Understanding The Claims Process |

Written by-Avila Ibrahim

When a crash occurs, it's all-natural to feel urged to look for compensation from your insurance coverage provider. Nevertheless, sending a case can be complicated and laborious, involving massive amounts of paperwork.

Whether you're filing an auto, home or responsibility claim, the process adheres to comparable guidelines and also is broken down into 4 phases. Understanding these stages can aid you submit your insurance claim successfully.

1. You'll Obtain a Notice of Case

As you collaborate with your insurance provider to file a claim, they will send you files needing you to offer evidence of loss, consisting of buck quantities. They may likewise request information from your medical professional or company. This is a typical part of the cases procedure, as well as it is usually done to validate your insurance coverage covers what you are asserting for.

As soon as the proof of loss is received, they will certainly verify it versus your insurance policy strategy and also deductibles to guarantee they are correct. They will then send you an explanation of advantages that will information the services obtained, quantity paid by insurance coverage as well as remaining balance due.

Insurance companies can make the cases process a lot easier if they keep their consumers and also staff members satisfied by keeping a clear and also regular experience. One method they can do this is by seeing to it their workers have the ability to promptly address any kind of inquiries or concerns you have. You can additionally consult your state insurance coverage department to see if they have any kind of problems versus a specific business or agent.

2. You'll Obtain a Notification of Denial

When a case is refuted, it can cause tremendous aggravation, confusion as well as expense. It is essential to keep up to day on your insurance company's adjudication and appeal processes. This info ought to be available on their web sites, and also they must likewise offer it in paper copy when you enroll in new protection with them.

When related resource site get a notification of rejection, ask for the certain factor in creating. This will certainly allow you to compare it to your understanding of the insurance policy terms and conditions.

Constantly document your follow-up calls as well as conferences with your insurance provider. This can help you in future actions such as taking an appeal to a higher degree or filing a legal action. Tape-record the day, time and also name of the agent with whom you speak. This will certainly save you useful time when you require to reference those documents in the future. Additionally, it will certainly permit you to track that has been interacting with you throughout this process.

3. You'll Receive a Notice of Reimbursement

Once the insurance firm has actually authenticated your claim, they will send out repayment to the doctor for solutions made. This can take a couple of days to a number of weeks. Once visit site , you will obtain an Explanation of Advantages (EOB) statement that details how much the company billed as well as how much insurance covers. The supplier will after that expense clients and also employers for the remainder, minus coinsurance.

If you have any issues with your claim, make certain to document every interaction with the insurance company. Maintaining a record of whatever that goes on with your claim can assist quicken the process.

It's also smart to maintain invoices for extra expenditures that you might be repaid for, especially if your house was harmed in a tornado or fire. Having a clear and also documented cases procedure can additionally aid insurance provider enhance customer retention by offering a far better experience. It can likewise help them determine areas of their process that could be enhanced.

4. You'll Receive a Notice of Final Negotiation

Insurer manage numerous claims on a daily basis, so they have systems in position to track each step of the process for all the insurance holders. This enables them to maintain your original insurance claim as well as any kind of allures you may make organized in a way that is very easy for them to manage. It is essential for you to mirror their procedure by maintaining every one of your documentation in one place that is easy to access and also evaluation.

If you determine to submit an insurance provider appeal, collect the proof that sustains your instance. https://writeablog.net/jonathon9matt/the-ultimate-...e-a-successful-insurance-agent could consist of cops records, eyewitness details, pictures and also medical reports.

Bear in mind that your insurance company is a for-profit service and also their objective is to decrease the amount they award you or pay in a settlement. This is since any type of awards they make lower their revenue stream from the costs you pay. They may also see this as a reason to increase your future rates.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

Opening The Keys To Closing Offers As An Insurance Policy Agent |

Written by-Bentley Barber

Insurance coverage agents are accredited experts who offer life, mortgage protection and also disability insurance. They have to be able to locate, draw in as well as maintain customers. They must likewise have a good understanding of plan protection and also terms, along with the capacity to work out.

Some salesmen usage traditional closing methods, which are manuscripts intended to encourage leads to get. These strategies can frustrate some purchasers, however.

1. Know Your Product

As an insurance representative, you have a distinct selling proposal. You can assist customers type through complicated information as well as choose that will safeguard their families in case of an emergency situation or catastrophe.

To do this, you have to know your products well and also comprehend just how they work together. This will certainly assist you build depend on with your clients and also resolve their arguments.

There are many shutting methods that you can utilize to shut life insurance policy sales. One is the assumptive close, where you assume that your prospect wants to acquire. This can be effective with a customer who is ready to dedicate, yet it can be repulsive for those who are still choosing.

2. Know Your Possibility

Offering worth to your customers and showing that you comprehend their demands is the most effective method to close an offer. Customers are more probable to rely on representatives that make the effort to learn more about their problems and use a service that fixes them.

It's additionally essential to understand your leads' existing plans. With Canopy Connect, insurance coverage confirmation is simply a click away and you can promptly source your client's affirmation web pages, case documents and also lorry info. This can aid you qualify leads faster, reduce sales cycles and also reinforce customer relationships. Try it today!

3. Know Yourself

Insurance policy representatives have two methods to market themselves: their insurance company or themselves. One of the most reliable way to market yourself is to be on your own.

Telling tales of just how you have actually helped clients is a wonderful means to build trust fund and maintain prospects psychologically engaged. It likewise aids to set you aside from the stereotyped salesperson that people hate.

Developing a network of good friends and also associates to count on for advice can increase your insurance policy organization and also give references for new customers. This will give you the chance to flaunt your sector expertise and also experience while developing an ever-expanding publication of business. https://www.greenfieldreporter.com/2023/02/24/mitc...riven-in-profession-community/ can bring about an uncapped earning potential.

4. Know Your Competition

When you recognize your competition, it becomes much easier to locate means to differentiate on your own and win company. This could be a particular insurance policy item, a special service that you use, or even your personality.

Asking clients why they picked to work with you over your rival can assist you find out what sets you apart. https://crista03krissy.wordpress.com/2023/07/20/to...s-an-insurance-representative/ may amaze you-- and they may not have anything to do with prices.

Creating relationships with your leads and customers is a significant part of insurance marketing. This can be done via social media, email, or even a public presentation at an occasion. This will construct trust and also establish you up for more opportunities, like cross-selling or up-selling.

5. Know Yourself as a Specialist

As an insurance agent, you'll function very closely with customers to identify their danger as well as build a defense plan that fulfills their requirements. Telling tales, explaining the worth of a plan, and asking questions are all means to assist your customers find their ideal coverage.

Several insurance policy representatives choose to work for a solitary firm (called captive representatives) while others companion with multiple firms (referred to as independent agents). Regardless of your choice, you'll take advantage of connecting with various other insurance professionals. Flood Insurance Calculator and experience can give invaluable insight and support for your profession. On top of that, getting in touch with fellow representatives can enhance your consumer base and recommendations.

6. Know Yourself as a Person

If you know yourself as a person, you can connect your proficiency and also value to consumers in ways that feel authentic. A consumer that relies on you is most likely to trust you as well as become a repeat customer.

Closing a handle the insurance coverage company is a lot more than simply a deal. You are offering safety as well as assurance to individuals that have unique demands.

Spend some time to think about what makes you distinct as an individual. You can use journaling or meaningful contacting discover your passions, temperament, and also worths.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

Understanding The Different Kinds Of Insurance Plan As An Agent |

Written by-Kearney Ritchie

Insurance policy is a vital financial investment that protects you as well as your possessions from monetary loss. Insurance representatives and also companies can help you comprehend the different kinds of insurance plan offered to satisfy your demands.

