth elements, as well as totally free insured delivery.

The company additionally organizes individual retirement account accounts, custodianship, and also storage space in IRS-approved vault locations. Furthermore, Augusta Precious Metals offers totally free 1-on-1 investing guidance from Harvard financial expert Devlyn Steele.

Buying gold and silver bullion is among the very best means to diversify your wide range. You can buy silver and gold coins, bars, rounds, as well as extra from Augusta Priceless Metals.

This reliable gold business has thousands of pleased consumers and supplies lifetime assistance, monetary suggestions, and precious metals profile management. They offer a high quality experience throughout the process, consisting of an initial 1-on-1 investing webinar with Devlyn Steele.

Lear Resources

Lear Resources is one of the first and most revered companies in the gold and precious metals industry. Established in 1997, it has head workplaces in Los Angeles and also aims to offer clients with a quality investment experience.

https://www.investopedia.com/open-a-roth-ira-for-someone-else-4770855 has a well-informed staff that can answer your concerns concerning precious metals, rare-earth elements, as well as gold. They have links to credible companies in this field and likewise can provide understanding on the current cost patterns and additionally the very best time to acquire.

On top of that, they charge a practical $180 yearly membership fee that covers shipment, custodian tracking, and quarterly records. This charge is worth the expense since it provides consistent access to your account as well as quarterly statements that are physically mailed to your residence.

On top of that, they have a highly well-informed consumer support team that can answer your concerns and also aid you with your precious metals IRA or SDIRA. They additionally have a 24-hour online account accessibility to keep you notified of your profile's performance.

American Hartford Gold

American Hartford Gold is a family-owned as well as operated service that aids you purchase rare-earth elements. They have actually remained in the market for over a years as well as are concentrated on client service.

They use competitive rates as well as a cost-free 25-page instructional overview for financiers. They additionally supply 401(k) rollover assistance.

If https://squareblogs.net/brice18elijah/just-how-to-expand-your-profile-with-a-gold-ira intend to take advantage of your retired life savings, buying a Gold IRA can be an excellent method to do so. These are tax-deferred and can offer significant development over time.

simply click the up coming internet page of purchasing a Gold individual retirement account is that you can liquidate your financial investment at any moment. This alternative isn't located in lots of gold individual retirement account companies, so it is a fantastic advantage to look into when you are thinking about purchasing rare-earth elements with your IRA.

Presently, American Hartford Gold has an A+ ranking from the BBB as well as has approximately 4.9 celebrities out of 5 on Depend on Pilot. They are just one of the better-rated companies in the industry and also clients have just good ideas to say regarding their services.

|

Метки: Gold IRA Company Regal Assets Gold Investment Companies Precious Metals Gold Investment Kit Silver Investment Self Directed IRA Gold Precious Metals IRA Company |

Exactly How To Expand Your Portfolio With A Gold IRA |

Article written by-Leach Herrera

Many investors are looking to gold as a method to expand their portfolios. These capitalists frequently do this by rolling over a portion of their individual retirement account or company-managed 401( k) into a gold individual retirement account.

There are a couple of crucial things to bear in mind when purchasing a gold IRA, such as choosing a custodian. The ideal choice can ensure the safety of your financial investments, in addition to prevent future issues.

Cash Metals Exchange

Money Metals Exchange is a reliable firm that uses clients a range of silver and gold bullion items. They provide coins, bars, fractionals, and also starter kits for both beginners and experienced capitalists.

The business provides real-time rates and also doesn't hide rates or mark them up for their very own gain. This permits clients to purchase rare-earth elements without shocks when the costs go up later on.

click for info can purchase gold bullion utilizing the website or by phone. They can also use a cord transfer, check, credit or debit card, and cryptocurrencies.

In addition, customers can send their purchased gold or silver to a high-security vault for safekeeping. This service expenses just 0.46% per year, based on the value of the things, and capitalists keep complete control over their metals.

Cash Metals Exchange additionally offers a consumer assistance group that is readily available to address all your inquiries as well as issues. They can be gotten to by means of phone or e-mail Monday through Friday.

Gold Bullion

A Gold individual retirement account is an unique pension that enables you to purchase physical gold bullion as well as coins. It's a great means to protect your cost savings versus financial problems such as rising cost of living and the dollar surge.

There are lots of business that supply this sort of IRA. You can locate a trusted one by browsing online and analysis evaluations from other customers.

You can select from a variety of coins and bars, including certified qualities, semi-numismatic as well as gold IRA-approved. Their products are likewise extremely secure and also safe and also they have a solid performance history of positive customer feedback.

The business has a group of professionals that have years of experience in the precious metals sector. They are committed to providing the best quality of service to their clients. They also provide cost-free secure and also insured shipment.

Monetary Gold

If you're wanting to buy rare-earth elements, you should consider opening up a gold individual retirement account. This is an excellent method to diversify your profile as well as secure versus inflation.

The best gold IRA firms have a well-staffed group of IRA specialists that can answer your inquiries and assist you with the procedure of establishing your account. They likewise get excellent reviews from customers on the various platforms we covered in this post.

You can open up a gold IRA with Monetary Gold as well as choose from a large range of IRS-approved coins, bars, and bullion to purchase. Unlike http://loan868steven.xtgem.com/__xt_blog/__xtblog_...ra?__xtblog_block_id=1#xt_blog , Monetary Gold enables you to get physical gold and silver with a low cost due to the fact that the intermediary is gotten rid of.

You can open a gold individual retirement account with either a traditional or Roth IRA. A conventional gold IRA utilizes pre-tax dollars as well as authorizes rollovers from other retirement accounts, while a Roth gold IRA uses after-tax cash as well as provides no prompt tax benefit.

Self Directed

A Self Directed Gold IRA is a retirement account that enables individuals to buy rare-earth elements. These accounts have similar contribution and also revenue constraints to conventional Individual retirement accounts, however they additionally permit investors to diversify their profile.

Unlike conventional IRAs, which limit your ability to buy paper properties, a gold individual retirement account lets you select the kinds of investments you wish to make. This liberty of option is specifically useful for those seeking to hedge their profile against unpredictable markets.

Nevertheless, it is necessary to note that a gold IRA should be kept in a secure vault. https://squareblogs.net/julianne56sade/below-are-t...-individual-retirement-account is, there are many IRS-approved depositories in the united state

. As soon as you have chosen a custodian, you'll need to set up your account. This can be done online, yet it's best to reserve an appointment with a credible firm. This will certainly aid ensure you do not wind up shedding money if your manager or vault declare bankruptcy. Having this added layer of security will certainly guarantee that you can keep your cash risk-free for the long haul.

|

Метки: Gold IRA Company Regal Assets Gold Investment Companies Precious Metals Gold Investment Kit Silver Investment Self Directed IRA Gold Precious Metals IRA Company |

Here Are The Advantages Of A Gold Individual Retirement Account |

where is money metals exchange located by-Munkholm Tran

A gold individual retirement account supplies a means to diversify your financial investment portfolio with properties that smooth out volatility and protect wealth. It additionally offers economic protection in the event of unforeseen calamities.

