Insider Tips For Discovering The Best Insurance Company For Your Home |

Article by-Goldberg Hobbs

Having the most effective residence insurance company can conserve you time, money and also stress and anxiety in case catastrophe strikes. There are numerous methods to discover the appropriate business, including online testimonials, expert scores as well as testimonials.

USAA places highly in client satisfaction with its residence plan and has several price cuts, consisting of commitment breaks for those that remain claim-free. It likewise supplies a special Contractor Connection database with thousands of vetted professionals to help homeowners reconstruct after calamity.

1. Know What You Want

Your residence is just one of the largest monetary investments you will certainly ever make. Do I Need Flood Insurance is why it is necessary to put in the time to locate an insurance policy supplier that uses protection based on your one-of-a-kind demands, and provides a favorable experience from policy purchasing, renewal as well as filing a claim.

A great location to begin your search goes to the internet site of your state's division of insurance coverage. Here, you can learn about the business's rating and also any customer complaints. You can additionally look at third-party rankings like those given by J.D. Power or the National Organization of Insurance policy Commissioners to acquire a better understanding of client complete satisfaction.

You might likewise take into consideration looking for a service provider with local agents, or electronic policy monitoring alternatives. These attributes can help reduce costs, in addition to offer assurance.

2. Search

If you're a house owner that intends to conserve money or are getting property owners insurance policy for the first time, looking around can assist you find the right plan. Beginning by requesting quotes for the exact same insurance coverage kind and also restrictions from several insurance providers. You can make use of an independent agent, on-line marketplace like Policygenius or contact your state insurance coverage division to get quotes. Likewise take into consideration a company's monetary toughness scores, JD Power as well as third-party customers when contrasting rates.

It's an excellent concept to compare quotes on an ongoing basis, specifically if your residence is valued greater than when it was originally guaranteed or if you're paying excessive. To make the process much easier, you can ask for quotes from numerous insurance firms at the same time making use of an on the internet comparison tool such as Gabi or by getting in touch with an independent insurance policy agent.

4. Seek Discount rates

Along with contrasting prices on-line, you can additionally try to find discount rates by looking around. Suggested Reading provide discount rates for things like having a brand-new roof, adding a security system as well as various other enhancements. Others will provide discounts for having a higher deductible. It's important to evaluate these options against each other, as a high deductible will certainly set you back more money in advance.

Some companies may additionally supply discounts based upon factors like your age or whether you function from residence. This is because these teams tend to be on the properties extra, which minimizes some dangers such as burglary.

An additional point to consider is just how pleased insurance policy holders are with the firm. This can be figured out by considering customer fulfillment reports as well as scores from customer web sites.

5. Get a Policy in Place

Property owners insurance coverage covers damages to your home and valuables, along with personal liability. A plan can set you back a couple of hundred bucks a year or less.

It's wise to obtain quotes prior to choosing a business, and to maintain shopping every few years as premium rates and also discounts may alter. You likewise must see to it to stay on top of the status of your home owner's plan.

Search for business that supply regional agents or a mobile application for client service. Also, take into consideration third-party scores and also testimonials, such as the JD Power home insurance policy consumer satisfaction ranking, which represents elements like expense, representative communication and also insurance claim handling. A great insurance provider will be clear and honest with consumers about rates and insurance coverage. https://blogfreely.net/cory23spencer/exactly-how-t...stomers-as-an-insurance-policy will certainly additionally be adaptable in the event of a modification in your home's scenario or security features.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

The Necessary Guide To Picking The Right Insurance Provider For Your Requirements |

Article by-Clemensen Stern

Many individuals concentrate only on rate or check out on the internet testimonials when choosing an insurer. However, there are various other crucial elements to think about.

As an example, if you are buying from a broker, consider their client satisfaction positions or ratings from agencies like AM Ideal. These scores can provide you a common sense of financial strength, claims-paying history as well as various other elements.

Price

Choosing insurance coverage is not just concerning affordability, yet likewise regarding ensuring the insurance coverage you select suffices to protect your monetary future. Thus, you must meticulously stabilize price with coverage, and also it is very important to examine exactly how your decisions will influence your lasting monetary objectives as well as demands. If Fema Flood Insurance are tempted to check out on the internet evaluations, think about reviewing them with a company representative, as they may have the ability to give feedback that is helpful in figuring out whether the review is accurate or not.

Protection

Insurance coverage is a means to pool risk by spending for cases. It's a gigantic rainy day fund that pays for disasters we can't manage, like hurricanes, wildfires, storms, and cooking area fires, and daily mishaps, such as fender benders and also cars and truck mishaps.

Analyzing your insurance coverage needs and selecting appropriate protection is a complex process. Considerations include cost, protection restrictions, deductibles, plan conditions, and also the credibility and also financial stability of insurance policy companies.

Take the time to contrast quotes from numerous insurers, taking into consideration price cuts supplied for bundling plans or preserving a tidy driving record. It's also crucial to assess the long-term effects of your protection selections. Evaluate just how they will certainly protect your assets, revenue, as well as loved ones throughout the years. In RV Rental Insurance , it's not just about cost-- it's about shielding what matters most. This Ultimate Guide will help you pick the right insurance coverage company for your one-of-a-kind demands. The very best protection will supply you with satisfaction and also safeguard your financial future.

Licensing

Prior to a person can begin offering insurance coverage, they require to get licensed. This is a process that varies by state, but normally consists of finishing pre-license education and learning courses and also passing the state insurance policy examination. It also calls for sending finger prints and also going through a history check.

The sort of license an individual requires depends on the sorts of insurance coverage they prepare to market. There are normally 2 primary kinds of insurance policy licenses: home and also casualty, which concentrates on insurance for autos and residences, as well as life and health, which concentrates on covering individuals and also family members in case of a crash or fatality.

Companies that offer several lines of insurance policy need to have a firm license, while private agents can acquire an individual permit for the lines they plan to sell. https://zenwriting.net/douglas2marylyn/the-role-of...rance-coverage-agent-practices licensing procedure is managed at the state degree, however several states now utilize third parties to assist overview and carry out license applications in order to promote efficiency.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

Recognizing The Claims Refine |

https://blogfreely.net/dorsey1adan/5-crucial-skill...icy-representative-must-master written by-McCormick Hejlesen

When a mishap takes place, it's natural to really feel motivated to seek compensation from your insurance company. Nonetheless, sending an insurance claim can be overwhelming and also tedious, entailing copious amounts of documentation.

Whether you're filing an auto, home or responsibility case, the process follows similar standards and also is broken down right into 4 phases. Comprehending these phases can aid you file your insurance coverage case efficiently.

1. You'll Obtain a Notification of Insurance claim

As you deal with your insurance provider to file a claim, they will certainly send you papers needing you to offer proof of loss, including dollar amounts. They might also inquire from your doctor or company. This is an usual part of the cases process, as well as it is frequently done to verify your insurance policy covers what you are declaring for.

When https://retha3lorine.wordpress.com/2023/07/20/exac...-as-an-insurance-policy-agent/ of loss is gotten, they will validate it versus your insurance policy plan as well as deductibles to ensure they are appropriate. They will after that send you a description of advantages that will detail the services received, amount paid by insurance policy as well as continuing to be balance due.

Insurance companies can make the cases process much easier if they keep their clients as well as workers happy by keeping a clear and also consistent experience. One method they can do this is by making sure their employees are able to immediately answer any type of questions or concerns you have. You can also talk to your state insurance policy division to see if they have any grievances against a specific business or agent.