Agents describe the various choices of insurance provider and also can finish insurance policy sales (bind protection) in your place. Independent representatives can deal with numerous insurance policy service providers, while hostage or exclusive insurance representatives stand for a single business.

Captive Representatives

If you're looking to buy a specific kind of insurance coverage, you can get in touch with restricted representatives that work with one specific carrier. These agents sell only the policies supplied by their company, that makes them specialists in the kinds of coverage and also price cuts supplied.

They also have a strong relationship with their firm and are commonly called for to fulfill sales quotas, which can affect their capacity to aid clients fairly. They can use a wide array of policies that fit your needs, however they won't be able to present you with quotes from various other insurance companies.

Restricted representatives usually collaborate with prominent insurance providers such as GEICO, State Farm and also Allstate. They can be a great resource for customers that intend to support local organizations and develop a long-term relationship with a representative that understands their area's unique risks.

Independent Representatives

Independent agents usually deal with several insurance companies to market their customers' policies. This allows them to give a more individualized and also adjustable experience for their clients. They can likewise help them re-evaluate their insurance coverage over time and recommend new policies based on their demands.

They can use their clients a range of plan alternatives from numerous insurance coverage service providers, which suggests they can supply side-by-side comparisons of pricing as well as insurance coverage for them to select from. They do this with no ulterior motive and can help them locate the plan that really fits their distinct demands.

The very best independent representatives know all the ins and outs of their different product lines and also have the ability to respond to any kind of questions that come up for their customers. This is an invaluable solution as well as can save their customers time by managing all the details for them.

Life insurance policy

Life insurance plans commonly pay cash to assigned recipients when the insured passes away. The beneficiaries can be a person or service. https://blogfreely.net/zachery297daniel/how-to-eff...as-an-insurance-coverage-agent can buy life insurance policy plans directly from a personal insurance firm or via team life insurance used by companies.

https://www.wibw.com/2023/07/19/after-storm-kansas...cautions-those-making-repairs/ of life insurance plans require a medical examination as part of the application process. Streamlined problem as well as guaranteed problems are offered for those with illness that would otherwise stop them from obtaining a typical policy. Long-term policies, such as entire life, consist of a cost savings part that collects tax-deferred and may have higher costs than term life policies.

Whether marketing a pure protection plan or an extra complex life insurance policy policy, it is necessary for an agent to completely understand the functions of each item and how they connect to the client's particular situation. please click the up coming website page helps them make enlightened recommendations as well as stay clear of overselling.

Health Insurance

Medical insurance is a system for funding clinical expenditures. It is generally financed with payments or taxes as well as offered via private insurance providers. Exclusive medical insurance can be bought individually or through group plans, such as those supplied via companies or expert, public or religious teams. Some kinds of wellness insurance coverage consist of indemnity plans, which repay insurance holders for certain prices up to a set limitation, handled treatment plans, such as HMOs as well as PPOs, and self-insured plans.

As an agent, it is very important to recognize the different sorts of insurance coverage in order to aid your customers find the most effective choices for their demands as well as budgets. Nonetheless, errors can take place, and if an error on your component triggers a client to lose cash, errors and noninclusions insurance can cover the expense of the match.

Long-Term Treatment Insurance

Long-term care insurance policy assists people spend for residence health aide services and assisted living home treatment. It can likewise cover a part of the price for assisted living and also various other household treatment. Plans typically top how much they'll pay per day and also over an individual's lifetime. Some plans are standalone, while others combine protection with other insurance policy products, such as life insurance policy or annuities, and are referred to as hybrid plans.

Several private lasting treatment insurance plan need medical underwriting, which suggests the insurance company requests individual details and may ask for documents from a doctor. A preexisting condition might exclude you from obtaining advantages or could trigger the plan to be canceled, specialists warn. Some policies use a rising cost of living cyclist, which raises the day-to-day advantage quantity on an easy or compound basis.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

The Relevance Of Building And Also Maintaining Relationships As An Insurance Representative |

Content writer-Dennis Simonsen

Insurance coverage agents are involved in people's lives during milestone occasions and also difficulties. Keeping in touch with them and also building connections ought to be leading of mind.

Solid client partnerships profit both the representative as well as the customer. Satisfied customers become advocates, leading to more plan renewals as well as boosted sales chances. Customer partnerships also foster loyalty, which causes better client retention rates.

Customer support

Giving superb client service is important to building and also preserving partnerships as an insurance policy agent. This consists of the way in which representatives interact with leads prior to they come to be clients. If the initial interaction really feels as well sales-oriented, it might turn off possible clients. It likewise consists of how they deal with existing customers.

When insurance clients need assistance, such as when they have a claim to file, they want an agent that recognizes as well as feels sorry for their scenario. Compassion can restrain difficult situations as well as make consumers feel like their demands are important to the business.

On top of that, insurance policy agents ought to stay connected with present clients regularly to ensure they're meeting their expectations as well as staying on top of any changes in their lives that could influence their insurance coverage. This can include birthday celebration or vacation cards, emails to review any kind of approaching landmarks and conferences to evaluate renewals.

Recommendations

Getting references is among the very best ways to grow your service as an insurance policy representative. By concentrating on networking with individuals in particular industries, you can develop on your own as the go-to expert and also bring in a constant stream of customers.

When a customer counts on their insurance policy representative, they're most likely to remain faithful. Additionally, faithful clients will come to be supporters and refer brand-new organization to the agent. These references can counter the expense of getting new clients via traditional approaches.

By offering visit their website during the prospecting stage, representatives can construct partnerships that will last a long period of time, even when other insurance providers offer reduced costs. This needs producing a defined approach for customer interaction management, inserting personalized provides into transactional messages, as well as supplying tailored experiences. https://zenwriting.net/isobel982loren/the-ultimate...nsurance-policy-representative anticipate this sort of communication. Insurance providers that don't meet expectations risk falling back. The bright side is that forward-thinking insurance policy agents understand this and also have a competitive advantage.

Networking

Whether you're a social butterfly or a bit extra introverted, networking is one of the very best means for insurance representatives to expand their services. Even if your customers don't become a network of their very own, they're likely to mention you to friends and family that may require some protection.

Having a solid network of possible clients can make all the distinction in your insurance sales success. If you have a consistent stream of real-time insurance coverage leads, you can concentrate on structure relationships with your current clients and speeding up the process of obtaining them new business.

Seek networking possibilities at insurance coverage industry events or even at various other kinds of regional events. For example, going to a meeting of your local Chamber of Business or Merchants Organization can be a terrific place to satisfy fellow company owner and also form connections that can help you grow your insurance coverage company. The exact same goes for social media groups that are geared towards professionals in the business neighborhood.

Staying connected

The insurance policy industry is affordable, and it takes a lot of job to remain top of mind with consumers. Producing an excellent consumer experience initially will certainly make your customers more probable to stick with you, even if another agent provides reduced costs.

Being an insurance policy agent isn't practically marketing, it has to do with aiding individuals browse an intricate area and also protect themselves versus unforeseen economic loss. Helping them with their monetary decisions can additionally make them trust your recommendations, and that equates right into repeat business and references.