Nevertheless, prior to you open up a gold individual retirement account, ensure to inspect its qualifications. It should be signed up as well as have all the proper licenses and also insurance policy to secure your money.

Money Metals Exchange

If you're seeking a trustworthy dealer to purchase or offer gold and also other rare-earth elements, Cash Metals Exchange deserves taking a look at. It supplies protected storage alternatives and a selection of gold bullion items.

Buying physical silver and gold is basic on their internet site. They provide coins, rounds, fractionals and also bars in different weights and prices. They also offer a buyback program that accepts your gold, silver and also platinum.

Their customer support is readily available by phone, email and also live conversation. They're open Monday with Friday from 7:00 AM to 5:30 PM MT.

They likewise have a client reference program. New customers that refer a good friend can get a complimentary one-ounce silver American Eagle coin, no matter the amount they have actually spent on their initial order.

They accept a variety of settlement techniques, including financial institution cable transfer, bitcoin, credit scores or debit card, PayPal, and check. Nevertheless, a 4% processing charge applies to purchases made with PayPal or credit cards.

Gold Bullion

Gold is among the most steady investments and has actually exceeded supplies as well as other possessions. It is additionally an excellent bush versus rising cost of living, which can trigger a decline in the worth of your buck.

Buying jm bullon is readily available with traditional as well as Roth IRAs. Contributions are tax-deductible and also withdrawals are without tax obligations when you get to old age.

Prior to https://squareblogs.net/doria8raymundo/right-here-are-the-advantages-of-a-gold-ira purchase gold, there are a few things to consider. First, you need to discover a custodian that will save and also guarantee your gold. The custodian must be approved by the IRS and has to have safe and secure storage centers, which might consist of a secured depository.

The custodian might charge a yearly upkeep fee, which can vary from $50 to $150 per year, depending upon the dimension of your account. In addition, the custodian might add a markup to the rate of the gold.

Monetary Gold

Gold IRAs are a prominent method to expand your financial investment portfolio, bush against rising cost of living, and produce a safe haven for retired life savings. These Individual retirement accounts enable capitalists to buy as well as buy internal revenue service authorized gold coins, bullion, as well as bars.

As the economic situation remains to degrade and also stock markets have actually dropped, many people are seeking alternative financial investments that will help them hedge versus these monetary dangers. Precious metals have a near-zero relationship with stocks and bonds, which is why several investors are relying on gold in order to lower their danger direct exposure.

There are several steps to getting started with a gold individual retirement account, consisting of opening up an account, choosing a custodian and also vault, and acquiring physical gold. Thankfully, lots of custodians and depositories that focus on gold Individual retirement accounts make the process fast and simple, so you can jump on your way to attaching gold within a few weeks.

Self Directed Gold

The Gold IRA is a particular kind of self-directed pension that enables you to invest in rare-earth elements as well as other alternative assets. This option uses some of the same tax benefits as a typical IRA yet supplies an extra versatile approach to retirement preparation.

When purchasing precious metals with a gold IRA, you must always consider your own financial investment goals. Having the ideal sort of direct exposure to these steels can help in reducing your profile volatility, create a hedge versus rising cost of living and include a chance for resources gratitude.

You can buy IRA-approved gold coins, bars and bullion with your IRA funds via an authorized supplier or a vault. You'll intend to make sure that the dealership you select is a reliable one as well as can satisfy every one of the internal revenue service policies regarding holding rare-earth elements in your IRA.

|

Метки: Gold IRA Company Regal Assets Gold Investment Companies Precious Metals Gold Investment Kit Silver Investment Self Directed IRA Gold Precious Metals IRA Company |

The Advantages And Disadvantages Of A Gold IRA |

Article writer-Hall Amstrup

If you have an interest in purchasing gold, a gold IRA may be an excellent option for you. Yet prior to you enter, make sure to do your research.

A gold individual retirement account needs the same IRS guidelines as various other retirement accounts, consisting of a qualified depository as well as custodian. It also comes with a variety of charges, yet these are typically a lot less than the ones on conventional IRA accounts.

Cash Metals Exchange

If you wish to diversify your retired life savings and also bush against volatility, after that purchasing substantial properties is a great concept. https://investmentu.com/is-silver-a-good-investment/ is the premier safe-haven hard asset and also has done well throughout five of the past 7 economic downturns.

You can acquire gold bars in lots of dimensions ranging from 1 gram up to 400 ounces. You ought to try to find bars that are packaged in assays, plastic product packaging that verifies bench's weight and also purity. These bars are often tamper-evident and also will secure versus counterfeiting.

Cash Metals Exchange supplies a wide variety of silver as well as gold items at affordable costs and excellent customer care. They likewise offer a monthly payment plan that allows you lock in your rare-earth elements rate monthly.

Gold Bullion

If you're aiming to diversify your retired life portfolio with a smart investment that offers strong growth possibility and also acts as an efficient bush versus inflation, you should take into consideration investing in a gold individual retirement account. However, prior to you invest in this possession course, you need to familiarize on your own with the advantages and disadvantages.

The IRS has actually approved certain precious metals as well as forms of bullion for Individual retirement accounts, consisting of bars, coins as well as bullion conference details excellence requirements. Capitalists must make use of a custodian for these transactions.

Custodian fees differ, however are generally higher than those for conventional IRAs. They might consist of a single account configuration cost, annual as well as assorted purchase charges as well as broker agent charges. These prices can add up to several thousand dollars for an initial financial investment. Storage space and insurance charges additionally can amount to a significant sum over time.

Monetary Gold

Rare-earth elements use a steady as well as safe and secure property that can help you expand your retired life portfolio. On top of that, they can additionally shield you from rising cost of living and other threats that influence the worth of your financial investments.

A Gold individual retirement account is a tax-deferred interest-bearing account that permits you to invest in precious metals, such as silver and gold. https://s3.us-west-2.amazonaws.com/goldinvesting/investment-in-gold-stocks.html offers some tax benefits, such as the capability to deduct payments as well as tax-free withdrawals throughout retirement.

A gold individual retirement account works just like a traditional or Roth IRA In a conventional IRA, you contribute with pretax bucks, as well as your distributions are tired when you withdraw them during retirement. A Roth IRA, on the other hand, utilizes after-tax dollars to money the account, and withdrawals are tax-free during retirement.

Self Directed Gold Individual Retirement Account

The Self Directed Gold IRA is a fantastic means to expand your retirement profile. It can be a tax-favored alternative to traditional Individual retirement accounts invested in supplies, bonds and mutual funds.

Rare-earth elements like gold and silver are a safe haven for investors who want to expand their retired life cost savings. They can assist hedge against rising cost of living, securities market volatility and shield against money deflation.

To get going with a gold individual retirement account, you require to locate an IRS-approved custodian to open your account as well as buy precious metals on your behalf. The custodian will certainly also collaborate with an accepted vault to save your precious metals securely as well as securely.

Gold IRA Spending

If you're looking for an option to typical retirement accounts, a gold individual retirement account could be best for you. These self-directed accounts permit you to invest in physical gold, silver and platinum.

These precious metals use diversity and also tax benefits. However, they can also be pricey.