2. You'll Receive a Notification of Denial

When an insurance claim is rejected, it can create significant disappointment, complication and also expenditure. It is essential to maintain to date on your insurance provider's adjudication and also allure processes. This information needs to be readily available on their sites, and they need to also supply it in hard copy when you enroll in brand-new protection with them.

When you receive a notice of denial, ask for the particular reason in composing. This will allow you to compare it to your understanding of the insurance policy terms.

Always document your follow-up calls as well as meetings with your insurance provider. look at here can help you in future activities such as taking an appeal to a greater degree or filing a suit. Videotape the date, time as well as name of the representative with whom you speak. This will certainly save you useful time when you need to reference those records in the future. Likewise, it will allow you to track that has been communicating with you throughout this procedure.

3. You'll Obtain a Notice of Compensation

Once the insurer has authenticated your case, they will certainly send out repayment to the doctor for services provided. This can take a few days to a number of weeks. As soon as the insurer provides a repayment, you will get an Explanation of Advantages (EOB) declaration that details just how much the company billed and how much insurance coverage covers. The supplier will then expense clients as well as employers for the remainder, minus coinsurance.

If you have any type of issues with your claim, make certain to record every interaction with the insurer. Maintaining a document of whatever that happens with your case can aid quicken the process.

It's likewise wise to maintain invoices for extra expenditures that you may be repaid for, especially if your residence was harmed in a tornado or fire. Having a clear as well as recorded claims process can also aid insurance companies enhance customer retention by supplying a better experience. It can likewise help them identify locations of their process that could be improved.

4. You'll Get a Notice of Final Negotiation

Insurance companies handle hundreds of claims daily, so they have systems in position to track each step of the process for all the insurance policy holders. This allows them to maintain your original insurance claim as well as any charms you may make organized in such a way that is very easy for them to handle. It's important for you to mirror their process by keeping all of your documents in one area that is easy to access as well as review.

If you determine to submit an insurance provider appeal, gather the evidence that sustains your situation. This can include cops records, eyewitness information, photographs as well as medical records.

Bear in mind that your insurance provider is a for-profit company and also their objective is to reduce the amount they award you or pay in a negotiation. This is because any kind of awards they make lower their earnings stream from the premiums you pay. They could also see this as a reason to raise your future rates.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

The Future Of Insurance Coverage Representatives: Adapting To Altering Customer Requirements |

Content written by-Vega Bland

The insurance policy industry is going through a major technological overhaul. Yet will it make insurance policy agents outdated?

Local business owner as well as customers continually rate comfort as one of the most crucial factor in their policy purchasing decisions. Representatives can fulfill customer demands for electronic, seamless, and hybrid support by embracing innovation that equips them to drive new business.

1. Customization

A customized experience can make customers seem like they are being heard as well as understood. This is an important action towards structure loyalty, references as well as retention.

Insurance coverage sector leaders have actually started to reorient their organizations around consumers, as opposed to products. Recommended Studying can assist insurance firms produce tailored digital experiences and provide even more worth to customers.

As an example, insurance policy carriers have the ability to identify low-risk clients as well as offer them with cheaper premiums by utilizing information gathered via telematics, IoT and machine learning. Some are also able to instantly change quotes based upon way of living modifications.

Boosting the effectiveness of digital self-service can better enhance the customer experience. While a human agent will certainly still be required for more complicated transactions, the ability to connect quickly and also effectively across digital channels can help expand service in 2023 and beyond. mouse click the following web page will certainly require a robust modern technology facilities to sustain client interactions and make it possible for even more aggressive risk-prevention services. It will certainly also be very important to ensure the uniformity of the client experience throughout various communication channels.

2. Ease

The COVID-19 pandemic accelerated this trend, yet digital-savvy customers were already driving it. To prosper in this environment, insurance representatives need to adjust to meet their customers where they are.

Technology can help them do this. Automated tools quote plans, fill out applications and also analyze dangers. Yet human judgment continues to be vital when it involves one-of-a-kind circumstances such as prospect clinical problems, services with complex policy types or start-ups that require help finding insurers going to cover their danger profile.

To maximize these opportunities, insurance providers can equip their connect with digital customer communication devices like instant messaging and also video clip chat for more comprehensive reach. They can also supply practical, digitized processes that improve convenience and minimize processing hold-ups for both events. These consist of on the internet consultation organizing for consultation meetings with leads as well as customers, electronic signatures for new business and advisory videos for items that can be shown on tablet computer computers. These can substantially improve conversion rates.

3. Movement

Like typing, insurance agents may quickly be changed by computer systems that price estimate rates, submit applications and assess risks. However fortunately is that brand-new technology can likewise aid agents stay relevant and also successful.

As an example, chatbots can provide information swiftly, and automation and anticipating modeling take intestine reaction out of underwriting choices. And also company insurance industries eliminate the need to consult with a representative, allowing consumers to obtain instantaneous or near-instant decisions.

Customer expectations for a smooth, customized and interesting experience like the ones they get from leading sellers and ridesharing companies are pushing insurance providers to revamp their front-end experiences. Embedding plans into customers' community journeys, including telematics data from noncarrier partners and automobile OEMs right into underwriting engines as well as offering adaptable usage-based insurance coverage are some of the ways to do it. These adjustments require carriers to change their existing sales channels, however those that do will certainly reap the rewards of a more tailored and involved consumer base.

4. Convenience

Guaranteeing today's generation of consumers indicates meeting them where they are, not attempting to compel them right into an old system. In simply click the following webpage , insurance coverage representatives will certainly end up being process facilitators and also product instructors. Their job will certainly be aided by AI devices, remote interactions as well as other modern technologies that help them serve a broader client base.

This shift in workflow will certainly additionally permit insurance providers to offer consumers a seamless digital and also hybrid sales trip. This consists of remote recommendations, digital self-serve systems and also in-person conferences when hassle-free for the customer.

This adaptability is key to attracting and also maintaining younger clients, which will certainly drive future growth for the industry. Along with communicating with more youthful customers with the networks they like (message, conversation, email as well as video clip), insurance agents have to also have the ability to determine as well as support leads using technology-backed information. This can enhance conversion prices, increase sales opportunities and aid stay clear of costly errors like a missed sale. This will certainly be especially vital as insurers upgrade legacy systems.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

The Future Of Insurance Coverage Brokers: Adapting To Transforming Consumer Demands |

Content create by-Flindt Farley

The insurance coverage market is undertaking a major technological overhaul. But will it make insurance representatives outdated?

Local business owner and consumers continually place convenience as one of the most crucial factor in their policy getting decisions. Agents can satisfy client needs for digital, smooth, as well as hybrid assistance by welcoming innovation that equips them to drive new organization.

1. Personalization

A tailored experience can make consumers feel like they are being heard and also recognized. This is an essential action towards structure loyalty, recommendations as well as retention.

Insurance sector leaders have started to reorient their companies around consumers, as opposed to products. This strategy can aid insurers produce customized electronic experiences and supply even more value to consumers.

For instance, insurance policy companies have the ability to determine low-risk clients and also offer them with less expensive costs by utilizing information gathered via telematics, IoT as well as machine learning. Some are likewise able to automatically readjust quotes based on way of living changes.

