ƒжессика Ћэнг (Jessica Lange) входит в число самых почитаемых и авторитетных американских актрис. „ертой, присущей еЄ игре, считаетс€ способность донести эмоции, не впада€ в экзальтацию страстей. «везда √олливуда, по мнению экспертов, обладает богатым набором чувств, которыми жонглирует перед камерой, полага€сь не на технику, а на интуицию.

ƒетство и юность

20 апрел€ 1949 года в американском городке локете по€вилась на свет будуща€ актриса ƒжессика Ћэнг. ƒевочка родилась под знаком зодиака ќвен. ≈Є отец зарабатывал на жизнь профессией коммиво€жера, поэтому семье, в которой воспитывались четверо детей, посто€нно приходилось сниматьс€ с одного места и переезжать в другое. ѕозднее ƒжессика вспоминала, что в детстве сменила 18 школ.

„астые переезды не отражались на учебе девочки — она получала хорошие оценки. — детства Ћэнг увлекалась рисованием. ¬озможно, сказалась тесна€ св€зь с отцом, который смотрел на мир философски, но при этом отдавалс€ эмоци€м, как ребЄнок.

ќтлична€ успеваемость в школе позволила ƒжессике получить стипендию в ”ниверситете ћиннесоты, где она изучала искусство. ќднако через год после поступлени€ девушка бросила вуз и отправилась за своей мечтой.

¬ молодости ей хотелось посмотреть мир, хот€ бы ту его часть, котора€ входит в —еверо-јмериканский континент. омпанию в этом путешествии 19-летней ƒжесс составил еЄ бойфренд, испанец ѕако √ранде. — ним девушка проехала тыс€чи километров американских дорог, жила как хиппи. огда кочева€ жизнь пор€дком надоела ƒжессике, она отправилась в ѕариж учитьс€ пантомиме.

¬скоре талантлива€ девушка уже выступала в «ќпера комик», а параллельно подрабатывала в качестве модели, но ни одна из профессий еЄ не занимала. Ћэнг оставила пантомиму и увлеклась фотографией. ќна прожила в ѕариже несколько лет, пока ѕако не позвал еЄ обратно в јмерику.

Ќью-…орк встретил ƒжессику враждебно — ей пришлось зарабатывать на жизнь официанткой. ¬ свободное врем€ она закрывалась от мира и часами просиживала, гл€д€ в пустоту. ќднажды один из друзей привЄл еЄ в школу современного танца. “анцы, по признанию актрисы, еЄ спасли.

„ерез несколько мес€цев Ћэнг устроилась в модельное агентство — симпатичную девушку с точеной фигурой, ростом 173 см и весом 52 кг охотно прин€ли на работу. ѕако к тому времени уже ослеп, и ей приходилось работать за двоих.

‘ильмы с ƒжессикой Ћэнг

¬ агентстве мод фото Ћэнг увидел продюсер « инг- онга». ќн искал актрису на главную роль и предложил девушке попробовать свои силы. ƒжессика сыграла ƒуэн, когда ей было 27 лет, обойд€ на пробах ћерил —трип и √олди ’оун. ‘ильм вошел в п€терку самых кассовых картин 1976 года, получил р€д номинаций на «ќскар», а вот актЄрска€ игра Ћэнг оставила п€тно на еЄ творческой биографии. –ецензии критиков были разгромными — актриса решила, что больше никогда не будет сниматьс€, но судьба распор€дилась иначе.

–ежиссЄры начали обхаживать красавицу и осыпать еЄ предложени€ми. ¬ 1979 году ƒжессика сыграла малозначительную роль в фильме «¬есь этот джаз», дальше была череда других неприметных образов. ѕереломным моментом в еЄ карьере стала картина «ѕочтальон всегда звонит дважды»: в ней драматический талант актрисы раскрылс€ полностью. ¬ 32 года ƒжессика Ћэнг проснулась знаменитой.

«атем фильмографи€ исполнительницы пополнилась знаковыми картинами времени: биографической драмой «‘рэнсис» и комедией «“утси», которые упрочили е.е репутацию. –оль в «“утси», за которую ƒжессика получила «ќскар» как лучша€ актриса второго плана, оказалась единственной романтической мелодрамой в еЄ кинокарьере. „аще исполнительнице предлагали играть упр€мых, волевых, независимых женщин.

—тав попул€рной, ƒжессика сама выбирала героинь и ставила услови€ продюсерам. ¬ 1996 году публике представили экранизацию пьесы “еннесси ”иль€мса «“рамвай “∆елание”». «а роль Ѕланш ƒюбуа актриса получила четвертый в карьере ««олотой глобус» и номинацию на премию «Ёмми».

–ежиссЄрским дебютом ƒжули “еймор стала основанна€ на трагедии ”иль€ма Ўекспира драма «“ит — правитель –има». √лавного геро€ ленты, полководца “ита јндроника, воплотил Ёнтони ’опкинс, а на роль захваченной им в плен королевы “аморы режиссЄр пригласила ƒжессику Ћэнг. ритики восхвал€ли актрису за проделанную работу по перевоплощению.