Besides broker agent fees as well as account configuration costs, capitalists should pay storage space prices. Custodians may additionally charge markups for sale costs, and they might also charge a buy-back fee when you offer your financial investment.

When selecting a gold individual retirement account company, it's important to recognize the fees and minimum financial investment amounts they charge. These expenses are a great indication of the worth you receive from their solutions.

|

Метки: Gold IRA Company Regal Assets Gold Investment Companies Precious Metals Gold Investment Kit Silver Investment Self Directed IRA Gold Precious Metals IRA Company |

Right Here Are The Advantages Of A Gold Individual Retirement Account |

Authored by-Britt Norton

A gold individual retirement account provides a means to diversify your financial investment portfolio with possessions that ravel volatility and maintain wealth. It additionally gives financial security in case of unpredicted disasters.

Nonetheless, before you open a gold IRA, make certain to inspect its qualifications. It ought to be signed up and have all the correct licenses and insurance to secure your cash.

Cash Metals Exchange

If you're seeking a trustworthy dealer to acquire or offer gold as well as various other precious metals, Money Metals Exchange deserves taking a look at. It offers safe and secure storage space alternatives as well as a range of gold bullion products.

Getting physical gold and silver is straightforward on their website. They provide coins, rounds, fractionals as well as bars in different weights and also rates. simply click the up coming website page supply a buyback program that approves your gold, silver as well as platinum.

Their customer support is available by phone, email and live conversation. They're open Monday with Friday from 7:00 AM to 5:30 PM MT.

They likewise have a consumer reference program. New customers who refer a pal can receive a totally free one-ounce silver American Eagle coin, regardless of the quantity they've spent on their very first order.

They approve a variety of settlement methods, including financial institution wire transfer, bitcoin, credit score or debit card, PayPal, as well as check. Nonetheless, a 4% processing cost relates to transactions made with PayPal or credit cards.

Gold Bullion

Gold is just one of the most stable financial investments and has outshined supplies as well as other properties. It is additionally an excellent hedge against inflation, which can cause a decline in the worth of your dollar.

Purchasing gold bullion is available with typical as well as Roth IRAs. Contributions are tax-deductible as well as withdrawals are free of taxes once you get to old age.

Before you purchase gold, there are a few points to consider. Initially, you require to discover a custodian who will save and also insure your gold. helpful site should be accepted by the IRS and also has to have secure storage space facilities, which may include a secured depository.

The custodian may bill a yearly maintenance fee, which can range from $50 to $150 each year, relying on the size of your account. Additionally, the custodian may add a markup to the rate of the gold.

Monetary Gold

Gold IRAs are a preferred means to diversify your financial investment portfolio, bush versus inflation, and also develop a safe house for retired life financial savings. These Individual retirement accounts permit capitalists to buy and also invest in internal revenue service accepted gold coins, bullion, as well as bars.

As the economic climate remains to wear away and also securities market have actually fallen, many people are looking for option investments that will certainly help them hedge versus these financial dangers. Rare-earth elements have a near-zero connection with supplies as well as bonds, which is why numerous investors are counting on gold in order to minimize their risk exposure.

There are numerous actions to beginning with a gold individual retirement account, consisting of opening an account, picking a custodian and also depository, as well as buying physical gold. The good news is, several custodians as well as depositories that specialize in gold Individual retirement accounts make the procedure fast and very easy, so you can hop on your way to investing with gold within a few weeks.

Self Directed Gold

The Gold individual retirement account is a particular kind of self-directed retirement account that allows you to invest in rare-earth elements and other alternate possessions. This option uses a few of the exact same tax benefits as a standard individual retirement account however gives a much more versatile approach to retirement preparation.

When buying precious metals with a gold individual retirement account, you need to constantly consider your very own investment purposes. Having the right type of exposure to these metals can help in reducing your profile volatility, produce a bush versus rising cost of living and also include an opportunity for resources gratitude.

You can acquire IRA-approved gold coins, bars and also bullion with your IRA funds with a certified dealership or a depository. You'll intend to guarantee that the dealership you choose is a credible one as well as can satisfy all of the internal revenue service laws pertaining to holding precious metals in your individual retirement account.

|

Метки: Gold IRA Company Regal Assets Gold Investment Companies Precious Metals Gold Investment Kit Silver Investment Self Directed IRA Gold Precious Metals IRA Company |

Below Are The Benefits Of A Gold Individual Retirement Account |

Content author-Corcoran Ludvigsen

A gold IRA provides a method to diversify your financial investment portfolio with possessions that ravel volatility and protect wealth. It additionally provides economic protection in case of unforeseen disasters.

However, prior to you open up a gold individual retirement account, see to it to examine its certifications. It should be registered and also have all the correct licenses and insurance coverage to shield your money.

Cash Metals Exchange

If you're looking for a trustworthy dealership to get or sell gold as well as various other precious metals, Money Metals Exchange deserves having a look at. https://s3.us-west-2.amazonaws.com/goldinvesting/i...ng-gold-a-good-investment.html provides safe and secure storage choices and a range of gold bullion products.

Purchasing physical silver and gold is basic on their internet site. They supply coins, rounds, fractionals as well as bars in various weights and costs. They likewise provide a buyback program that accepts your gold, silver and also platinum.

Their client service is readily available by phone, e-mail as well as live chat. They're open Monday through Friday from 7:00 AM to 5:30 PM MT.

They additionally have a consumer reference program. New consumers who refer a pal can get a cost-free one-ounce silver American Eagle coin, despite the amount they've invested in their very first order.

They approve a variety of repayment techniques, consisting of financial institution cable transfer, bitcoin, credit or debit card, PayPal, and check. However, a 4% processing fee puts on deals made with PayPal or charge card.

Gold Bullion

Gold is among one of the most secure investments and also has actually outmatched stocks as well as other assets. It is additionally a great bush versus inflation, which can cause a decrease in the worth of your buck.

Buying gold bullion is available with conventional as well as Roth IRAs. Contributions are tax-deductible as well as withdrawals are without tax obligations once you reach retirement age.

Prior to https://www.fool.com/investing/2022/04/19/3-unstop...ocks-to-buy-in-2022-and-beyon/ purchase gold, there are a few things to think about. First, you require to find a custodian who will keep as well as guarantee your gold. The custodian must be accepted by the IRS and has to have safe and secure storage facilities, which may include a safeguarded vault.

The custodian may bill a yearly maintenance cost, which can vary from $50 to $150 annually, relying on the size of your account. Additionally, the custodian may add a markup to the rate of the gold.

Monetary Gold

Gold IRAs are a popular method to expand your financial investment portfolio, bush against rising cost of living, and produce a safe haven for retirement cost savings. These Individual retirement accounts permit capitalists to buy and invest in internal revenue service authorized gold coins, bullion, as well as bars.

As the economic situation remains to deteriorate and stock markets have actually fallen, many individuals are looking for option financial investments that will certainly help them hedge against these economic threats. Rare-earth elements have a near-zero correlation with stocks and bonds, which is why numerous financiers are resorting to gold in order to minimize their threat direct exposure.