Boosting https://larissa8275vito.wordpress.com/2023/07/20/t...s-an-insurance-representative/ of electronic self-service can even more enhance the client experience. While a human representative will still be required for even more complex transactions, the ability to communicate promptly as well as successfully throughout electronic channels can help grow service in 2023 as well as beyond. This will certainly call for a durable innovation infrastructure to sustain client interactions and allow more aggressive risk-prevention services. It will additionally be important to make certain the consistency of the consumer experience across different communication channels.

2. Comfort

The COVID-19 pandemic increased this trend, however digital-savvy customers were currently driving it. To flourish in this environment, insurance coverage representatives must adapt to meet their clients where they are.

Modern technology can help them do this. Automated tools price estimate policies, fill out applications and assess risks. Yet human judgment continues to be important when it concerns unique scenarios such as possibility medical conditions, organizations with complicated plan types or startups that require aid searching for insurance firms ready to cover their danger profile.

To capitalize on these possibilities, insurance firms can furnish their connect with electronic customer interaction tools like instant messaging and also video clip chat for broader reach. They can likewise supply practical, digitized procedures that improve comfort and also reduce handling hold-ups for both events. These include on the internet visit scheduling for consultation conferences with potential customers as well as customers, electronic trademarks for brand-new company as well as advising videos for products that can be revealed on tablet computer computers. These can considerably enhance conversion prices.

3. Flexibility

Like inputting, insurance agents might quickly be replaced by computers that price estimate rates, submit applications and assess threats. Yet fortunately is that new innovation can additionally help agents remain relevant and also lucrative.

For example, chatbots can give details rapidly, and automation and also predictive modeling take gut instinct out of underwriting choices. And organization insurance coverage marketplaces get rid of the need to meet a representative, allowing consumers to obtain instantaneous or near-instant choices.

https://retha3lorine.wordpress.com/2023/07/19/the-...surance-policy-representative/ for a seamless, personalized as well as engaging experience like the ones they obtain from leading merchants and ridesharing firms are pushing insurers to upgrade their front-end experiences. Installing https://patch.com/georgia/cascade/classifieds/jobs...rance-south-fulton-palmetto-ga into customers' ecosystem trips, incorporating telematics data from noncarrier companions as well as automobile OEMs into underwriting engines as well as giving versatile usage-based insurance coverage are a few of the methods to do it. These modifications call for service providers to change their existing sales channels, but those that do will certainly reap the incentives of an extra individualized and also involved client base.

4. Comfort

Insuring today's generation of consumers means satisfying them where they are, not attempting to require them into an old system. In the future, insurance policy representatives will become process facilitators and also product educators. Their job will be assisted by AI devices, remote communications and also various other innovations that help them serve a more comprehensive consumer base.

This shift in operations will also allow insurance companies to provide customers a smooth electronic and also hybrid sales journey. This consists of remote guidance, digital self-serve platforms as well as in-person conferences when practical for the customer.

This flexibility is crucial to attracting as well as maintaining more youthful clients, which will certainly drive future growth for the market. Along with communicating with younger shoppers through the networks they choose (message, chat, e-mail as well as video clip), insurance coverage representatives need to additionally have the ability to determine as well as support leads making use of technology-backed information. This can enhance conversion rates, rise sales chances as well as help prevent costly mistakes like a missed sale. This will be specifically vital as insurers update legacy systems.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

How To Conserve Cash On Insurance Policy Premiums With The Right Insurance Provider |

Authored by-Vinther Nielsen

You might think that there's nothing you can do to lower your vehicle insurance costs, yet WalletHub has located a couple of ways to save. Boosting your deductible (however not so high that you can't manage to pay it) can save you cash, as can taking a motorist security course or setting up an anti-theft tool.

1. Look around

Whether you're looking for wellness, auto or life insurance policy, it pays to shop around. Some insurance companies provide online quote devices that can conserve you effort and time by revealing several prices for the plan you're considering.

Other aspects like credit rating, a secure driving document as well as bundling plans (like automobile as well as home) can likewise decrease your rates. You ought to also routinely examine your insurance coverage requirements as well as reassess your premium costs. This is especially essential if you hit life milestones, such as a new kid or obtaining wed. In a similar way, you should regularly consider your car's worth as well as think about switching to a usage-based insurance coverage program, like telematics.

2. Know Your Insurance coverage

Making use of these methods will certainly need a long time and effort, but your job will certainly be rewarded with reduced yearly costs for many years to come.

Various other ways to conserve consist of paying your policy six or a year each time, which costs insurance companies less than monthly payments. Likewise, eliminating protection you don't need, like roadside aid or rental auto repayment, can save you money.

Your credit score, age and also place likewise affect your rates, in addition to the car you drive. Bigger lorries, like SUVs and also pickup trucks, price even more to guarantee than smaller sized cars and trucks. Selecting try this website -efficient lorry can lower your premiums, as will opting for usage-based insurance policy.

3. Drive Securely

There are lots of points you can manage when it concerns decreasing your automobile insurance coverage prices. Some methods include taking a protective driving course, increasing your insurance deductible (the quantity you need to pay before your insurance begins paying on a claim) and also switching over to a safer vehicle.

Some insurers also offer usage-based price cuts and telematics tools such as Progressive Snapshot, StateFarm Drive Safe & Save as well as Geico DriveEasy. These can reduce your price, however they might also raise it if your driving practices come to be much less risk-free in time. Think about using mass transit or car pool, or minimizing your mileage to get these programs.

4. Get a Telematics Tool

A telematics device-- or usage-based insurance policy (UBI)-- can conserve you cash on your auto insurance. Essentially, https://zenwriting.net/kristopher46gayle/5-importa...-representative-need-to-master connect the device into your car and it tracks your driving actions.

Insurance provider after that use that information to find out exactly how dangerous you are. As well as they set your costs based on that. Usually, that can suggest significant savings.

Yet take care. One poor decision, such as competing to defeat a yellow light, can transform your telematics tool into the tattletale of your life. That's due to the fact that insurer can use telematics data to decrease or deny claims. As well as they might even withdraw discounts. That's why it's important to consider the trade-offs prior to enrolling in a UBI program.

5. Obtain a Multi-Policy Discount Rate

Getting car as well as residence insurance coverage from the very same service provider is usually a great way to save cash, as many credible insurance firms use discounts for those that purchase several plans with the exact same carrier. Additionally, some insurance policy service providers supply telematics programs where you can make deep discount rates by tracking your driving habits.

Various other methods to save include downsizing your lorry (if possible), carpooling, and also using public transportation for job and also leisure. Likewise, keeping your driving document tidy can conserve you money as the majority of insurer use accident-free and great chauffeur discount policies. Numerous providers additionally offer client loyalty discount rates to lasting customers. These can be considerable discount rates on your premium.

6. Obtain an Excellent Price

Enhancing your insurance deductible can lower the amount you pay in the event of a mishap. However, it is essential to make sure you can manage the greater out-of-pocket expense before devoting to a higher deductible.

If you own a bigger vehicle, consider downsizing to a smaller sized car that will set you back much less to guarantee. Similarly, think about changing to a more fuel efficient automobile to save on gas prices.