A customer's relationship with an agent is tested when they have a claim. That's when a representative can reveal they care, which can enhance their partnership. Utilizing customized advertising to keep in touch is necessary because not all clients value the very same communications channel. please click the next post could like e-mail newsletters, while others might intend to satisfy in-person or access info online. It's important for representatives to know their customers' preferences so they can be available when the time comes.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

The Crucial Overview To Selecting The Right Insurance Provider For Your Demands |

https://writeablog.net/kathrin1405tyler/the-functi...surance-policy-agent-practices -Carlsen Nymand

Many individuals concentrate entirely on price or check out on-line testimonials when picking an insurer. Nevertheless, there are other important elements to take into consideration.

For example, if you are purchasing from a broker, look at their client complete satisfaction positions or ratings from agencies like AM Best. These scores can offer you a good sense of economic stamina, claims-paying background and also other variables.

Cost

Picking insurance coverage is not only about affordability, yet also about making certain the coverage you pick suffices to safeguard your economic future. Therefore, mouse click the up coming website page should carefully stabilize price with insurance coverage, as well as it is important to evaluate exactly how your choices will certainly influence your long-term economic objectives as well as requirements. If you are attracted to check out on-line reviews, consider reviewing them with a firm representative, as they may be able to give responses that is practical in figuring out whether the review is precise or otherwise.

Insurance coverage

Insurance policy is a means to pool threat by paying for insurance claims. It's a giant nest egg that spends for catastrophes we can't control, like tornadoes, wildfires, cyclones, and also cooking area fires, as well as everyday problems, such as minor car accident as well as car accidents.

Examining your insurance policy requires and choosing suitable insurance coverage is a complex procedure. Factors to consider consist of price, coverage restrictions, deductibles, plan conditions, as well as the track record and monetary stability of insurance coverage service providers.

Make the effort to compare quotes from several insurance providers, considering discounts provided for packing policies or keeping a tidy driving document. It's likewise crucial to assess the long-term ramifications of your insurance coverage choices. Evaluate just how they will certainly protect your properties, income, and also enjoyed ones for many years. In the long run, it's not nearly cost-- it has to do with shielding what issues most. This Ultimate Overview will help you choose the appropriate insurance policy provider for your special requirements. The best protection will provide you with assurance and also secure your monetary future.

Licensing

Prior to a person can begin selling insurance, they require to get accredited. This is a process that differs by state, yet usually includes completing pre-license education training courses and passing the state insurance examination. It also requires sending finger prints and also going through a history check.

The type of certificate a person requires relies on the sorts of insurance they intend to sell. There are typically 2 primary kinds of insurance licenses: residential or commercial property and casualty, which focuses on insurance for cars and trucks and houses, and life and health and wellness, which concentrates on covering individuals and also family members in the event of a mishap or fatality.

simply click the following webpage that provide several lines of insurance coverage have to have a company permit, while private representatives can acquire an individual permit for the lines they prepare to sell. The licensing procedure is managed at the state level, yet lots of states now make use of 3rd parties to assist guide as well as administer permit applications in order to advertise efficiency.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

The Importance Of Building And Also Maintaining Relationships As An Insurance Coverage Agent |

Content by-Dennis Morsing

Insurance representatives are involved in individuals's lives throughout milestone occasions and also obstacles. Talking with them as well as building connections should be leading of mind.

Solid client partnerships profit both the representative and also the client. Satisfied clients become supporters, resulting in more policy renewals and also increased sales possibilities. Client partnerships likewise cultivate commitment, which brings about far better client retention prices.

Customer care

Offering excellent client service is essential to building and preserving relationships as an insurance coverage representative. This consists of the way in which agents interact with potential customers prior to they end up being clients. If the first interaction feels also sales-oriented, it might switch off potential clients. It additionally includes exactly how they treat existing clients.

When insurance customers need support, such as when they have a claim to submit, they want a rep that understands and also empathizes with their scenario. https://zenwriting.net/giuseppina7niki/the-ultimat...ssful-insurance-coverage-agent can pacify stressful scenarios and make consumers seem like their demands are essential to the business.

Furthermore, insurance coverage representatives should interact with present customers often to ensure they're fulfilling their assumptions and also keeping up with any type of adjustments in their lives that might impact their coverage. This can include birthday or holiday cards, e-mails to talk about any forthcoming turning points and meetings to assess renewals.

Recommendations

Obtaining referrals is among the best ways to expand your organization as an insurance representative. By concentrating on connecting with informative post in certain sectors, you can establish on your own as the best specialist and also draw in a consistent stream of customers.

When a client trusts their insurance policy representative, they're more likely to continue to be devoted. Additionally, Best Condo Insurance Companies will certainly become supporters and also refer new service to the representative. These recommendations can offset the cost of acquiring new customers with standard methods.

By offering a favorable consumer experience during the prospecting phase, representatives can develop partnerships that will last a very long time, also when other insurance companies supply reduced costs. This requires developing a specified method for consumer communication management, placing personalized supplies right into transactional messages, as well as providing tailored experiences. Customers today expect this sort of interaction. Insurers who do not meet expectations take the chance of falling behind. Fortunately is that forward-thinking insurance representatives comprehend this as well as have a competitive advantage.

Networking

Whether you're a social butterfly or a little bit much more introverted, networking is among the most effective methods for insurance coverage agents to grow their organizations. Even if your clients do not develop into a network of their own, they're likely to discuss you to loved ones that might need some protection.

Having a strong network of prospective customers can make all the distinction in your insurance policy sales success. If you have a constant stream of real-time insurance policy leads, you can focus on structure relationships with your present customers and also accelerating the procedure of getting them brand-new company.

Look for networking chances at insurance market occasions or even at various other kinds of neighborhood gatherings. For example, attending a conference of your local Chamber of Commerce or Merchants Organization can be a fantastic area to meet fellow business owners and also form connections that can help you expand your insurance firm. The exact same chooses social media teams that are tailored toward professionals in business community.

Keeping in Touch

The insurance policy industry is affordable, and it takes a great deal of job to stay top of mind with clients. Developing a great client experience initially will certainly make your customers more probable to stick to you, even if another representative supplies reduced costs.

Being an insurance policy representative isn't practically marketing, it has to do with aiding people navigate an intricate area and also protect themselves versus unexpected monetary loss. Helping them with their monetary choices can also make them trust your advice, which converts into repeat organization and references.

A customer's partnership with a representative is put to the test when they have a claim. That's when an agent can show they care, which can reinforce their connection. Making use of customized advertising to interact is important due to the fact that not all clients value the same communications channel. Some may like email newsletters, while others may want to fulfill in-person or access info online. It is essential for representatives to understand their customers' preferences so they can be readily available when the moment comes.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

5 Crucial Skills Every Insurance Agent Should Master |

Written by-Breen Dickson

Insurance coverage representatives need to be able to communicate plainly with consumers. This indicates using a professional vocabulary but still being conversational and also friendly.

They additionally need to have a mutual understanding of the products they are selling. This is because they will certainly require to be able to describe the advantages of each product to their clients.

1. Communication

Having strong communication skills is important for any person who intends to end up being an insurance coverage representative. An excellent representative requires to be able to explain complex policies clearly as well as conveniently to customers. In mouse click the up coming web site , they must be able to pay attention to customers to recognize their needs and find the very best policy for them.

It's also important for insurance coverage agents to be able to communicate with their experts successfully. They should use clear language and prevent making use of technological terms that might perplex underwriters.

In addition, representatives need to think about improving interaction with their customers by utilizing a customer site. This can help in reducing the time that representatives invest publishing out files, making payment suggestion calls and rekeying information. This maximizes their time to focus on structure partnerships as well as consumer loyalty.

2. Customer Service

Customer support abilities are a have to for licensed insurance coverage agents. They guarantee that clients obtain the prompt as well as understanding support they are worthy of.