There are a number of actions to starting with a gold IRA, including opening up an account, selecting a custodian and also vault, as well as purchasing physical gold. Thankfully, lots of custodians as well as depositories that specialize in gold Individual retirement accounts make the process fast and easy, so you can hop on your means to attaching gold within a couple of weeks.

Self Directed Gold

The Gold IRA is a certain sort of self-directed pension that enables you to purchase precious metals and various other alternative possessions. This choice supplies several of the same tax benefits as a conventional IRA yet gives a much more adaptable technique to retired life preparation.

When buying rare-earth elements through a gold individual retirement account, you ought to constantly consider your own financial investment purposes. Having the right kind of direct exposure to these metals can help reduce your profile volatility, produce a hedge against rising cost of living as well as include a possibility for funding recognition.

You can purchase IRA-approved gold coins, bars as well as bullion with your IRA funds via a certified dealership or a depository. You'll want to make certain that the supplier you select is a trustworthy one and can satisfy all of the IRS laws pertaining to holding rare-earth elements in your individual retirement account.

|

Метки: Gold IRA Company Regal Assets Gold Investment Companies Precious Metals Gold Investment Kit Silver Investment Self Directed IRA Gold Precious Metals IRA Company |

Option Investments - What You Need To Know |

What Are Alternative Investments written by-Obrien Bager

Throughout the last decade, Choice Investments have come to be a progressively fundamental part of the monetary landscape. This includes hedge funds, personal equity, as well as uncommon antiques.

Exclusive equity

Buying exclusive equity as an alternative financial investment can be a profitable selection for those seeking a high return. But it additionally features some dangers. The financial investment might require a long holding duration and is relatively illiquid.

Personal equity investment company have different financial investment methods, as well as they may use different techniques for every financial investment. For instance, an exclusive equity fund might purchase all the shares of an underperforming firm, streamline it, and afterwards change elderly monitoring. After that, it could try to market it at a greater value. This raises the worth of the investment as well as likewise enhances the return on the money spent.

Exclusive equity investment company can additionally make use of financial obligation to obtain a company. This enables the business to obtain even more funding, yet the financial debt comes with additional danger.

https://squareblogs.net/greg8chassidy/below-are-mi...rior-to-you-buy-hedge-finances

Unlike mutual funds, hedge funds purchase a variety of different assets. These asset classes include stocks, currencies, realty, and also assets. The objective of hedge funds is to decrease volatility and optimize capitalist returns.

Alternative Investments are typically much less correlated with stock and bond markets, and they may use much better liquidity as well as reduced minimum investment demands. These are great additions to a lasting profile. However, financiers should meticulously consider their alternatives.

Different investments can be riskier than typical investments, and might enforce considerable charges. Nevertheless, proceeded product development might enhance access and increase the investor base.

Along with traditional property courses, alternate investments are additionally much less prone to rate of interest adjustments and also rising cost of living. Commodity prices can be an essential diversifier, as they are connected to provide as well as demand and government plan.

https://blogfreely.net/jesse29elmer/choice-investments-what-you-need-to-know

Purchasing art as a different financial investment is ending up being an increasing number of popular. It is a wonderful method to diversify your portfolio. It is likewise a way to add individuality and enjoyable to your office or home.

It has been known to exceed standard investments such as equities and bonds, however it is also subject to the very same dangers as other possession classes. In order to take advantage of art as an investment, you need to have a good approach.

Purchasing art has actually become prominent for several factors. It is inexpensive as well as can give diversity to a profile. Unlike other property classes, art tends to retain its value in time. It is also an optimal financial investment in good times and bad.

However, it is essential to bear in mind that investing in art as an alternative investment is not without its risks. It calls for a certain amount of commitment as well as a high threat resistance. It is likewise very illiquid, which makes it challenging to trade. Additionally, the cost of art can be diminished in time.

Unusual antiques

Purchasing rare collectibles is an alternative financial investment that can be exciting and also gratifying. However before you start investing, ensure that you comprehend the risks included.

Antiques are illiquid, suggesting that they don't trade on a public market. As a result of this, there's no assurance that you'll have the ability to offer them at a greater rate than they cost you. This means that your revenue is mosting likely to depend upon the value of the thing you're accumulating, the number of prospective customers, and also the market's capacity to produce demand.

Some collectibles can come to be expensive as well as illiquid if you don't understand just how to buy low as well as market high. This is why it's an excellent suggestion to have a specialist assess the thing prior to you acquire it.

Antiques are a great hedge versus inflation, considering that they are usually valued higher than they are when they are first bought. Buying antiques can additionally diversify your profile.

Cryptocurrency

Purchasing cryptocurrencies has actually been an interesting choice for numerous. It has the possible to help you gain a decent return while lowering your total profile threat. Nevertheless, before you can make the decision to invest in this brand-new fad, you need to know even more about it.

Cryptocurrency is a digital money that is protected by cryptography as well as a dispersed journal. These technologies enable you to store and exchange digital possessions without a middleman. Furthermore, crypto systems can not be counterfeited.

It holds true that cryptocurrencies are growing in appeal, however they aren't yet an universally approved investment. As a matter of fact, the governing atmosphere for these electronic assets is likely to get even more strict over the years.

Cryptocurrency is an excellent investment, however you need to be careful. In fact, some capitalists are shedding money. The most effective way to see to it that you will not get duped is to only invest in what you can manage to lose.

Below Are The Few Things You Should Recognize Prior To You Invest In Hedge Finances |

Article written by-Olesen Villarreal

Purchasing hedge funds is a great means to grow your riches.

Certified investors

Buying hedge funds calls for knowledge and also a considerable amount of cash. As with any financial investment, this can be risky. Fund supervisors use sophisticated trading techniques and also utilize to create a favorable return. They also seek to produce good returns, despite market problems.

The Securities and also Exchange Compensation (SEC) sights hedge funds in a different way from other protections. They view these as an extra adaptable financial investment alternative, allowing competent investors to capitalize on financial investments that are inaccessible to the public.

To be an accredited financier, you must have a total assets of at the very least one million dollars. You likewise require to have an expert economic background. This consists of having a salary of a minimum of $200,000 per year for the past two years, or a consolidated income of a minimum of $300,000 if you are married as well as have a spouse.

Assets under management

Buying hedge funds uses a solid return possibility. However, https://www.gobankingrates.com/investing/strategy/crypto-gold-either-good-investment/ of cash can be tough to handle efficiently. Hedge fund supervisors bill huge costs for the management of these funds. Hedge fund capitalists are generally extremely wealthy people.

Assets under management (AUM) is the complete market value of all financial investments held by a specific or establishment. It can differ from establishment to establishment. Some establishments likewise include financial institution deposits in the estimation.

Possessions under administration is additionally used as an efficiency indicator. AUM varies daily based on market efficiency as well as investor flows. If a fund has a stable investor base, the volatility of AUM will be lower. However, if a fund has regular inflows and also outflows, the computation of AUM will be extra unpredictable.

AUM is likewise utilized to compute administration fees. A fund manager's charge is generally calculated as a percent of AUM.

Fee structure

Unlike a mutual fund, hedge fund charges are based upon two main sources. The first is the monitoring fee, which is typically 2% of the complete assets under administration. The second source is the efficiency cost.