јртистке довелось сотрудничать как с начинающими, так и с поистине великими режиссЄрами, например с “имом ЅЄртоном в « рупной рыбе».

Ћэнг выступила продюсером фильма «ƒеревн€» 1984 года, где по€вилась в роли главной героини. ѕродюсерский опыт артистка повторила в 2017-и на съЄмках восьми эпизодов сериала «¬ражда». ƒжессика и еЄ коллега —ьюзан —арандон сыграли в этом фильме двух звезд √олливуда — ƒжоан роуфорд и Ѕетт ƒейвис, соперничавших на прот€жении длительного времени, начина€ со съемок 1962 года.

Ќа международном кинофестивале в —ан-—ебасть€не осенью 2022 года Ќил ƒжордан представил триллер «ћарлоу» — экранизацию романа ƒжона Ѕэнвилла «„ерноглаза€ блондинка». ѕозже режиссЄр призналс€, что видел в роли ƒороти авендиш только ƒжессику Ћэнг и отча€нно наде€лс€, что она согласитс€ прин€ть его предложение. јктрисе составили компанию на площадке Ћиам Ќисон и ƒиана рюгер.

ƒжессика решила пополнить коллекцию работ, сн€вшись в новой экранизации пьесы ёджина ќ’Ќила «ƒолгое путешествие в ночь», отмеченной ѕулитцеровской премией. ѕремьера драмы была запланирована на 2023 год, но создатели столкнулись с финансовыми трудност€ми, что привело к череде проволочек. ќб окончании работы над фильмом Ћэнг упом€нула в интервью в 2024 году, однако тогда ещЄ рано было говорить о выходе ленты. ≈Є презентовали зрител€м на ƒублинском кинофестивале в феврале 2025-го.

ѕримерно в то же врем€, как начались съЄмки, ƒжессика решилась на откровенное признание. јктриса всю жизнь открещивалась от важности психологической стороны жизни, избегала самоанализа и при этом жила с посто€нным спутником — депрессией. ќна боролась с одиночеством и тоской без чьей-либо поддержки. ѕо словам знаменитости, ситуаци€ стала ещЄ хуже из-за роли ћэри в драме «ƒолгое путешествие в ночь» — женщины, зависимой от наркотиков и переживающей внутреннее см€тение.

Ќе менее сложную работу Ћэнг провела, создава€ образ знаменитой актрисы, пам€ть которой раствор€ет деменци€, в ленте ћайкла ристофера «¬елика€ Ћилиан ’олл».

ћузыка

«а врем€ творческой карьеры ƒжессика записала один сольный альбом From the Big Apple to the Big Easy: The Concert for New Orleans, выпустила сборник и р€д синглов.

¬ 2009 году голос актрисы прозвучал в саундтреке к сериалу «—ерые сады». авер исполнительницы на песню Ћаны ƒель –ей Gods & Monsters попал в музыкальное сопровождение четвертого сезона «јмериканской истории ужасов». ¬ разных эпизодах проекта ƒжессика представала в образах верховной ведьмы ‘ионы, сестры ƒжуди ћартин, героини онстанс Ћэнгдон и Ёльзы ћарс.

Ћична€ жизнь

ƒжессика Ћэнг почти дес€ть лет провела с ѕако √ранде. ‘отограф был еЄ официальным мужем, они зарегистрировали отношени€ в 1970 году. јктриса ещЄ жила с ним, когда в Ќью-…орке в середине 70-х годов случайно встретила русского танцора ћихаила Ѕарышникова.

ћихаил Ѕарышников

«накомство с Ѕарышниковым кардинальным образом изменило личную жизнь исполнительницы. ¬ этих отношени€х родилась дочь јлександра. јктриса подмечала в ней вли€ние русских корней.

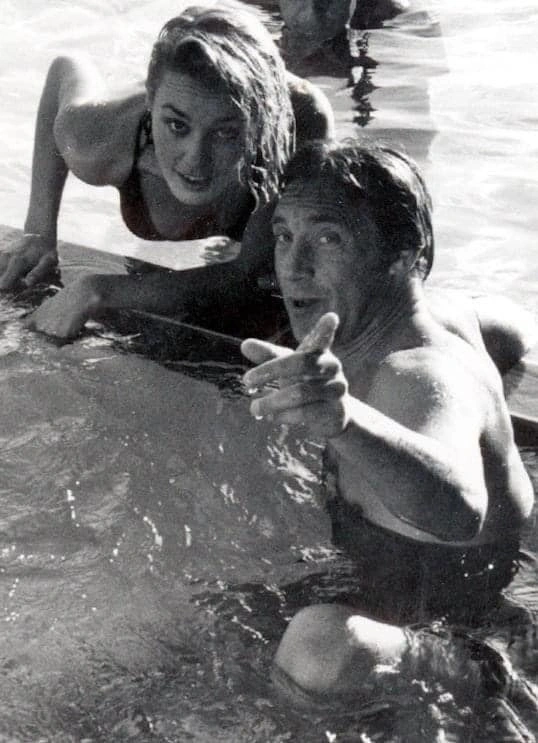

Ѕлагодар€ мужу американка познакомилась с советским бардом ¬ладимиром ¬ысоцким. ¬стреча запечатлена на совместной фотографии 1976 года, на которой предстали также ћилош ‘орман и ћарина ¬лади.