Check into various other price cuts, such as multi-vehicle, multi-policy, excellent motorist, safe driving and military discounts. In addition, some insurance provider use usage-based or telematics insurance coverage programs that can conserve you cash by monitoring how much you drive. Ask your service provider for even more details on these programs.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

Revealing The Leading Insurance Provider - A Thorough Comparison |

Authored by-McLain Summers

The insurance sector is changing swiftly as it embraces new modern technology as well as digital improvement. Consequently, simply click the next website page that want to innovate and adopt a customer-centric way of thinking have an edge over their competition.

This short article will cover the top insurance provider for automobile, home, and also life insurance policy. We will also highlight a few of the most effective life insurance policy firms that offer lenient underwriting for those with a pre-existing health and wellness condition.

New York Life

New york city Life supplies a range of life insurance plans with a wide range of choices. Their business has actually been around for 175 years as well as offers skilled guidance from their insurance coverage representatives. They have a terrific reputation and also superb consumer fulfillment scores. They provide a variety of plan alternatives and extensive bikers to make them one-of-a-kind from the competitors.

New york city life is a wonderful alternative for anybody searching for a permanent life insurance policy plan. They have entire life and also global policies that are developed to last for a person's lifetime and also develop money value. They also use a variety of different financial investment alternatives and also supply access to financial advice for their customers.

They have a reduced complaint ratio with the National Association of Insurance Commissioners and have outstanding customer contentment rankings. https://zenwriting.net/jada07florencio/the-ultimat...ssful-insurance-coverage-agent have a thorough internet site where you can start a claim or download solution forms.

Northwestern Mutual

Founded in 1857 in Wisconsin when the state was only 9 years old, Northwestern Mutual is a shared firm without personal shareholders. Because of this, they have the ability to return revenues directly to insurance policy holders in the form of reward checks. These returns can be utilized to pay premiums, enhance cash money value or purchase added coverage.

This company is recognized for its financial stamina and also high customer fulfillment rankings. Actually, they place fourth in J.D. Power's 2022 Individual Life Insurance Research Study, and also they have extremely reduced problem rates.

They also provide a variety of financial products, including retirement as well as investment solutions. The Milwaukee-based business manages possessions for institutional customers, pooled investment automobiles and high-net-worth individuals. It offers online solutions such as quotes and an on-line client portal for insurance policy holders.

Banner Life

With a customer service score of A+ from the Bbb, Banner Life is among the top firms for those seeking to buy life insurance. They likewise have a thorough web site with plenty of details to help consumers understand their alternatives and also the process.

The company provides affordable prices for term life insurance in a variety of wellness categories and even uses some no-medical examination policies. They are also among minority insurance providers to supply tables for cigarette smokers as well as those with significant conditions like diabetes, liver disease B or C, and also coronary artery condition without including a flat extra.

In addition, their Term Life Plus policy permits the conversion to irreversible protection, and their Universal Life Step UL policy has a good rate of interest. Banner operates in every state besides New york city, which is served by their sister firm William Penn

. Lincoln National

Lincoln Financial provides a range of insurance and also financial investment items, consisting of life insurance policy and also office retirement plans. The business rewards consumer complete satisfaction and boasts a strong reputation in the individual money press. It likewise does well in our rankings for monetary stability, product as well as feature variety, as well as the general acquiring experience.

The firm is a Ton of money 250 firm as well as ranks among the top life insurance policy companies in regards to financial stamina scores from AM Ideal, Fitch, and also Moody's. It likewise flaunts a reduced grievance index score according to NerdWallet's evaluation of information from the National Organization of Insurance Policy Commissioners.

In addition to being a solid option permanently insurance policy, the firm sustains the neighborhood via its philanthropic initiatives. The Lincoln Financial Foundation donates millions to a variety of not-for-profit organizations.

Prudential

Prudential offers a wide variety of life insurance policy plans as well as has suitable scores from credit score rating agencies. Nevertheless, https://www.theintelligencer.com/news/article/Comm...ital-for-Marteeny-17533684.php does have a reduced consumer fulfillment rating as well as more problems than expected for its size.

The firm likewise does not supply entire life insurance policy, which is the most common kind of long-term life insurance policy. This limits the variety of options offered to consumers.

Along with supplying high quality products, Prudential has a great credibility for its neighborhood participation. Its staff members volunteer and also dedicate their time to aid their neighborhood communities.

Prudential is currently running a collection of advertisements across America. These advertisements are focusing on economic health and also highlighting the relevance of getting life insurance. A few of their ads feature a dad that is stressed over his little girls in case of an unanticipated death.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

5 Crucial Abilities Every Insurance Policy Agent Should Master |

Content written by-Pugh Nilsson

Insurance policy representatives require to be able to connect plainly with customers. This implies making use of an expert vocabulary yet still being conversational and also friendly.

They likewise require to have a good understanding of the products they are offering. This is because they will require to be able to discuss the advantages of each item to their clients.

1. Communication

Having strong communication skills is necessary for any individual who intends to end up being an insurance representative. A good agent requires to be able to describe difficult plans clearly and also easily to clients. On top of that, they must have the ability to pay attention to customers to recognize their demands and also discover the very best policy for them.

It's also crucial for insurance policy representatives to be able to communicate with their underwriters effectively. They should utilize clear language and also stay clear of making use of technological terms that could puzzle underwriters.

Furthermore, representatives should take into consideration enhancing interaction with their clients by utilizing a client website. This can help in reducing the time that agents invest publishing out records, paying reminder calls and also rekeying information. This maximizes their time to concentrate on building partnerships and customer commitment.

2. Client service

Customer support skills are a must for qualified insurance coverage representatives. https://www.cnbc.com/select/best-travel-insurance-companies/ guarantee that customers get the punctual and also empathetic assistance they are worthy of.

These skills enable customers to feel heard and also recognized, which goes a long way in producing a positive experience. Besides responding to queries, emails as well as contacts a prompt way, clients likewise anticipate an agent to comprehend their special scenario and supply them with the best info.

Insurance coverage representatives that possess outstanding customer care abilities can get in touch with their clients on a deeper level and also help them see the economic truth of their circumstance. They are additionally with the ability of transmitting tickets to the ideal group as soon as they come to be urgent, assisting clients to reach a resolution quicker. This is vital, as it boosts customer contentment and commitment.

3. Negotiation

Insurance coverage representatives work with consumers to work out plans. This calls for solid customer care skills, and a positive method to problem-solving. This is specifically vital when discussing a plan as well as discussing costs, as money evokes emotion in lots of people and logical idea tends to fall apart.

Throughout the interview procedure, show your capacity to build rapport by smiling at your recruiter and displaying open body language. This will certainly assist you share your self-confidence in the duty.

Learn just how to work out effectively by exercising with a career services consultant or a good friend and role-playing a number of times. It is likewise essential to have a practical view of the area of feasible agreement, which is specified as the array where you and your settlement partner can locate commonalities on a particular concern.

4. Sales

Insurance representatives have to have solid sales skills to protect and preserve a constant circulation of service. They must also be able to take initiative and also seek out brand-new clients, such as by cold-calling local business owner or checking out business to introduce themselves.

Good sales abilities entail the capacity to assess client demands as well as recommend suitable insurance plan. It is important for insurance policy agents to place the customer's demands ahead of their very own, not treat them like a cash machine.

This calls for a degree of compassion with clients, which can be difficult in some circumstances. Ultimately, good sales skills involve a willingness to learn about new products and also other aspects of the industry on an ongoing basis. Keeping current with the current insurance coverage news and trends is important to preserving competition in the market.