A performance cost is only charged when the hedge fund makes earnings that exceed a pre-determined limit. For example, if the fund's properties expand to $200,000 and then raise to $800,000, a 20% efficiency cost would be charged. The fund would not be billed if the asset value fell to $100,000.

The most essential feature of the efficiency cost is that it is just paid when the fund reaches a pre-determined profit limit. This implies that a hedge fund supervisor needs to recuperate any type of losses initially before billing an efficiency cost.

A high water mark stipulation is an additional attribute of the efficiency charge. This makes sure that a hedge fund supervisor can only charge an efficiency fee if the fund's profits increase to a certain level.

Market direction nonpartisanship

Investopedia describes market direction nonpartisanship for hedge funds as "an investment method that intends to generate favorable returns no matter market instructions." Nevertheless, it does not get rid of all risk from the marketplace. Rather, it is a financial investment approach that minimizes danger to a greater degree than other financial investment methods.

Market instructions nonpartisanship for hedge funds is a means to mitigate danger from severe equity market declines. The strategy additionally intends to accomplish lower overall volatility. Furthermore, it can additionally provide earnings in contracting markets.

A market-neutral fund strategy includes an equilibrium in between lengthy and also brief settings in the exact same hidden asset. The long settings are matched by brief placements, which are balanced frequently to maintain market nonpartisanship. This method allows better accuracy in projecting future returns.

you can try these out -neutral methods can likewise supply diversification from traditional asset classes. Unlike conventional benchmark-centric strategies, which tend to have high degrees of market direct exposure, market-neutral funds have no beta. Beta is the organized danger associated with a particular property. Investopedia defines beta as "the level to which a supply is associated with other supplies in the market."

Market-neutral techniques have been around for years. They are a typical investment approach amongst hedge funds. They are additionally used by proprietary trading companies.

Law

Governing actions are necessary to shield financiers and also make certain the honesty of the financial market. They might be developed to dissuade too much threat taking as well as protect against fraudulent as well as criminal conduct. They also affect the wider economic system.

The Dodd-Frank Act laid out sweeping regulatory modifications for the economic markets. Some of these actions were aimed at safeguarding investors while others were developed to enhance the governing system.

The Dodd-Frank act needed the Stocks as well as Exchange Commission to change its policies to require hedge fund supervisors to register. Alternative Investments To Stocks needed more reporting from hedge fund managers as well as also prolonged the size of audits from 120 to 180 days. It additionally eliminated the exclusive consultant exception.

Tim Geithner, the US Treasury Assistant, promoted the creation of a brand-new systemic danger regulatory authority. He suggested that hedge funds depend on leverage and short-term financing, which placed them at risk of systemic failing.

Exactly How To Expand Your Profile With These 5 Alternative Investments |

Authored by-Hess Cochran

Whether you are aiming to expand your profile or just want to try your hand at alternate financial investments, you can find a variety of financial investments that appropriate for you. These consist of assets, art, exclusive equity and also cryptocurrecy.

Private equity

Investing in personal equity as an alternative financial investment can be a rewarding choice. It offers higher returns than typical investments such as supplies or bonds. Nonetheless, it also comes with higher risk. You must be prepared for large losses if you do not grow the worth of your financial investment.

The asset class has actually been around for years. It began with specific capitalists and also firms. Nonetheless, public pension plan plans and also insurance companies came to be major capitalists in the 1990s. After https://schiffgold.com/peters-podcast/peter-schiff...st-significant-rate-hike-ever/ came the development of hedge funds, which concentrated on specific types of transactions.

Exclusive equity managers are usually worked with to reorganize a business. They will certainly often try to re-sell the business at a higher worth. This can likewise lead to significant expense cuts. In some cases, exclusive equity supervisors will certainly take control of the firm's previous management team.

Fundraising is an essential part of the personal equity market. Companies invest varying amounts of time raising resources, depending on the passion of their financiers. A firm's strategy might include restructuring, cost cuts, and brand-new innovation.

Fine art

Investing in art can be an exciting and also rewarding method to diversify your portfolio. Yet it is essential to understand what you are getting involved in. Below are some suggestions to make certain you don't get scammed.

Among the best ways to purchase art is through a reliable auction home. As an example, Christie's is one of one of the most famous auction residences worldwide.

Another choice is to invest in shares of top public auction houses. There are numerous companies using this solution. Nonetheless, it is important to make sure that you validate the authenticity of any kind of bonds you acquire.

Among the simplest means to purchase fine art is via an on-line art auction. Saatchi Art, as an example, offers artwork online.

An advanced type of investing in art is through the use of an art fund. https://canvas.instructure.com/eportfolios/1000454...rofile_With_Choice_Investments has expanded in the last few years, with a number of business offering a variety of alternatives.

Investing in the art market is a bit various than buying supplies or realty. Unlike these more typical properties, art has a tendency to be volatile as well as illiquid.

Cryptocurrency

Buying cryptocurrencies has been a growing pattern in recent years. These electronic possessions are made use of for whatever from on-line purchases to hiring people without having to see a financial institution. In spite of its growing appeal, some investors are cynical of this new investment choice.

Buying cryptocurrency can be dangerous. This is particularly true if you are buying uncommon antiques that can take a very long time to offer. An even more prudent strategy is to expand your portfolio. This will help to make sure that your portfolio is protected in case of a financial crisis.

Although it is a bit difficult, buying cryptocurrencies can supply a good return in the long-term. This is because they often tend to outshine other possession classes. But, it is very important to think about that cryptocurrencies are additionally very unstable.

In the past 5 years, cryptocurrencies have actually ended up being a lot more preferred as an alternate financial investment. This is due to the reality that they give some of the same advantages of other financial investment options. Furthermore, they are additionally more available to a larger audience.

Commodities

Purchasing products is a smart way to hedge versus inflation. Prices of assets increase when rising cost of living climbs as well as they are thought about safe houses in rough market conditions. Commodities can also assist to spread danger in a portfolio.

Commodities are a type of investment that uses investors the possibility to earn equity-like returns when markets are unpredictable. However, investing in products is dangerous. This is since prices are extremely unstable as well as products have reduced connection to equities. A commodity futures agreement is one method to invest in products.

Commodities are categorized right into tough and soft commodities. Hard assets include things that need to be extracted, such as steels. Soft assets include things that are expanded, such as coffee, cacao, and also fruit. https://telegra.ph/Just-How-To-Buy-Oil-And-Gas-And-Also-Commodity-Funds-12-10-2 have a tendency to be a lot more unpredictable. Nonetheless, they react well to extreme occasions, such as earthquakes, and also can provide investors with a greater return.

Assets are a fundamental part of a balanced profile. They are not necessarily correlated with equities, as well as they have reduced correlation to bonds. Commodities can likewise offer financiers with inflation defense and portfolio diversity.

Diversify Your Profile With Choice Investments |

Article written by-Buch Gadegaard

Purchasing alternative financial investments is an alternative for those interested in diversifying their profiles. These investments can be discovered in hedge funds, fine art, took care of futures, products, and also farmland as well as forests. These investments permit investors to diversify their profiles while still keeping a level of control.