These skills allow clients to really feel heard and comprehended, which goes a long way in developing a positive experience. Besides reacting to inquiries, emails as well as calls in a timely way, clients also expect an agent to understand their distinct circumstance as well as give them with the appropriate info.

Insurance coverage representatives that have excellent customer support skills can get in touch with their clients on a deeper degree and also help them see the economic reality of their scenario. They are also with the ability of transmitting tickets to the appropriate group as quickly as they end up being immediate, aiding clients to reach a resolution quicker. This is crucial, as it enhances client contentment and commitment.

3. Settlement

Insurance representatives deal with clients to bargain policies. This calls for strong customer service skills, as well as a favorable strategy to problem-solving. This is specifically vital when reviewing a plan and working out costs, as money evokes feeling in many people and rational thought tends to crumble.

Throughout the interview process, reveal your capacity to construct relationship by smiling at your interviewer and also presenting open body language. This will certainly assist you convey your confidence in the role.

Discover exactly how to discuss successfully by practicing with a career solutions consultant or a good friend and role-playing numerous times. It is additionally important to have a realistic view of the area of feasible agreement, which is defined as the variety where you and your negotiation companion can find common ground on a particular concern.

4. Sales

Insurance agents must have strong sales abilities to protect as well as preserve a constant flow of business. They should also be able to take initiative and also seek out new customers, such as by cold-calling company owner or checking out business to introduce themselves.

Good sales abilities involve the ability to examine client requirements and also recommend ideal insurance coverage. It is essential for insurance representatives to place the client's requirements ahead of their very own, not treat them like a cash machine.

please click the following webpage calls for a level of empathy with customers, which can be difficult in some circumstances. Lastly, excellent sales abilities include a determination to learn more about brand-new products as well as other aspects of the market on an ongoing basis. Keeping existing with the current insurance coverage news and also fads is important to maintaining competition out there.

5. Organization

Insurance agents need to be well-organized in their job. This is due to the fact that they have to have the ability to take care of volumes of details and make quick estimations. They must likewise have the ability to keep track of their customers and also remain in touch with them.

Insurance experts must constantly aim to be knowledgeable in their area and also also beyond it. This will certainly help them understand prospective clients much better and suggest the ideal plans for their demands.

Soft skills training is a fantastic method for insurance representatives to construct their customer-facing skills. In fact, a recent study found that business that invest in soft skills training see a typical ROI of 256%. This is greater than double what they would obtain from purchasing technology or product training.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

5 Necessary Skills Every Insurance Policy Agent Ought To Master |

Content author-Bendsen Currie

Insurance representatives require to be able to communicate plainly with customers. This implies making use of a specialist vocabulary but still being conversational and also approachable.

They likewise need to have a good understanding of the products they are offering. This is since they will need to be able to explain the advantages of each item to their customers.

1. Communication

Having solid interaction skills is important for anybody who wishes to end up being an insurance policy agent. A great representative requires to be able to clarify complicated plans clearly and easily to customers. Furthermore, they have to be able to listen to consumers to recognize their needs and also locate the most effective policy for them.

It's likewise vital for insurance policy representatives to be able to connect with their experts properly. They must make use of clear language as well as prevent making use of technological terms that might puzzle underwriters.

In addition, agents should think about improving communication with their customers by utilizing a client website. This can help in reducing the time that representatives spend publishing out papers, paying suggestion calls and also rekeying information. This maximizes their time to focus on building relationships and customer loyalty.

2. Client service

Customer care skills are a have to for accredited insurance agents. They make certain that clients obtain the prompt and also compassionate assistance they deserve.

https://www.investopedia.com/terms/i/independent-agent.asp permit customers to feel listened to and understood, which goes a long way in creating a positive experience. In addition to reacting to inquiries, e-mails and calls a prompt way, clients also anticipate an agent to recognize their special situation and also give them with the appropriate info.

Insurance coverage representatives that have outstanding customer care skills can get in touch with their clients on a deeper degree and help them see the financial truth of their situation. They are also capable of directing tickets to the suitable team as quickly as they become urgent, assisting consumers to get to a resolution quicker. This is critical, as it enhances customer fulfillment and also commitment.

3. Settlement

Insurance coverage agents deal with clients to negotiate policies. This needs solid client service skills, and also a favorable method to analytic. https://www.ocregister.com/2022/12/08/tustin-insur...efrauding-100000-from-clients/ is particularly vital when talking about a plan as well as negotiating rates, as money evokes feeling in many people and logical thought has a tendency to crumble.

Throughout the interview process, reveal your ability to develop connection by smiling at your interviewer as well as showing open body movement. This will assist you share your confidence in the duty.

Find out how to bargain efficiently by practicing with a career services advisor or a buddy as well as role-playing several times. It is additionally essential to have a reasonable sight of the area of possible arrangement, which is specified as the variety where you and your negotiation companion can discover commonalities on a specific issue.

4. Sales

Insurance policy agents should have strong sales skills to safeguard and also keep a consistent flow of organization. They have to likewise be able to take initiative as well as seek out brand-new customers, such as by cold-calling business owners or going to places of business to present themselves.

Excellent sales skills entail the ability to review customer requirements and recommend suitable insurance coverage. It is important for insurance policy agents to place the customer's needs ahead of their own, not treat them like a cash machine.

This calls for a degree of compassion with customers, which can be challenging in some situations. Ultimately, great sales skills involve a readiness to find out about new products and various other elements of the sector on a recurring basis. Keeping present with the most up to date insurance coverage information as well as trends is vital to maintaining competitiveness on the market.

5. Organization

Insurance representatives need to be efficient in their job. This is since they should be able to manage quantities of information as well as make quick computations. They must additionally have the ability to keep an eye on their clients as well as remain in touch with them.

Insurance policy professionals need to always aim to be well-informed in their field as well as even beyond it. This will help them comprehend possible consumers much better as well as recommend the appropriate plans for their needs.

Soft abilities training is a fantastic way for insurance representatives to construct their customer-facing skills. As a matter of fact, a recent study found that companies that buy soft abilities training see a typical ROI of 256%. This is more than dual what they would obtain from purchasing modern technology or item training.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

Top 7 Techniques To Produce Leads As An Insurance Coverage Representative |

Article written by-Chapman Horowitz

Insurance coverage agents require a consistent flow of bring about grow their service. However creating high quality leads isn't very easy. Right here are some smart tactics that can help.

A devoted link with a digital insurance coverage application that's house to genuine, bindable quotes is a simple means to produce leads. Use https://www.nerdwallet.com/article/insurance/best-pet-insurance-companies in an email, on social networks or in advertising.

1. Develop a solid online visibility

As an insurance policy agent, you need a solid sales pipe. You have to load it with high quality leads that turn into clients.

Online marketing approaches give a range of options for brand-new service generation. They can assist you generate leads at a portion of the initial investment cost contrasted to traditional techniques.

Creating material that offers worth to your target market can be a reliable way to draw in brand-new consumers to your website. However, you need to ensure that this material is relevant to your audience's requirements.

Listing your company on online organization directories can improve regional exposure. It can also enhance your SEO initiatives by enhancing brand awareness.

2. Get provided on trustworthy evaluation sites

Getting leads is an integral part of building your insurance service. But https://www.scmp.com/business/article/3227737/hong...nagement-standards-uncertainty , specifically, can discover it hard to produce adequate quality leads.

Focusing on material advertising is one way to bring in a lot more insurance leads. Develop relevant and also beneficial web content that helps your target market address their troubles and also construct a bond with your brand name.