5. Company

Insurance agents should be well-organized in their work. https://www.wolterskluwer.com/en/expert-insights/esg-as-a-key-factor-ifb-blogarticle is due to the fact that they should be able to deal with volumes of info as well as make fast estimations. They ought to also be able to monitor their customers and stay in touch with them.

Insurance coverage experts should constantly make every effort to be experienced in their area and also also beyond it. This will help them recognize prospective customers better and also suggest the appropriate plans for their requirements.

Soft abilities training is a wonderful method for insurance coverage representatives to build their customer-facing abilities. In fact, a recent study found that business that buy soft skills training see a typical ROI of 256%. This is greater than dual what they would obtain from investing in technology or product training.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

5 Necessary Skills Every Insurance Policy Agent Should Master |

Written by-Bendsen Lykke

Insurance policy representatives need to be able to connect clearly with consumers. https://www.insurancebusinessmag.com/us/guides/six...n-insurance-broker-428809.aspx suggests utilizing a professional vocabulary however still being conversational and approachable.

go to this site !3m2!1i1024!2i768!4f13.1!3m3!1m2!1s0x872b7562055c8fdb%3A0x60507b29d5ebb813!2sLuxe%20Insurance%20Brokers!5e0!3m2!1sen!2sph!4v1688812113899!5m2!1sen!2sph" width="600" height="450" style="border:0;" allowfullscreen="" loading="lazy" referrerpolicy="no-referrer-when-downgrade">

They also need to have a mutual understanding of the products they are marketing. This is due to the fact that they will need to be able to clarify the advantages of each item to their clients.

1. Communication

Having solid communication skills is necessary for any individual that intends to come to be an insurance representative. A great agent requires to be able to clarify complicated plans clearly as well as quickly to customers. On top of that, they have to have the ability to pay attention to customers to comprehend their requirements and discover the very best plan for them.

It's additionally vital for insurance coverage representatives to be able to connect with their experts efficiently. They must make use of clear language and stay clear of using technical terms that can confuse experts.

Additionally, agents need to take into consideration simplifying communication with their clients by using a customer website. This can help in reducing the time that agents invest printing out papers, making payment suggestion calls and also rekeying data. This maximizes their time to focus on structure connections and also client loyalty.

2. Customer care

Customer care abilities are a need to for qualified insurance coverage agents. They guarantee that customers obtain the prompt and compassionate support they deserve.

These skills permit customers to really feel listened to and understood, which goes a long way in producing a favorable experience. Besides reacting to inquiries, emails and also calls a prompt way, consumers also anticipate a representative to recognize their special circumstance and also supply them with the ideal details.

Insurance representatives that possess exceptional customer service abilities can get in touch with their customers on a deeper level and help them see the monetary truth of their scenario. They are additionally with the ability of transmitting tickets to the appropriate team as quickly as they end up being urgent, aiding clients to get to a resolution quicker. This is crucial, as it increases client satisfaction and also loyalty.

3. Settlement

Insurance policy representatives collaborate with consumers to discuss policies. This requires solid client service abilities, as well as a favorable approach to analytical. This is particularly essential when talking about a policy and discussing costs, as money stimulates feeling in many individuals as well as rational idea has a tendency to fall apart.

Throughout the meeting process, show your ability to build relationship by smiling at your interviewer as well as displaying open body movement. This will certainly help you communicate your confidence in the role.

Find out exactly how to bargain efficiently by practicing with a job services expert or a pal as well as role-playing several times. It is additionally important to have a sensible view of the zone of possible arrangement, which is defined as the array where you and also your negotiation partner can discover commonalities on a specific concern.

4. Sales

Insurance coverage representatives must have solid sales skills to secure and also maintain a consistent circulation of organization. They should likewise have the ability to take initiative as well as seek out new customers, such as by cold-calling entrepreneur or visiting business to present themselves.

Excellent sales skills involve the ability to assess client demands and recommend ideal insurance policies. It is essential for insurance coverage representatives to place the customer's needs ahead of their very own, not treat them like an atm.

This requires a degree of empathy with customers, which can be tough in some scenarios. Finally, excellent sales skills include a determination to learn more about brand-new products and also various other elements of the sector on an ongoing basis. Keeping existing with the latest insurance policy news and fads is necessary to keeping competitiveness in the marketplace.

5. Organization

Insurance policy agents must be well-organized in their work. This is because they have to be able to handle quantities of information and make fast calculations. They ought to likewise be able to track their customers and remain in touch with them.

Insurance policy specialists must constantly aim to be educated in their field as well as even beyond it. This will certainly help them comprehend possible customers better as well as recommend the appropriate policies for their requirements.

Soft abilities training is a fantastic method for insurance agents to construct their customer-facing abilities. Actually, a recent study discovered that companies that invest in soft abilities training see an average ROI of 256%. This is more than dual what they would certainly obtain from investing in modern technology or product training.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

Top 7 Strategies To Create Leads As An Insurance Agent |

Article created by-Chapman Horowitz

Insurance policy representatives need a steady flow of cause expand their company. However producing high quality leads isn't very easy. Below are some wise methods that can help.

A dedicated link with an electronic insurance policy application that's residence to genuine, bindable quotes is a simple way to produce leads. Utilize it in an email, on social networks or in advertising and marketing.

1. Develop a strong on-line visibility

As an insurance coverage representative, you need a strong sales pipeline. You have to fill it with high quality leads that turn into clients.

Internet marketing methods give a range of choices for brand-new business generation. https://www.nerdwallet.com/article/insurance/best-renters-insurance can assist you create leads at a fraction of the initial investment expense contrasted to typical approaches.

Developing material that offers value to your audience can be a reliable way to bring in new consumers to your web site. Nonetheless, please click the following website should guarantee that this material pertains to your target market's needs.

Providing your company on online service directories can enhance neighborhood presence. It can also complement your search engine optimization initiatives by enhancing brand awareness.

2. Obtain detailed on reputable testimonial sites

Getting leads is a vital part of building your insurance coverage organization. However new insurance policy agents, particularly, can find it tough to produce enough top quality leads.

Focusing on material marketing is one method to generate much more insurance coverage leads. Develop pertinent as well as useful material that aids your target market solve their problems as well as build a bond with your brand name.

You can additionally use social media sites to boost your list building. Uploading write-ups on your LinkedIn and Quora web pages can help you get in touch with more competent prospects. You can even hold academic webinars to attract possible clients and enhance your trustworthiness.

3. Use clear phone call to activity

Insurance coverage is a service sector that flourishes or withers on the top quality of its list building approaches. Using clear, straight phone call to activity is one way to produce high-grade leads.

For instance, a site that is enhanced for appropriate search phrases will attract customers who are already looking for an agent. Obtaining detailed on trusted evaluation websites can also boost your consumer base and also produce referrals.

Keep in mind, however, that it takes some time to obtain results from these efforts. Monitor your pipe closely, and also utilize efficiency metrics to fine-tune your marketing approach.

4. Buy leads from a lead service

The insurance coverage biz can be a challenging one, even for the most seasoned representatives. That's why it pays to utilize practical advertising and marketing approaches that are verified to create leads and transform them into sales.

As an example, making use of an appealing internet site with fresh, relatable web content that positions you as a neighborhood specialist can bring in online website traffic. Getting noted on respectable evaluation websites can aid as well. As well as having a chatbot is a must-have for insurance coverage digital advertising and marketing to aid clients reach you 24x7, even when you run out the workplace.