Assets

Investing in alternate financial investments in products can assist expand your portfolio. They are usually fluid and supply high returns. However, there are lots of threats connected with buying commodities. So prior to deciding, it is essential to understand the advantages and disadvantages of investing in products.

For instance, the S&P GSCI Asset Index has actually skyrocketed over 30 percent so far this year. The iPath Bloomberg Commodity Index Total Return ETN is a strong option for long-lasting product investing.

A product ETF offers an inexpensive and also clear means to purchase products futures. It additionally gives exposure to a wide variety of asset producers.

Products have actually been shown to add real value to a portfolio, along with supplying rising cost of living defense. They are likewise a safe haven in unstable markets, as well as an insurance coverage versus equity market losses.

https://www.prweb.com/releases/2021_best_year_so_f...h_gold_group/prweb18432047.htm and forests

Agricultural land and woodlands provide an one-of-a-kind investment opportunity. They use financiers a variety of advantages including stable cash revenue, high returns each of danger, and diversification benefits. Nonetheless, they also come with threats.

Agricultural land and woodlands offer vital community services, consisting of food manufacturing, fresh water, and provisioning solutions. These solutions aid secure the setting, promote human wellness, as well as keep biodiversity. Loss of these solutions can have negative effect on biodiversity and household efficiency.

In addition, agricultural investments use reduced connections to various other property courses. They also supply a hedge against rising cost of living. However, they are much less industrialized than typical property classes. This produces an obstacle for personal capitalists. They need to develop financial investment products that are effective as well as financially eye-catching. They should also have robust compliance as well as oversight capabilities. They have to also have strong partnerships with local companions.

Managed futures

Usually marketed to high net worth individuals, managed futures is a professional possession course supplied by broker-dealers. The financial investment course supplies many useful qualities as well as attributes.

Besides giving diversity benefits, managed futures may additionally help reduce general portfolio danger. These advantages can be accomplished by making use of various active financial investment methods. These approaches include energetic lengthy as well as short settings, based upon technological or fundamental inputs. Some strategies might additionally utilize utilize to improve returns.

More Information and facts futures methods have actually been made use of by professional portfolio supervisors for over 3 years. These methods have shown to be efficient in aiding to decrease portfolio risks and boost total profile efficiency. Historically, managed futures have actually offered attractive absolute returns.

The crucial benefits of taken care of futures include the ability to take advantage of danger without incurring additional expenses. The technique can be used in conjunction with conventional asset classes to boost returns.

Art

Buying art can be a fun and also rewarding experience. Nevertheless, you require to make the effort to research the market and also figure out which jobs are worth buying.

In order to find out which pieces are worth buying, you'll need to speak with a trustworthy art dealer. You'll likewise intend to visit your local galleries and talk to managers. You can additionally try web searches to locate smaller on-line galleries.

Among the most interesting means to invest in art is with fractional shares. hop over to here enables regular financiers to get a piece of the blue-chip art market without spending numerous bucks.

An additional way to invest in art is via crowdfunding. This entails raising money from a group of financiers to fund a project that will certainly enhance the worth of an art work.

Hedge funds

Typically, hedge funds have been thought of as risky investment automobiles. Nonetheless, the fund of funds structure, which allows investors to spread their financial investment right into a variety of hedge funds, has actually become a feasible way for a bigger team of investors to gain access to different investment products.

In the past years, the fund of funds service has expanded significantly. In addition to being a relatively low-priced, extremely liquid option, these items permit investors to join the returns of alternate asset classes. They might also reduce overall profile volatility since different assets tend to have reduced relationship with conventional financial investment profiles.

The alternative investment market faces marginal guideline. Nevertheless, these investments are typically more high-risk than standard investments. They might also have higher minimum financial investment demands. A few of these investments might also have actually limited ballot legal rights or various other functions that restrict investors' capability to join the fund's activities.

Diversify Your Profile With Option Investments |

Content create by-Aguilar Rode

Investing in alternative financial investments is an option for those curious about diversifying their portfolios. These investments can be discovered in hedge funds, art, took care of futures, assets, and farmland and also woodlands. These financial investments allow capitalists to diversify their profiles while still preserving a level of control.

Assets

Buying different investments in commodities can assist expand your portfolio. They are often fluid as well as offer high returns. Nonetheless, there are numerous risks connected with purchasing assets. So before deciding, it is essential to comprehend the pros and cons of investing in products.

As an example, the S&P GSCI Asset Index has risen over 30 percent until now this year. The iPath Bloomberg Commodity Index Total Return ETN is a solid choice for long-lasting product investing.

An asset ETF gives a cost-effective and also clear method to buy commodities futures. More Information and facts supplies exposure to a wide range of product producers.

Products have been revealed to add actual value to a portfolio, in addition to providing rising cost of living security. They are also a safe house in unpredictable markets, in addition to an insurance coverage against equity market losses.

Farmland and also woodlands

Agricultural land and also forests offer an unique investment opportunity. They provide investors a selection of benefits including steady cash earnings, high returns each of risk, as well as diversification benefits. However, they additionally feature dangers.

Agricultural land as well as woodlands offer crucial ecological community services, including food production, fresh water, and also provisioning solutions. These services help safeguard the setting, promote human health, as well as preserve biodiversity. Investing Future of these services can have negative impacts on biodiversity and also family efficiency.

Furthermore, agricultural financial investments supply lower correlations to other property courses. They likewise supply a bush against inflation. However, they are much less developed than conventional possession classes. This creates a difficulty for exclusive investors. They need to create financial investment items that work and also economically appealing. They should also have robust compliance and also oversight abilities. They must additionally have strong relationships with regional companions.

Managed futures

Usually marketed to high total assets people, took care of futures is a specialist possession course used by broker-dealers. The investment course provides numerous useful attributes and qualities.

Besides providing https://www.click4r.com/posts/g/7329133/buying-rea...wonderful-way-to-create-wealth , took care of futures may likewise help in reducing general profile risk. These advantages can be attained by utilizing different energetic investment techniques. These methods include energetic lengthy and also brief settings, based upon technological or essential inputs. Some methods might likewise make use of leverage to boost returns.

Managed futures methods have actually been made use of by professional portfolio supervisors for over 3 decades. These techniques have actually confirmed to be reliable in aiding to decrease portfolio dangers as well as enhance total profile performance. Historically, managed futures have actually given eye-catching outright returns.

The vital benefits of managed futures consist of the capability to leverage danger without incurring added prices. The strategy can be used together with conventional asset classes to boost returns.

Fine art

Investing in art can be an enjoyable and also rewarding experience. However, you require to make the effort to investigate the market and discover which jobs are worth purchasing.

In order to figure out which items deserve investing in, you'll need to get in touch with a reputable art dealer. You'll also intend to visit your local galleries as well as talk with curators. You can additionally try internet searches to discover smaller sized online galleries.

Among one of the most interesting ways to invest in art is with fractional shares. This enables average financiers to get an item of the excellent art market without spending numerous bucks.

An additional means to invest in art is via crowdfunding. This involves raising money from a group of capitalists to money a job that will certainly raise the value of an art work.