You can likewise use social networks to increase your list building. Uploading short articles on your LinkedIn and Quora web pages can help you connect with more qualified potential customers. You can even organize instructional webinars to attract potential clients and also increase your trustworthiness.

3. Use clear contact us to activity

Insurance coverage is a service market that thrives or withers on the quality of its lead generation strategies. Making use of clear, direct contact us to activity is one method to generate high-grade leads.

For example, a website that is optimized for pertinent keywords will certainly draw in customers that are already looking for a representative. Getting detailed on reputable evaluation websites can also increase your consumer base and generate references.

Bear in mind, though, that it requires time to obtain arise from these initiatives. Monitor your pipe very closely, and also use efficiency metrics to refine your advertising method.

4. Buy leads from a lead solution

The insurance policy biz can be a challenging one, also for the most seasoned representatives. That's why it pays to utilize useful advertising techniques that are shown to generate leads and transform them into sales.

For example, utilizing an engaging site with fresh, relatable material that positions you as a neighborhood specialist can draw in on the internet traffic. Getting noted on reliable evaluation sites can help as well. And having a chatbot is a must-have for insurance policy digital marketing to aid customers reach you 24x7, also when you're out of the workplace.

5. Support leads on LinkedIn

Several insurance policy agents are in a race against time to get in touch with possible clients before the leads weary and also take their business elsewhere. This process is commonly described as "functioning your leads."

Insurance policy firms can create leads on their very own, or they can acquire leads from a lead solution. Acquiring leads saves money and time, however it is very important to understand that not all lead solutions are created equivalent.

In order to get one of the most out of your list building initiatives, you require a lead solution that concentrates on insurance.

6. Ask for customer testimonies

Insurance representatives thrive or perish based on their ability to get in touch with prospects. Obtaining as well as supporting high quality leads is necessary, particularly for new representatives.

Online content advertising, a powerful as well as inexpensive technique, is an efficient means to produce leads for your insurance coverage organization. Think about what your target audience is searching for and develop practical, useful web content that reverberates with them.

Testimonials, in message or sound format, are an excellent tool for establishing trust fund with potential customers. These can be published on your web site or used in your e-mail e-newsletter and social media sites.

7. Outsource your list building

Maintaining a regular pipeline of certified leads can be testing for insurance coverage representatives, specifically when they are busy servicing existing customers. Outsourcing your list building can free up your time to focus on growing your company and also getting new customers.

Your site is just one of the most effective tools for producing insurance leads. It should be easy to navigate as well as offer clear calls to activity. Furthermore, it is necessary to get provided on credible review sites and also utilize reviews.

Another wonderful method to create insurance policy leads is through web content advertising. By sharing relevant, insightful write-ups with your audience, you can construct depend on and establish on your own as a thought leader in the market.

|

Метки: auto insurance insurance brokers home insurance motorcycle insurance flood insurance rv insurance insurance agents insurance company insurance agency excess liability auto owners insurance |

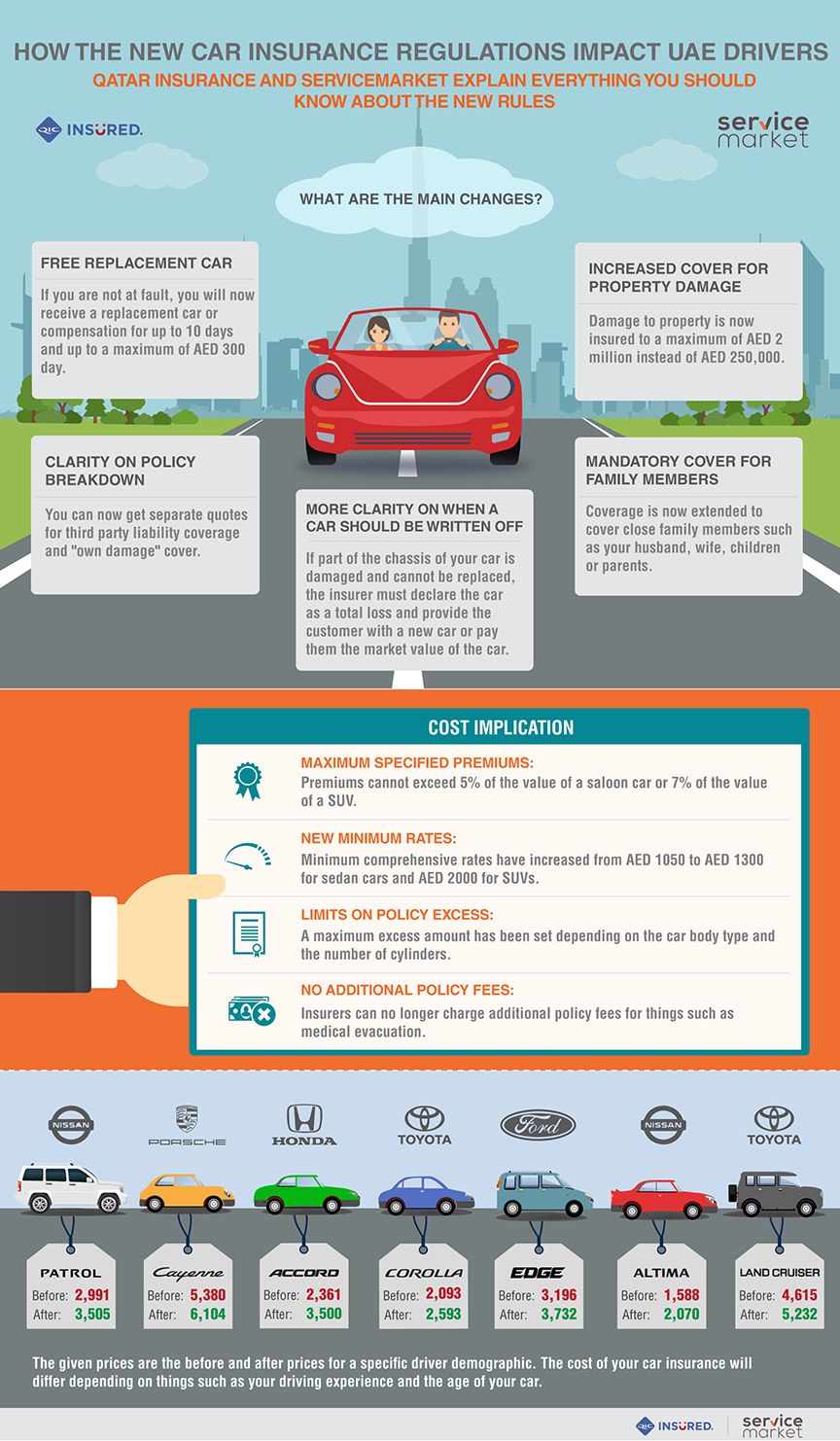

Reduced Your Car Insurance Policy Fees With These Tips |

Content written by-McMahan Herring

Insurance coverage for your auto is a great way to cover the liabilities that you may incur in the event of a motor vehicle accident, whether you are at fault or not. It can help you to keep you from being personally sued and losing assets. This article can help you understand different coverages and decide which one can best serve you.

Look around on the web for the best deal in auto insurance. Most companies now offer a quote system online so that you don't have to spend valuable time on the phone or in an office, just to find out how much money it will cost you. Get a few new quotes each year to make sure you are getting the best possible price.