5. Nurture leads on LinkedIn

Several insurance policy agents are in a race against time to get in touch with possible customers before the leads weary and also take their service elsewhere. This process is often referred to as "functioning your leads."

Insurance coverage firms can generate leads on their own, or they can purchase leads from a lead solution. Buying leads saves money and time, yet it is very important to comprehend that not all lead solutions are produced equal.

In order to get one of the most out of your lead generation efforts, you need a lead service that concentrates on insurance coverage.

6. Request consumer testimonies

Insurance policy representatives flourish or wither based on their ability to connect with leads. Obtaining as well as supporting high quality leads is vital, especially for brand-new representatives.

Online web content advertising and marketing, a powerful and also economical method, is a reliable way to create leads for your insurance coverage organization. Think of what your target market is looking for and also produce practical, helpful content that resonates with them.

Testimonies, in text or audio layout, are an excellent device for developing trust with possible clients. These can be published on your web site or utilized in your email e-newsletter as well as social media.

7. Outsource your list building

Maintaining a consistent pipe of certified leads can be testing for insurance coverage representatives, specifically when they are busy servicing existing clients. Outsourcing your list building can liberate your time to focus on expanding your business and also getting new customers.

Your web site is one of the most effective devices for producing insurance leads. It should be easy to navigate and give clear contact us to action. Additionally, it's important to get listed on trusted testimonial websites and also make use of reviews.

Another terrific way to create insurance policy leads is through web content advertising. By sharing relevant, helpful articles with your target market, you can build trust fund and also develop yourself as a thought leader in the sector.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

Ways On Just How To Obtain Low-Cost Automobile Insurance Policy |

Article written by-Santos Bengtson

Sometimes, auto insurance can feel like a necessary evil. Every driver is required by law to have it, and it can seem awfully expensive. Learning about the options available can help drivers spend less and get more out of their car insurance. This article will offer a few tips for auto insurance that may be of interest.

The year and options on your vehicle will play a large roll in how much your insurance premium is. Having a newer car with lots of safety features can save you some, but if you have it financed you will also have to pay more for full coverage.

Before buying a car, take into consideration the cost of the insurance policy for the type of car or cars you are looking at. Generally, the more expensive the car is, the higher the insurance cost will be. Take into account the insurance cost before purchasing the car you have chosen.

A great way to get an affordable price on auto insurance is to seek quotes on different models prior to shopping for a new car. By doing so, you will be able to factor the cost of insurance into your vehicle selection, and be certain that you will be able to afford the entire cost of owning whichever car you decide to take home.

To get the most for your money when pricing automobile insurance, be sure to consider the extras that are included with some policies. You can save on towing costs with emergency roadside assistance that is included by some insurers. Others may offer discounts for good drivers or including more than one car on your policy.

With other expenses already so high, it is a good idea to drop some of those after-market upgrades that only add to aesthetic value. Upgrades such as leather seats and a killer sound system are awesome, but these are not things you really need. If ever you car is stolen or totaled, your insurance won't reimburse you for damages done to it.

If red light camera ticket driven is low, your auto insurance premium should be, too. Fewer miles on the road translates directly into fewer opportunities for you to get into accidents. Insurance companies typically provide a quote for a default annual mileage of 12,000 miles. If you drive less than this be sure your insurance company knows it.

When you are requesting quotes for car insurance, comparing costs of annual premiums is just a small part of your overall analysis. Look at how good the actual policies are when comparing companies. For example, what are the deductibles? What is your level of coverage? What kind of limits can you expect?

You need to contact your insurance company and add your teen to the policy, before allowing him or her to get behind the wheel. If your teen would get into an accident while not on the policy, it could cause you to have to pay for any damages out of your own pocket. It only takes a few minutes to add someone to a policy.

Keep car insurance in mind when buying a new car. Different cars have different premiums. You might have your heart set on an SUV, but you might want to check just how much it is going to cost to insure before you spend money on it. Always do your insurance research before buying a new vehicle.

Do not bother insuring an older car with collision coverage. Your insurance provider will only give you the book value on your car. Chances are that an older vehicle might not be worth much, thus rendering the collision coverage pretty useless. Check the book value on the car before continuing with collision coverage.

When dealing with an auto insurance claim, always keep all of the information related to the claim with you at all times, in a pocket or a purse. Claim settlements are often slowed down by the client not having information handy with the insurance company contacts them, meaning they'll have to wait until that evening to get things moving.

If you live in a city, own a car and you are getting car insurance, it may be wise to think about moving to the suburbs. By making this move, you could be saving thousands each year on your car insurance, as it is always more costly in the city.

You should evaluate exactly how much coverage you will need. Not everybody really needs full coverage, so why should you have to pay for more then you need. For example, if you have an older car, it might not be worth it to have your car covered. click the up coming post could save you quite a bid of money, but know that if your car gets totaled, you will not get compensated for it.

You don't have to wait until your auto insurance is up for renewal to change companies, but it does make the most sense. Your insurance company will always prorate your coverage and return any unused portion to you, but obtaining that unused portion can be a hassle. Canceling between renewal periods is simpler.

Consider suspending coverage on a vehicle you are not actively driving to reduce your premium payments. Often, you can suspend coverage except comprehensive on a vehicle not being driven, which still provides protection should the vehicle be damaged while garaged or parked. However, check with any lienholder or your state to make sure you are adequately covered and complying with loan requirements before suspending coverage.

Sign up for the superior driving test. Taking this step is one way to show your automobile insurance company that you are serious about being a conscientious and safe driver. It can reduce your chances of having a car accident, and it will save you money in the long run.

Usually, you can find some of the best insurance deals on the web. This is because selling directly to customers cuts out costs like an agent. So the insurance companies get to keep a little more for themselves. This also will trickle down to you in the form of a small discount.

Don't hesitate to price compare when you're looking for an auto insurance policy, as prices can vary widely. The internet has made it increasingly easy to check around for the best price on a policy. Many insurers will give you instant quotes on their website, and others will e-mail you with a quote within a day or two. Make sure that you give the same information to each insurer to guarantee you're getting an accurate quote, and take into account any discounts offered, as these can vary between insurers.

Whatever your car insurance needs are, you can find better deals. Whether you just want the legal minimum coverage or you need complete protection for a valuable auto, you can get better insurance by exploring all the available possibilities. This article has, hopefully, provided a few new options for you to think about.

|

Метки: Auto Insurance Car Insurance General Insurance Home Insurance House Insurance Insurance Agents Car Insurance Company |

Safeguard The Financial Investment You Made In Your Car |

Article written by-Davidsen Yang

It is important to become educated about auto insurance. It is a key aspect of any driver's life. Making bad decisions can cause you to waste a lot of time and money. Below you will find some very useful tips that will save you more hassles in the long run.

Auto insurance for young drivers is very costly. You can save some money by choosing the right kind of car for your teenager to drive. If you allow your teen to drive the Mustang, prepare to pay through the roof. If, on the other hand, you restrict your teen to the most "beater"-like car you own, your premiums will be notably lower.

Do not settle for the first auto insurance company that you find. You may be missing out on special discounts or rewards. For instance, some insurance companies offer discounted premiums for accident-free drivers, or for people of certain professions. Some even give discounts to college students who maintain good grades.