Hedge funds

Commonly, hedge funds have been thought of as high-risk financial investment lorries. Nevertheless, the fund of funds framework, which allows capitalists to spread their financial investment into a number of hedge funds, has actually emerged as a sensible method for a larger team of investors to access alternate investment products.

In the past decade, the fund of funds service has expanded dramatically. In addition to being a relatively low-priced, very liquid choice, these items enable investors to participate in the returns of alternative possession classes. They might likewise lower total portfolio volatility since alternate properties often tend to have reduced connection with standard investment profiles.

The alternate financial investment market encounters marginal regulation. Nevertheless, these financial investments are usually much more risky than conventional investments. They might additionally have higher minimum financial investment needs. Several of these investments may additionally have actually limited ballot legal rights or other attributes that restrict financiers' capacity to take part in the fund's tasks.

Option Investments - What You Need To Know |

Content by-Walker Hammond

Throughout the last decade, Option Investments have actually come to be a progressively important part of the financial landscape. This includes hedge funds, private equity, and also rare collectibles.

Personal equity

Buying private equity as an alternative financial investment can be a rewarding choice for those seeking a high return. Yet it also includes some dangers. The investment might require a long holding period as well as is reasonably illiquid.

Exclusive equity investment company have different financial investment approaches, and also they might make use of different techniques for each investment. For example, a personal equity fund could acquire all the shares of an underperforming company, streamline it, and after that replace senior management. After that, it could attempt to market it at a higher worth. This raises the worth of the financial investment and also enhances the return on the money spent.

Personal equity investment firms can likewise use financial obligation to get a company. This enables the company to obtain even more resources, however the financial debt comes with additional threat.

Hedge funds

Unlike mutual funds, hedge funds purchase a variety of different possessions. These property classes consist of stocks, currencies, realty, and also products. https://www.gainesvillecoins.com/blog/how-to-invest-gold-etfs of hedge funds is to decrease volatility and maximize financier returns.

Alternate Investments are typically much less correlated with supply and also bond markets, and they may supply better liquidity and lower minimal investment requirements. These are good additions to a long-term profile. Nonetheless, investors should thoroughly consider their alternatives.

Different investments can be riskier than standard financial investments, and might enforce significant charges. Nonetheless, continued product technology could enhance accessibility and also broaden the financier base.

In addition to traditional possession courses, alternative investments are likewise less prone to rate of interest changes and inflation. Asset prices can be an important diversifier, as they are tied to provide and also demand as well as federal government plan.

Art

Investing in art as an alternative investment is coming to be increasingly more preferred. It is an excellent means to expand your portfolio. It is also a way to add character and also enjoyable to your office or home.

It has been recognized to surpass standard investments such as equities and also bonds, yet it is additionally subject to the same threats as other possession courses. In order to maximize art as an investment, you need to have a good technique.

https://www.click4r.com/posts/g/7327667/buying-gol...sify-your-investment-portfolio in art has actually become prominent for several reasons. It is cost-effective and also can provide diversification to a profile. Unlike various other property classes, art tends to keep its value in time. It is additionally an optimal investment in good times and also negative.

However, it is important to bear in mind that buying art as a different financial investment is not without its threats. It requires a particular amount of dedication and also a high risk tolerance. It is likewise really illiquid, that makes it difficult to trade. Furthermore, the price of art can be depreciated with time.

Unusual collectibles

Buying rare antiques is a different financial investment that can be amazing and rewarding. Yet before you begin spending, make sure that you understand the threats involved.

Antiques are illiquid, implying that they do not trade on a public market. Due to this, there's no warranty that you'll have the ability to sell them at a greater cost than they cost you. This means that your earnings is mosting likely to rely on the worth of the thing you're accumulating, the variety of potential purchasers, and also the marketplace's ability to produce demand.

Some collectibles can come to be expensive and also illiquid if you don't recognize just how to buy low as well as offer high. This is why it's a good idea to have an expert assess the thing prior to you buy it.

Antiques are a great hedge versus inflation, given that they are normally valued more than they are when they are first acquired. Investing in collectibles can additionally diversify your profile.

Cryptocurrency

Purchasing cryptocurrencies has been an appealing option for numerous. It has the prospective to help you make a decent return while decreasing your general profile danger. Nonetheless, prior to https://notes.io/qbtA9 can make the decision to invest in this brand-new craze, you need to recognize even more regarding it.

Cryptocurrency is a digital currency that is secured by cryptography as well as a dispersed journal. These technologies allow you to store and also exchange electronic properties without an intermediary. Furthermore, crypto devices can not be counterfeited.

It holds true that cryptocurrencies are expanding in popularity, yet they aren't yet a generally accepted investment. As a matter of fact, the regulatory setting for these digital assets is most likely to obtain more rigorous throughout the years.

Cryptocurrency is an excellent investment, but you need to take care. Actually, some capitalists are shedding money. The best method to see to it that you won't obtain duped is to just invest in what you can manage to shed.

Exactly How To Diversify Your Portfolio With These 5 Alternative Investments |

Article created by-Fallon Mendez

Whether you are seeking to expand your portfolio or simply intend to try your hand at different investments, you can discover a variety of investments that appropriate for you. These include commodities, art, personal equity and cryptocurrecy.

visit site in exclusive equity as a different financial investment can be a profitable alternative. It provides higher returns than conventional financial investments such as supplies or bonds. Nonetheless, https://blogfreely.net/clyde82charolette/investing...pand-your-financial-investment features higher threat. You must be gotten ready for big losses if you don't expand the value of your financial investment.

The asset class has actually been around for decades. It started with individual investors and also companies. Nevertheless, public pension plan plans and insurance firms became significant financiers in the 1990s. After that came the development of hedge funds, which concentrated on certain sorts of transactions.

Private equity managers are commonly hired to restructure a company. They will often attempt to resell the company at a higher value. This can also lead to major expense cuts. Sometimes, personal equity supervisors will certainly take control of the firm's previous administration team.

Fundraising is a crucial component of the personal equity market. Companies spend varying amounts of time increasing resources, relying on the interest of their investors. A company's strategy may consist of restructuring, cost cuts, and brand-new modern technology.

Fine art

Buying fine art can be an amazing and also satisfying means to diversify your portfolio. Yet it's important to understand what you are getting involved in. Here are some pointers to see to it you do not obtain scammed.

Among the best methods to invest in art is with a respectable auction home. For instance, Christie's is among one of the most popular auction houses in the world.

Another choice is to invest in shares of top auction houses. There are a number of firms supplying this service. Nevertheless, it is essential to see to it that you confirm the credibility of any bonds you buy.

Among the most basic means to buy art is through an online art auction. Saatchi Art, for example, markets art work online.

An advanced form of purchasing art is through making use of an art fund. The art fund sector has actually expanded recently, with a number of firms using a series of options.

Investing in the art market is a little bit different than buying supplies or real estate. Unlike these more standard possessions, art tends to be unpredictable and illiquid.

https://www.liveinternet.ru/users/monahan_pollock/post496880124

Purchasing cryptocurrencies has been an expanding fad in recent times. These electronic possessions are used for whatever from online acquisitions to employing individuals without having to check out a financial institution. Despite its growing appeal, some capitalists are doubtful of this brand-new investment alternative.