When keeping down the cost of auto insurance, protect your no-claims record. If you have several years of auto insurance with the same company and you have not needed to file any claims, avoid filing a small claim. The increase in your premiums will be more expensive than simply covering the small claim damage out of pocket.

local broker insurance figure up your monthly payments in part based on the risk you present as a driver. To lower this risk factor, you can make sure your car or truck is parked away in a garage. Not only does keeping your car in a garage help prevent theft, but it also helps prevent weather damage and other damages that may occur.

Keeping up with the times is a great way to save money on your auto insurance. vintage motorcycle insurance ontario have electronic payment plans set up via their websites. If you use these and make your payments on time, you will be able to save some money. There's nothing wrong with the old-fashioned way, but you can save some cash by making e-payments.

A great way to save some money on your car or truck insurance is to drive your vehicle less frequently. Many of today's best auto insurance companies offer discounts to customers for low-mileage, incentivizing people to keep their cars parked. If you can walk instead of drive, you can get some good exercise and save money on your insurance.

Consider using liability coverage when shopping for automobile insurance. This is the lowest available coverage options required by law, and it is also the cheapest option. If you do not have a car that is worth a lot of money, this option may work for you. If you have an accident, your car will not be covered.

The cost of auto insurance for any specific car, will vary from company to company. One of the reasons for this is because each company determines premiums based in part, on their past experiences with that specific car. Certain companies may have significantly different histories dealing with a specific car. Even in cases where the experiences are similar, there are bound to be small differences. Because of this, there is a definite benefit to shopping around when looking for auto insurance.

Beware of car insurance quotes that seem too good to be true. It's possible that it is a great deal, or the price may speak for itself. Try to learn more about the policy that you're trying to get and how it can help you cover damages, if ever you get into an accident.

Are you looking for the best rate on auto insurance? In order to find the lowest rates, you should check with several different companies. The same coverage could cost anywhere from $500 to $1500, depending on which company you get your insurance from. By contacting several different agents, you could end up saving yourself hundreds of dollars a year.

When choosing an auto insurance policy, look into the quality of the company. The company that holds your policy should be able to back it up. It is good to know if the company that holds your policy will be around to take care of any claims you may have.

Part of the cost of your auto insurance is based on where you live. In particular, people who live in urban areas, generally pay a significant amount more for their auto insurance than people who live in rural areas. If you live and work in a city, you might want to consider trying to find a place in a rural area, from where you can feasibly commute to work.

When determining how much auto insurance coverage you will need, you must keep in mind your driving record. If you make a long treacherous commute to work every day, or if you have a history of accidents, you should get more complete coverage. More complete coverage could include collision or comprehensive, depending on your specific requirements.

Try to car pool to work. This will keep the number of miles that you put on your personal vehicle down. If you can keep the mileage that you drive each year low, you will likely qualify for the low-mileage discount that many insurers offer. It will save you bundles over the years.

If you want to get cheap rates on auto insurance one of the things that you can do in order to achieve this is by joining an automobile club. This is because most clubs offer insurance coverage to their members. These clubs have policies on who they want to include in their club. Policies could be based on how classy or special your car is.

Usually, you can find some of the best insurance deals on the web. This is because selling directly to customers cuts out costs like an agent. So the insurance companies get to keep a little more for themselves. This also will trickle down to you in the form of a small discount.

Be aware of what other drivers in your household can mean for you in terms of lowering your auto policy premium. Double-check the status of every driver in your family with your insurance agent. Most discounts apply to only one portion of the policy, so don't count on extensive discounts.

Make sure you know what kind of coverage you have in your policy. Be aware of what your auto insurance is actually insuring. Many things affect the final cost of the policy. There is bodily injury liability, property damage liability, medical payments, uninsured motorist protection, collision coverage, and comprehensive coverage.

Though simple, the tips listed above could save hundreds and thousands of dollars per year on expensive auto insurance payments. The point is, take your time and calculate your costs carefully. Get ahead of the curve and be prepared for what you will need to pay before you even go to get your vehicle. Knowledge and research is the key to saving.

|

Метки: Auto Insurance Car Insurance General Insurance Home Insurance House Insurance Insurance Agents Car Insurance Company |

Easy Tips On Just How To Get Affordable Prices On Vehicle Insurance Policy |

Content by-Michael Mangum

As fun as planning for something happening to your car may seem, it is a very important reason to start buying your auto insurance now, even if you have a policy already. Another thing is that prices drop a lot, so you can have better coverage for a better price. These tips below can help you start looking.

To save money on your car insurance, choose a car make and model that does not require a high insurance cost. For example, safe cars like a Honda Accord are much cheaper to insure than sports cars such as a Mustang convertible. While owning a convertible may seem more desirable at first, a Honda will cost you less.

If you are a young driver and pricing auto insurance, consider taking a driver's education course, even if your state does not require driver's education to earn your license. Having such a course under your belt shows your insurance company that you are serious about being a safer driver, and can earn you a substantial discount.

If compare insurance ontario can decrease your annual mileage, you can expect a decrease in cost for your automobile policy. Insurance companies normally estimate that you will drive around 12,000 miles per year. If you can lower this number, or are someone who does not drive that far that often, you may see a reduction. Be sure that you are honest about your miles since the insurance company may want proof.

If you can decrease your annual mileage, you can expect a decrease in cost for your automobile policy. Insurance companies normally estimate that you will drive around 12,000 miles per year. If you can lower this number, or are someone who does not drive that far that often, you may see a reduction. Be sure that you are honest about your miles since the insurance company may want proof.

The best way to save money on your insurance is to never get into an accident. If you take good care of your car, and are careful when you drive, you will never have to file a claim. Your insurance company will reward you with a discount that can save you money on your premiums.

An important consideration in securing affordable auto insurance is the condition of your credit record. It is quite common for insurers to review the credit reports of applicants in order to determine policy price and availability. Therefore, always make certain your credit report is accurate and as clean as possible before shopping for insurance.

Insurance companies base their rates on their past experiences with their customers. If you hear something about a general trend regarding one type of vehicle, this might not reflect how all insurance companies view that particular vehicle. You should request quotes from several companies and compare them: you might notice a rather big difference.

One of the absolute greatest factors in the price of your auto insurance remains, unfortunately, completely outside of your control, this is your age. The majority of companies consider people under 25 to be a higher risk and due to this you will end up paying more. Remember, especially when you are younger, to check constantly with your agency for discounts based on age year by year.

You should always pay your car insurance on time. You will have to pay back your insurance company, perhaps with interest. If you cancel your policy without paying back your insurance company, this will show up on your credit score. When you apply for a new insurance, your bad history will show up.

The cost of your auto insurance will be impacted by the number of tickets and points on your driving record. To get visit the next internet site , you must wait until your driving record is clear and then look for a new auto insurance provider. The cost will be significantly lower; you will save a lot on your premiums.

To streamline your insurance needs and get the best possible rate on several different insurance types, consider combining your auto insurance, home insurance and life insurance under one company. The more policies you have with a company, the steeper your overall discount will be. As an added bonus, this also means only one bill to pay at the same time every month.

Look for multi-car discounts where ever you can get them. If your teen just started driving, you will save money by putting their car on your policy. Newly married? Get quotes from each insurer for a new combined policy and go with the best company that gives you the best features for your money.

If you haven't done so already, add your spouse to your automobile insurance policy. Insurance companies view marriage as a sign of stability, maturity, and balance. They often offer lower premiums to married couples. Even if your spouse doesn't drive the car, adding them might be worth your while.

If you want to lower premium payments, try raising your deductible. Having a high deductible is the best way to have high premiums. Be aware that should you be involved in an accident, you will need to have the cash available to fulfill the deductible. You should have an emergency fund just in case you need it.