Saving money on auto insurance does not have to be a difficult thing, especially if you are loyal to the same company. Most policies are only for a term of around a year, so make sure you re-up with the same company. If you show loyalty to the insurer, you will be rewarded with lower monthly premium payments.

Your insurance premium will be dependent upon the brand of car, SUV, truck, ATV, boat or motorcycle you buy or lease. The mileage, make, model and year of the car will determine how much your insurance bill will be. If you like expensive things, your insurance will be expensive. If you want to save money on insurance, choose a safe, modest vehicle.

If you are an older driver ask the insurance company that you are looking into about its age discounts. If you have a safe driving record, and are over a certain age, most insurance companies will offer you discounts for it. The best rate period is when you are between the ages of 55 and 70.

Rental car policies vary, but most allow only an immediate relative, who is of age, to drive the rental car. Be sure to pay special attention to the rental contract as it will state who is allowed to drive the car. Some rental companies will require anyone driving to sign the agreement and provide their driver's license. It is also possible for the rental company to charge an additional fee for additional drivers.

You need to contact your insurance company and add your teen to the policy, before allowing him or her to get behind the wheel. If your teen would get into an accident while not on the policy, it could cause you to have to pay for any damages out of your own pocket. It only takes a few minutes to add someone to a policy.

When purchasing car insurance, do not get unnecessary add-ons. Things like Motor Club, Travel Club, and Accidental Death Insurance are rarely used and just end up costing you more money each year. Instead, stick with things you will use, such as collision coverage, liability and property damage, and bodily injury coverage.

If you are short of funds and desperate to reduce your insurance premiums, remember you can always raise your deductible to lower your insurance's cost. This is something of a last-ditch maneuver, though, because the higher your deductible is the less useful your insurance policy is. With https://faranabilla-yusoff.blogspot.com/2021/07/in...or-high-risk-drivers-best.html will end up paying for minor damages entirely out of your own pocket.

Do not settle for the first auto insurance company that you find. You may be missing out on special discounts or rewards. For instance, some insurance companies offer discounted premiums for accident-free drivers, or for people of certain professions. Some even give discounts to college students who maintain good grades.

Check to see if your auto insurance company has a discount for not filing claims. Sometimes if you haven't had any claims for a period of time, you may be eligible for a discount. If they aren't upfront about the discount, ask them. Having no claims can reduce your insurance.

You should raise your deductible, so that you can save more money in the end. While this means more money spent up front if you are have an accident, it will save money on your premium. In order to make this strategy work, you should set aside enough money for the deductible in case of an accident. Increasing your deductible will lower the amount you have to pay for your premium.

Not only is auto insurance mandatory, but valuable. Purchasing insurance for your vehicle is a daunting task, as there are lots of options to explore. You want to shop around, perhaps by calling around using the listings in your phone book or by using the internet. Once you find a comfortable price and coverage plan for your automobile then you can be sure if you are in an accident or pulled over by the police you're protected.

Do not allow your auto insurance policy to terminate for non-payment or terminate before you switch to a new insurer. If visit the following web site do, this may cause your insurance rates to increase for quite some time.

If you would like to have lower insurance premiums, you will need to increase your deductible. High deductibles protect you if your vehicle is totaled or if you are liable for accidents; however, it would still be your responsibility to repair damage from smaller accidents. Try a high deductible if you have a car with low value.

When you are looking to purchase a new auto insurance policy ask each company if they offer a discount to seniors. Some companies offer a discount if you have a good driving record and are above the age of 65 If one company does not give a discount, it may be worth moving on to another who does.

There are many types of coverage in an auto insurance policy. One that is very important is comprehensive (physical damage) coverage. This important type of coverage covers the damage to your car as a result of theft, fire, vandalism, flood, wind, and other natural causes. Remember it carries a deductible too.

When trying to settle your auto insurance claim don't just settle for the person who calls you first. If you don't like their offer, ask to speak to their supervisor, and their supervisor and so forth until you get the result you want. Since they don't want you complaining to your friends and family, you have a good bargaining chip.

As stated before in this article, auto insurance is required by many states. Those who drive without auto insurance may face legal penalties, such as fines or jail. Choosing the right auto insurance for your needs may be hard, but with help from the tips in this article, it should be much easier to make that decision.

|

Метки: Auto Insurance Car Insurance General Insurance Home Insurance House Insurance Insurance Agents Car Insurance Company |

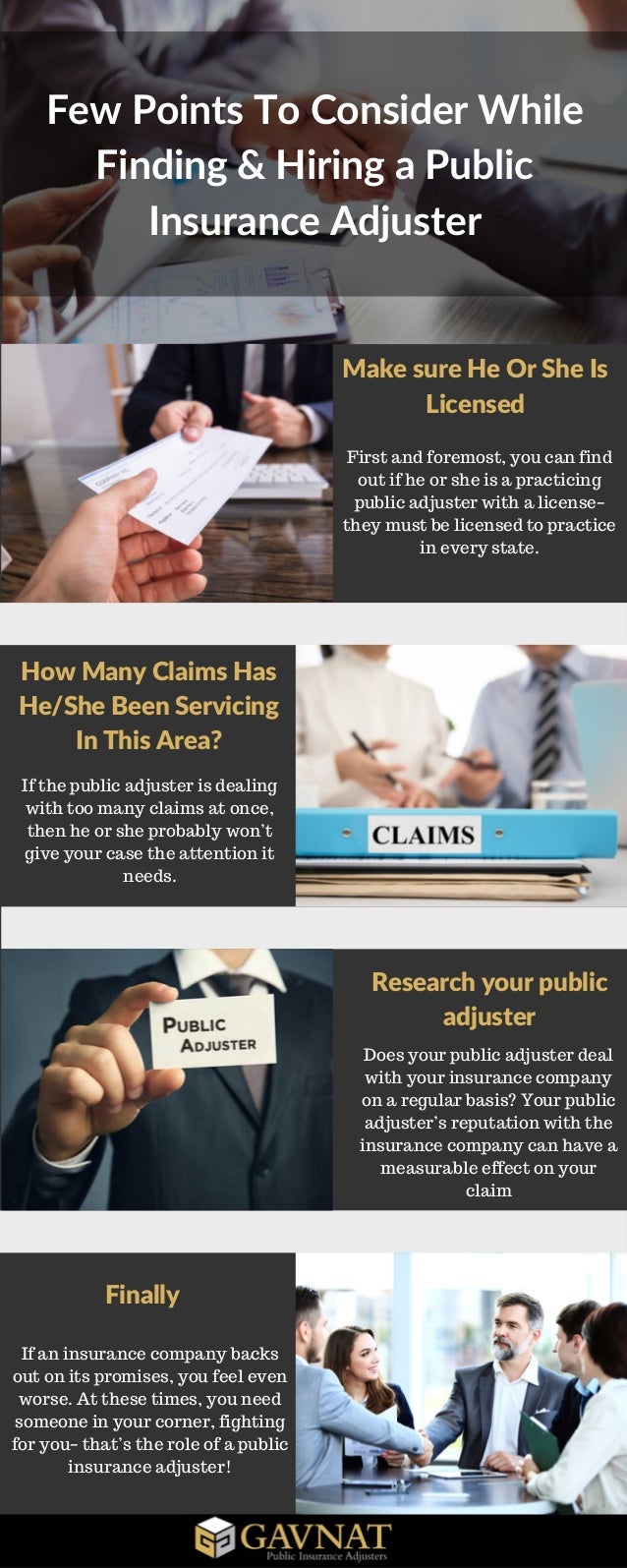

Just how Does A Public Insurance Adjuster Can Help You With Your Claim? |

Posted by-Wilkerson Snedker

If you are involved in a vehicle accident that was not your mistake, you may be qualified to obtain payment from a Public Insurance adjuster. You can get settlement from the Insurance Department, even if you were not at fault. It is constantly advised that you consult with an Insurance policy Agent before making any choices concerning your claim. They can aid you with the insurance claims procedure and also assist you comprehend how the procedure works.