Ѕарышников заставл€л жену сходить с ума от ревности — о его любовных романах говорил весь творческий бомонд. √азеты писали, что танцор ведЄт себ€ сумасбродно, заставл€ет Ћэнг готовить непон€тные русские блюда, периодически поднимает на неЄ руку, часто водит в дом своих при€телей. ѕосле рождени€ дочери отношени€ у пары наладились, но больше напоминали крепкую дружбу.

—эм Ўепард

¬ 1981 году ƒжессику пригласили на роль ‘рэнсис ‘армер в фильме «‘рэнсис» — ей пришлось уехать из дома на несколько мес€цев. Ќа съЄмках актриса познакомилась с драматургом и партнЄром по картине —эмом Ўепардом. —импати€, сразу же вспыхнувша€ между ними, переросла в любовь, но пара старательно скрывала свои отношени€. —эм был женат, у него рос сын.

ѕосле съемок влюбленные разъехались и попытались жить как прежде. ќни встретились на вручении «ќскара»: ƒжессику Ћэнг номинировали сразу в двух категори€х. —эм Ўепард с женой подошли поздравить еЄ — в тот момент ƒжессика пон€ла, что любит его.

— 1982 по 2010 год актЄры жили вместе, в гражданском браке родились двое детей: дочь ’анна ƒжейн Ўепард и сын —эмуэл ”олкер Ўепард. ¬ одном из откровений Ћэнг призналась, что сельска€ одежда и тиха€ жизнь на собственном ранчо в ћиннесоте р€дом с близкими сделали еЄ куда более счастливой, чем слава и попул€рность.

’обби и внешность

јктрисе нравитс€ буддизм, хот€ она воспитывалась в семье, представленной по большей части атеистами, и ни в какую религию на прот€жении жизни глубоко не погружалась.

” Ћэнг множество увлечений, в числе которых фотографи€. ќбща€сь с мастерами-фотографами, актриса долго не решалась профессионально приступить к созданию художественных изображений и только в 90-е годы обратилась к черно-белой плЄнке, чтобы запечатлеть очередное путешествие в серии фото. ќпубликовать свои работы она решилась лишь в 2008 году.

“ак свет увидел первую коллекцию «50 фотографий», после чего сразу по€вилась втора€ — «¬ ћексике». јвторству ƒжессики Ћэнг принадлежит книга о фотоискусстве и детска€ повесть «Ёта истори€ про птичку». ¬ рамках «‘отобиеннале-2014» актриса побывала в –оссии, где представила выставку под названием «Ќезримое».

ѕо достижении 60 лет ƒжессика решила обратитьс€ в клинику пластической хирургии, несмотр€ на то что раньше категорически отвергала такую возможность. јктриса не делитс€ с общественностью информацией о том, к каким процедурам она прибегала, но, по мнению специалистов, кинозвезда делала подт€жку верхних век, мен€ла форму скул, использовала инъекции ботокса.

ƒжессика Ћэнг сейчас

—ейчас актриса востребована в профессии, а извести€ о свежих проектах с еЄ участием периодически по€вл€ютс€ в новост€х. ¬се чаще ƒжессике предлагают роли исторических персон и личностей, повли€вших на мировую культуру. ¬ 2025 году она была зан€та в проекте –айана ћерфи, где изображала легендарную актрису ћарлен ƒитрих. роме того, Ћэнг выпала честь сыграть писательницу и журналистку ƒжоан ƒидион в экранизации еЄ мемуаров «√од магического мышлени€».

‘ильмографи€

- 1976 — « инг- онг»

- 1982 — «“утси»

- 1982 — «‘рэнсис»

- 1984 — «ƒеревн€»

- 1986 — « инг- онг жив»

- 1992 — «Ќочь и город»

- 1998 — «Ќаследство»

- 1998 — «»стории из моего детства»

- 2003 — « рупна€ рыба»

- 2006 — «Ѕонневиль»

- 2009 — «—ерые сады»

- 2011-2018 — «јмериканска€ истори€ ужасов»

- 2017 — «¬ражда»

- 2019 — «ѕолитик»

- 2022 — «ћарлоу»

- 2023 — «ƒолгое путешествие в ночь»

- 2024 — «¬елика€ Ћилиан ’олл»

»нтересные факты

- јктриса придерживаетс€ вегетарианства.

- ƒжессика — посол доброй воли ёЌ»—≈‘. ¬ числе доверенных ей вопросов — борьба с эпидемией ¬»„ и —ѕ»ƒа в –еспублике онго.

- ≈сли бы знаменитости предсто€ло сменить профессию, она хотела бы попробовать себ€ в соколиной охоте.

- ¬о всех городах, которые посещает Ћэнг, она стараетс€ побывать на кладбище, потому что считает его мистическую атмосферу прит€гательной.