When looking to purchase car insurance, get advice from people you know. You might find out that others have done research and they will give you what they found. Feel free then, to contact every referral that is given to you and reference the person who gave it to you. This could help you find someone with a good rate.

When trying to decide on an insurance company for your auto insurance, you should check into the department of insurance from your state. You will find some valuable information there which will include closed insurance cases, important financial data as well as licensing information. This research will help you decide if you feel comfortable trusting this insurance company.

Do you know what it means when your auto insurance policy contains full coverage? Full coverage auto insurance generally refers to having both comprehensive and collision coverage. An insurer rarely uses the term full coverage because it implies a higher insurance standard than what both comprehensive and collision usually cover.

As with any contractual agreement, read the fine print. There are different details provided in the fine print that you may want to be aware of, as knowing what it says could be the difference between your accepting or denying the policy. You could discover that you really aren't getting the coverage that you think you are getting.

When it comes to selecting an auto insurance policy, education is key. Finding the information you need can sometimes be confusing though. Sometimes sources are biased and sometimes information is not accurate. In this article we hope that we have helped to explain some of the most important terms. In addition, the tips that we have provided can help to make your selection process easier.

|

Метки: Auto Insurance Car Insurance General Insurance Home Insurance House Insurance Insurance Agents Car Insurance Company |

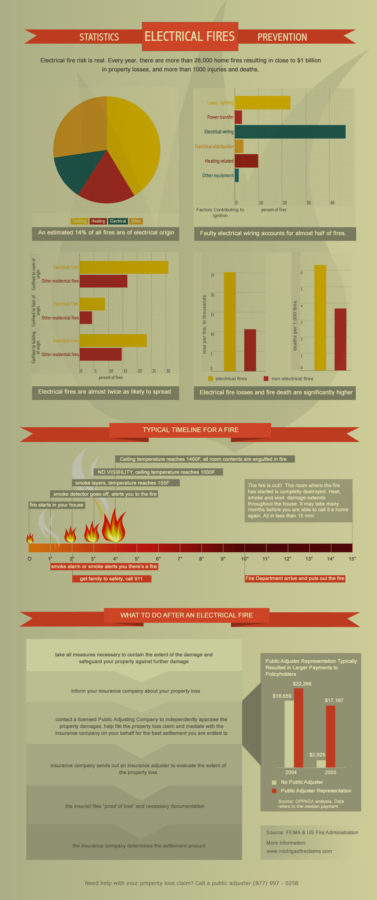

What Does A Public Insurance adjuster Does And Exactly How Can He Work To You? |

Content written by-Holgersen Dyhr

An insurance policy sales representative can be rather a vital consultant to many insurance clients and also becomes part of the group that is called the public insurer. Several are not familiar with specifically what the work of the insurance adjuster actually entails. Simply put, claims insurers are there to ensure that the consumer's insurance policy demands are met. Insurance policy representatives call them insurance adjusters or brokers. Below's hardwood floor damage take a look at what these individuals carry out in a day in the workplace:

- Checks on the validity - The whole procedure starts with an insurance claim being filed with the business that provides the plan. At this point, the insurance company will assess the insurance claim and verify if it is a valid one. If it stands, the policyholder will certainly be offered a letter from the adjuster to send out to the other party to compensate or obtain re-checked within a specific amount of time. In turn, the other party will return a letter claiming if the claim stands or not.

- Measuring the problems - After the firm receives the case, the Public Insurer will review it and also will begin gathering evidence. Sometimes, an insured person will certainly require to find in and also really see the damage in order to get a decision. Once every one of the evidence has been gathered by the agent, they will certainly request a short-term price quote of the overall quantity of money required to settle the case. Now, the insured may hire the solutions of a public insurance adjuster or he may choose to file a claim with the Insurance coverage Department of the State or National Insurance Data.

- Advice from insured - Once every one of the evidence is in order, the general public Insurance adjuster will take it to the following step and also will give guidance to the insured. Public Insurers has the ability to tell the insured just how much the insurance policy ought to pay. If the adjuster feels that the instance is valid, he may advise that the situation be explored by an insurance adjuster that will be independent from the Insurance Department. At this point, if the situation needs further examination, the general public Insurance adjuster will certainly aid the adjuster by obtaining additional details as well as data.

https://www.insurancejournal.com/news/southcentral/2020/03/24/562217.htm have the power to investigate how the insurance provider has dealt with previous claims. They can consider points like the number of rejections and the nature of those rejections. This is used by the insurers to figure out whether or not a firm's insurance coverage are truly legitimate or not. The Public Insurer will certainly also take into consideration the kinds of losses that happened as well as will use this info to establish how to manage future cases.

As part of the function of the public insurance adjuster, he/she has to additionally keep a connection with nationwide as well as state supervisors of insurance provider. They must have the ability to make suggestions to these supervisors regarding any kind of issues submitted versus them. The general public Adjuster have to additionally maintain documents on all communication that he/she gets from the business. By doing this, the general public Adjuster can make sure that all document is accurate. The documents that he/she have to preserve consist of the business's address, telephone number, telephone number, and insurer's address. He/she needs to be very detailed in his/her documents due to the fact that if there is ever an issue with a record, it will certainly be simple for him/her to correct it because it remains in the public document.

The Public Adjuster is a vital part of the Insurance coverage Division. Insurance policy representatives no longer require to stress over the general public Adjuster. If there ever before comes to be a need to review an insurance policy case, insurance coverage representatives can call on the general public Insurer to handle it. Public Insurance adjusters has several responsibilities and obligations, and he/she is well worth the job.

In order to make certain that the Insurance Department is doing their task, there has actually been a requirement for insurance representatives to fill out a Public Insurance adjuster Form every year. This kind is offered at their workplace or can conveniently be gotten on the internet. To see to it that this does not take place once more, insurance agents have to comply with all of the policies set forth in The Insurance coverage Procedure Act.

|

|

What Is A Public Insurance adjuster As Well As Exactly How Do I Work with One? |

Content author-Tarp Geertsen

Do you recognize what an insurance adjuster is? Have you ever came across an insurance adjuster prior to? What can they do for you? Exactly how do they assist you? These are just several of the inquiries you may have while you read this short article concerning Public Insurance adjusters, Insurance Insurance Adjusters and also Insurance Claims Insurers.

First, it is essential to recognize just what are Public Adjusters? If you have been making insurance policy cases in the past, the claims insurer you have actually had working for you is a Public Adjuster. If you are aiming to use the solutions of an insurance policy case insurer, they are typically described as Public Insurance adjusters and also are experienced in aiding customers that have actually remained in crashes. You will certainly find that there are lots of people who describe Public Adjusters as Insurance Insurance adjusters too.

Claims Adjusters readjust insurance claims that have been sent by the client or by one more individual related to the insurance claim. For example, if you have been making insurance cases, you may intend to get a cases adjuster to aid you. When you call the cases adjuster you might talk to them on the phone or satisfy them face to face. It is very important to bear in mind that declares insurers are independent service providers, not to be associated with any one particular insurance company or agent.

What does Public Insurers provide for you? They make adjustments to the negotiation total up to ensure the customer's case is obtained in a fair as well as simply fashion. In addition to this, insurers are accountable for accumulating every one of the settlement amounts for you or your insurance adjuster, unless the case is settled outside of their office. Claims adjustors must submit a record with the Insurance Company within 45 days of obtaining your claim. This will certainly ensure that they recognize what your negotiation quantity is and also if they are in charge of collecting it.