Insurance Agents are certified by the state to function as Public Insurance adjusters. You, the insurance holder, are designated by the insurance company to work as the Public Insurer. She or he works entirely for you and also has definitely no connections to the insurer. Therefore, the insurer will commonly assign its ideal insurance adjuster to handle its insurance claims.

Best Public Adjusters near me need to follow strict rules and laws. If you have concerns worrying a case, you should guide them to the insurance claims department. You have to give correct recognition as well as give copies of papers such as your insurance coverage, receipts, etc. In addition, you have to remain tranquil and cooperative and also do not chew out the insurance adjuster. A good public insurance adjuster will certainly aid you with these things as well as keep you informed.

Public Adjusters will assess your claim and act in a prompt fashion. Insurance provider want to work out as fast as possible because they do not want to have to pay the excess expenses connected with extensive lawsuits. Insurance companies employ certified public adjusters on a part-time or permanent basis. Part-time employees will be responsible for claims, while full time staff members will certainly concentrate on functioning as many claims as feasible. Most significantly, an excellent public insurance adjuster has access to the appropriate get in touches with and also will use this expertise to negotiate reduced settlement in your place.

If you are taking into consideration making use of the solutions of a professional public adjuster, ask to inspect references. Ensure that they have a tried and tested track record of phenomenal customer service. Check mold after water damage to make sure that they have had an excellent settlement rate in the past. You need to also check references from other customers that are pleased with their solutions.

As soon as you have actually chosen to deal with a reliable claims insurance adjuster, make certain to interact routinely with your insurer. Educate the adjuster of any type of changes that might occur throughout the process. Maintain all interaction lines open with your insurance coverage carrier. Additionally, make sure that you really feel comfortable letting your insurer understand of any kind of worries that you have. The good public insurers will always pay attention to your issues and also provide you comprehensive recommendations. If you are having difficulty interacting with your adjuster, it is essential that you discover a person who is willing and also able to interact well with you.

Some insurer prefer to employ actual loss insurance adjusters over independent brokers. This is since they feel a lot more comfortable recognizing that the broker is helping the insurer as opposed to a specific insurance claim insurance adjuster. However, when an insurance company works with an actual loss insurer, they preserve the rights to use him or her in any kind of future dealings with your insurance provider. In many cases, if you are taking care of an independent broker, he or she is not the same person who will certainly be managing your claim. This suggests that an independent broker can not give you suggestions regarding your real loss situation.

If you decide to work with a specialist public adjuster, it is important that you give them time to prepare your claim. The insurer will generally ask for a breakdown of your residential property losses prior to they begin servicing your claim. They will additionally evaluate your insurance coverage to make certain that the settlement offer is fair and affordable. If a settlement offer is not appropriate to you, the adjuster will likely request for more time to collect info and also create a suitable deal.

|

|

Public Insurance adjuster - What Does a Public Insurance adjuster Does? |

Author-Vest Geertsen

An Insurance Coverage Adjuster or Public Insurance adjuster is an accredited specialist who provides insurance coverage claims processing services for an Insurance provider. They are responsible for all matters related to insurance coverage declares processing, consisting of: Insurance Agent Education And Learning and also Training, keeping client data, underwriting policies and also revivals, recommending customers on post-policy maintenance arrangements, working out insurance claims, and also taking care of all case documents as well as document. The duty they play is important to Insurer because they make sure that every one of the needed treatments as well as regulations related to insurance coverage claims are complied with, are done properly, and all celebrations associated with the claims process are totally educated of their civil liberties and also obligations. Most notably, they make certain that each of the included celebrations is compensated for their loss. Insurance Adjusters need to have superb communication abilities, interpersonal abilities, superb logical abilities, excellent creating abilities, comprehensive experience, and understanding of the laws that relate to their area of expertise. Several of the many locations they must take care of include:

Cases Insurance adjusters are frequently puzzled with Insurance claims Managers, which are usually thought of as the exact same job. In truth, however, the roles and obligations of a claims adjuster and a supervisor do very different things. Insurance claims Adjusters normally provide every one of the info essential for the customer or insurance policy holder to obtain the insurance policy benefits they are qualified to through their insurance coverage. Insurance claims Insurance adjusters do not handle the day to day insurance claims procedure, yet rather report to the Insurer's Claims Division or to the customer's Manager. Likewise, claims adjusters are not paid by the client directly, however rather pay the Insurance Company directly for their solutions.

The role of a public adjuster differs according to state regulation. In some states, insurance holders have the duty of contacting as well as consulting with public adjusters; nonetheless, in various other states insurance holders are called for to file claims with the Insurance coverage Provider, not the general public Adjuster. In most cases, the public insurance adjuster will certainly follow up with the customer, make an evaluation of the insurance claim and afterwards alert the insurance carrier of the claim. Some state public insurance adjusters additionally appoint team to deal with insurance claims at the customer's house or location of employment.

Each state has its very own rules regarding that can make a case versus the residential property insurer. Insurance policy holders ought to be aware that if they choose not to follow the recommendations of the public adjuster that they may be dealing with a public responsibility claim. If they are established to be "liable" for a residential or commercial property insurance policy case, they might encounter fines, loss of current benefits, as well as even prison time. The very best time to get in touch with a public insurer is well prior to a case is filed. There are lots of things that a policyholder can do to aid avoid being the next victim.

First, policyholders ought to never sign any papers or agree to pay for repairs or replacements before speaking with the insurer. https://www.kplctv.com/2021/03/05/louisiana-depart...fers-winter-damage-claim-tips/ require a letter of authorization from the homeowner for any kind of type of residential or commercial property insurance coverage cases. Policyholders should additionally be aware that in some states the laws concerning when insurance claims can be submitted have altered. It is a good suggestion for insurance policy holders to consult with their state insurance coverage agents. They can also examine online for present information concerning insurance claims submitting needs. State insurance policy agents can be very handy in establishing who can make a home insurance coverage claim and who can not.

Insurance holders can likewise utilize the web to discover usual blunders that accompany insurance agreements. They can find out about the sorts of problems that might be covered by their insurance coverage and regarding just how to record all damage. Lots of insurance policies supply additional protection for mental and also emotional suffering. Sometimes these additional benefits will certainly be provided individually from the contract. Policyholders ought to review their insurance policy agreements thoroughly and also always describe their insurance policy documents for these particular information.

Insurance coverage representatives usually have an economic reward to work quickly. If they believe that a customer is exaggerating or existing concerning physical damages, they can make fast claims in order to work out the case before the adjuster has a chance to investigate it additionally. Insurance companies are not required to investigate all prospective disagreements in between customers and also adjusters. Oftentimes they will pick the option that offers them one of the most cash without carrying out any kind of examination whatsoever. Insurance policy holders who have actually experienced this from their insurance representatives must make certain that they do not allow this method for their own peace of mind.