Investing in cryptocurrency can be high-risk. This is specifically real if you are purchasing unusual collectibles that can take a long period of time to sell. A more sensible course of action is to expand your portfolio. This will assist to guarantee that your portfolio is shielded in case of a financial crisis.

Although it is a bit complex, buying cryptocurrencies can provide a great return in the long term. This is because they often tend to outshine various other property classes. Yet, it is essential to consider that cryptocurrencies are likewise very volatile.

In the past five years, cryptocurrencies have actually come to be a lot more popular as a different investment. This is due to the truth that they supply some of the exact same advantages of various other financial investment choices. Furthermore, they are additionally more obtainable to a bigger target market.

Products

Buying products is a clever means to hedge against inflation. Rates of products boost when inflation climbs as well as they are thought about safe havens in rough market conditions. Commodities can additionally aid to spread out threat in a portfolio.

Products are a kind of financial investment that offers capitalists the opportunity to make equity-like returns when markets are unpredictable. Nevertheless, investing in products is dangerous. This is due to the fact that prices are very volatile and products have low connection to equities. An asset futures agreement is one means to buy commodities.

Commodities are categorized right into hard as well as soft commodities. Hard commodities include things that need to be drawn out, such as steels. Soft commodities consist of things that are grown, such as coffee, chocolate, as well as fruit. Soft products have a tendency to be extra volatile. However, they respond well to severe events, such as quakes, and can offer investors with a higher return.

Assets are an important part of a well balanced profile. They are not always correlated with equities, and also they have low relationship to bonds. Assets can also supply financiers with inflation defense and portfolio diversity.

Investing In Realty Is An Excellent Method To Create Wide Range |

Content create by-Ward McKinley

You can invest in realty by buying a property and afterwards renting it out. You can also buy a property as well as hold on to it, which is called buy as well as hold investing.

Buy-and-hold

Purchasing buy-and-hold realty can be a great way to develop riches. However, there are a couple of things you ought to recognize before you start. It's important to have an organization plan and study in place before you begin. It's additionally a good suggestion to work with a residential or commercial property supervisor. This will certainly help you prevent renter nightmares.

Aside from creating riches, a buy-and-hold realty financial investment can also give passive income. You can also get tax benefits, including deductions for rental income.

Purchasing buy-and-hold residential properties is a superb way to secure your wealth from rising cost of living. This technique relies on the forecasting of area direction, which can help enhance home worth in time. Nonetheless, it is very important to have a plan in position to avoid a decline in the real estate market.

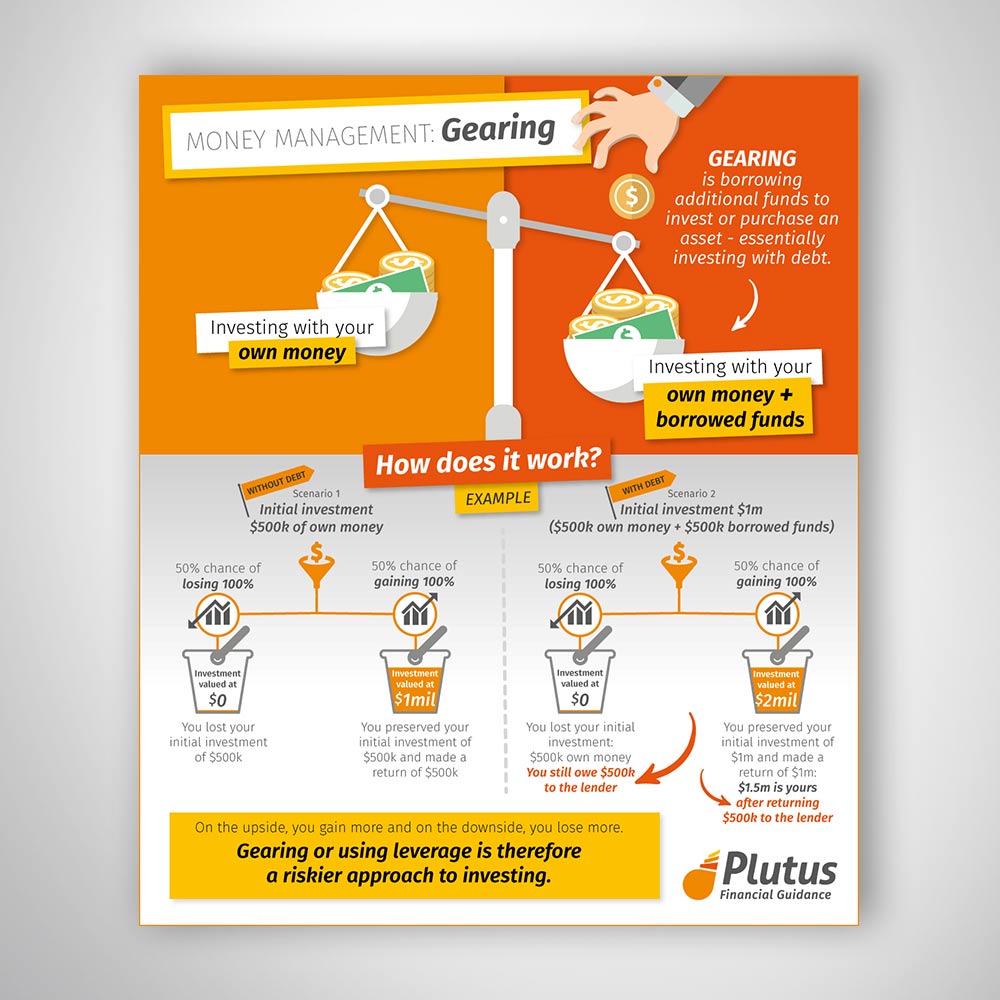

Utilize

Utilizing leverage in realty investing is an exceptional tool to improve your return on investment. By utilizing a home mortgage, charge card or business line of credit rating, you can purchase an expensive property without having to invest a lot of your own money. It is additionally a means to expand your profile and decrease tax obligations on your real estate financial investment.

Most people use a home mortgage when purchasing a house. Home loans include rate of interest that vary from loan provider to lender. You need to satisfy the lender's demands for getting financing. Most people will certainly pay back the funding over years. If you are incapable to pay the financing, the lending institution can foreclose on the residential property. This can injure your credit history and limit your ability to obtain future fundings.

Area

Buying real estate is a long-term venture, and also place is one of one of the most important elements that will determine the value of your home. Purchasing a home in a good area will make sure that you have a home that maintains worth with time, in addition to an area that you will certainly more than happy with for several years to come.

Area is very important since it determines whatever else that enters into the property transaction. This includes the value of your house, your happiness, and your family members's monetary future.

When it concerns place, there are 2 key types: "Macro" as well as "Micro". "Macro" describes Stocks Worth Investing In at once. The "Micro" describes the micro-location, which is an area within "Macro".

Buying click this link now in a good neighborhood will certainly raise the worth of your home. Areas that are close to crucial districts as well as transportation hubs are suitable. This is since these places have a high need for houses as well as will likely raise in value gradually.

Residential or commercial property devaluation