Public Insurance adjusters is very important when it pertains to water damages cases because in some cases you don't have time to prepare a reasonable claim settlement. Public Insurers can assist you determine the appropriate amount of water damage to evaluate the problems to your house, residential or commercial property, and also personal possessions. In addition, public insurers are accountable for collecting every one of the settlement amounts for you or your insurer, unless the case is settled beyond their workplace.

Are you taking into consideration working with a Public Insurer to help you with your water damage insurance claims? Public Adjusters can assist you by offering important information that can be vital when it concerns filing a successful case with your insurance service provider. For instance, you ought to employ an insurance adjuster if: you have actually experienced flooding; or, you have actually experienced a leak. On top of that, they can likewise aid with submitting all essential paperwork with your adjuster. Public Adjusters typically works with a backup basis, so it is essential to keep in mind that your insurer might not pay all or several of the expenditures connected with the fixings.

What should you do before you employ a Public Adjuster to assist you in your claim? Initially, you must arrange an appointment with your insurance company. The insurer will certainly assess the level of the damage after examining your insurance plan. Next off, click now should arrange an appointment to review the repair work with the general public Insurance adjuster. This will permit the insurance adjuster to evaluate the full level of your case based on the info they are provided. Finally, you should set up a visit to speak with the Public Adjuster about your personal insurance coverage.

Public Adjusters is typically appointed on a contingent basis. In this case, you would have the insurance adjuster to represent your passions throughout the insurance claim process. What this indicates is that you would certainly have the capability to select whether to retain the services of the adjuster or if you want to take care of the whole case procedure yourself. This choice ought to be made along with your insurance coverage representative. When Top Rated Public Claims Adjuster has reviewed your insurance claim and also whatever remains in order, you can after that review the following steps with your insurance coverage agent.

|

|

What Is A Public Adjuster And How Do They Work? |

Content by-Schwartz Baxter

What is a Public Adjuster? A public insurance adjuster, also called an independent assessor, is an independent professional acting only in behalf of the insured's lawful rate of interests. The insured pays the public adjuster, not the insurer, for his/her solutions. State laws restrict the authority of public insurance adjusters to the evaluation of residential or commercial property damages as well as losses and also restrict their obligation to the repayment of benefits to the injured, as well as limit their capacity to adjust injury cases.

If you are associated with an automobile accident, your insurance provider may have selected a "public insurance adjuster" to represent your passions before the Insurance coverage Adjuster. The insurance company's insurance adjuster will examine your insurance claim as well as evaluate your files. Your insurer will gather info from witnesses, photos, police records, fixing estimates, as well as other proof to make a good public insurer's record. The Insurance coverage Adjuster's job is to use all the information to establish who ought to pay you for your injuries.

When your insurance policy holder's insurance coverage claim is refuted, the insurance adjuster will certainly frequently seek the case vigorously. The adjuster's report is usually affixed to the decision of the Insurance policy Insurance adjuster to award the insurance holder an insurance claim amount. Although the Insurance Insurer's choice can be appealed, if the charm is refuted by the court, the Public Insurer will certainly not be called for to make a final record.

In several states, the charge for having a Public Insurance adjuster's record is not a required element of your policy. Nevertheless, insurance claims adjuster blogs charge a practical charge for their support. Additionally, the Insurance Company may ask for an additional charge from the Public Insurance adjuster in the event of a denial of a case. These fees are normally a percent of the actual loss quantity.

Insurance companies can discover numerous means to stay clear of paying a public insurer's charge. Some companies attempt to have a public insurer eliminate himself from the situation. If this happens, the Insurance provider will certainly still obtain every one of the reimbursement cash that the public adjuster was spent for. Other business attempt to get the Insurance Adjuster to not detail any type of unfavorable facets regarding your insurance claim.

Insurance companies that have public adjusters typically have a separate division responsible for making resolutions of the loss and also settlement quantity. As part of their work, the public insurance adjuster will certainly visit the actual website where the mishap occurred. She or he will evaluate the site and also listen to the claims from clients. From these brows through, the company insurance adjuster will prepare a modified report that will information every one of the information of your case.

When the Public Insurer makes his record, the Insurance provider will normally require an appraisal to figure out an accurate loss amount. This evaluation, which is frequently performed by an evaluator that is independent of the firm that performed the insurance claim, is extremely practical for the Insurance Company. click the up coming website page will certainly use the evaluation as a guide to make sure that they can make a precise decision of the loss. In addition to an appraisal, if the Insurer has a great insurance claim insurer, she or he might ask for that an expert (such as a land evaluator) additionally evaluate the loss record to ensure that the insurance claim is being made to an accurate standard.

There are two key reasons that the Insurance Public Adjuster charges a fee. Initially, he or she need to examine the insurance claim as well as prepare an accurate account. Second, he or she must gather the ideal quantity of the charge from the insurance holder. If the insurance holder challenges the precision of the record, the general public insurance adjuster must validate his/her billing the fee in composing. In some states, insurance holders are allowed to make their own ask for fixing mistakes and also omissions; if this holds true, the policyholder needs to be given composed notice of the right to make such a request.

|

|

What Is A Public Insurer And How Do I Hire One? |

Author-Schwartz Simpson

Do you know what an insurance coverage adjuster is? Have you ever before became aware of an insurance coverage insurer prior to? What can they provide for you? How do insurance claims adjuster pros and cons assist you? These are simply some of the questions you may have while you are reading this short article regarding Public Adjusters, Insurance Insurers and also Claims Insurance Adjusters.

Initially, it is very important to recognize just what are Public Insurance adjusters? If you have been making insurance cases in the past, the insurance claims insurer you have actually had helping you is a Public Insurance adjuster. If you are wanting to make use of the solutions of an insurance policy case insurance adjuster, they are generally referred to as Public Insurers as well as are experienced in assisting customers that have been in accidents. You will certainly discover that there are many people that refer to Public Adjusters as Insurance Insurance adjusters too.

Insurance claims Insurance adjusters readjust claims that have been submitted by the customer or by an additional individual related to the insurance claim. For instance, if you have been making insurance policy cases, you may intend to obtain an insurance claims insurance adjuster to assist you. When you call the cases insurer you may talk with them on the phone or satisfy them personally. It is very important to keep in mind that declares adjusters are independent professionals, not to be related to any kind of one specific insurance company or representative.

What does Public Adjusters provide for you? They make adjustments to the negotiation amount to ensure the client's claim is obtained in a fair and just fashion. In addition to this, insurers are responsible for collecting every one of the negotiation amounts for you or your insurer, unless the case is settled beyond their workplace. Claims adjustors should file a report with the Insurance Company within 45 days of getting your case. This will certainly ensure that they know what your negotiation quantity is and also if they are accountable for accumulating it.

Public Insurers is essential when it concerns water damages claims due to the fact that often you do not have time to prepare a practical claim settlement. Public Insurance adjusters can assist you establish the right quantity of water damage to analyze the damages to your home, home, as well as personal belongings. Furthermore, public adjusters are responsible for collecting all of the settlement amounts for you or your adjuster, unless the instance is worked out outside of their workplace.

Are you thinking about employing a Public Adjuster to help you with your water damages cases? Public Insurance adjusters can aid you by supplying useful information that can be vital when it pertains to filing an effective claim with your insurance policy provider. As an example, you need to hire an adjuster if: you've experienced flooding; or, you've experienced a leakage. On top of that, they can additionally help with submitting all required paperwork with your insurance adjuster. Public Insurers typically works with a backup basis, so it is very important to keep in mind that your insurer may not pay all or several of the expenses associated with the fixings.