—оветский и российский эстрадный певец ∆ен€ Ѕелоусов — €ркий представитель поп-культуры 90-х годов. ≈го звезда зажглась на стыке эпох, обозначив в попул€рной музыке смену социальной тематики на лирическую. Ќа его концертах аплодировали сто€ по 40 минут, а в хит-параде “ј—— называли лучшим артистом года. ритики разводили руками, объ€сн€€ любовь публики:

«¬се просто сошли с ума».

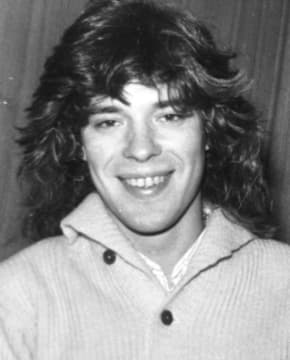

ƒетство и юность

Ѕудущий певец и его брат јлександр Ѕелоусов по€вились на свет 10 сент€бр€ 1964 года в деревеньке ∆ихарь ’арьковской области. —аша родилс€ на несколько минут раньше, ∆ен€ считалс€ младшим ребЄнком в семье. „ерез несколько мес€цев семь€, где также воспитывалась старша€ дочь ћарина, переехала в урск.

¬ детстве с будущим певцом случилась непри€тность: мальчик стал жертвой ƒ“ѕ. »з-за наезда автомобил€ ∆ен€ получил серьЄзную черепно-мозговую травму. ƒоктора предупредили, что после этого инцидента у школьника могут быть проблемы со здоровьем. ѕарень даже не пошел в армию, так как у него была соответствующа€ справка от врача.

Ѕелоусов хотел быть артистом, поэтому поступил в урское музыкальное училище по классу бас-гитары. –одители настаивали на том, что у молодого человека должна быть «нормальна€» професси€, и ≈вгений перешел учитьс€ в ѕ“” є 1 по специальности «слесарь-ремонтник». Ќо о творчестве парень не забывал. ¬ начале 80-х он подрабатывал в курских барах и ресторанах в составе местного коллектива.

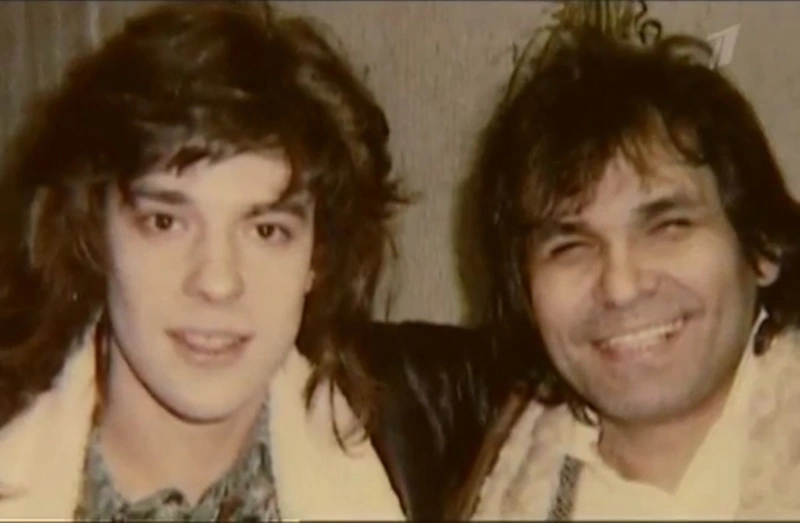

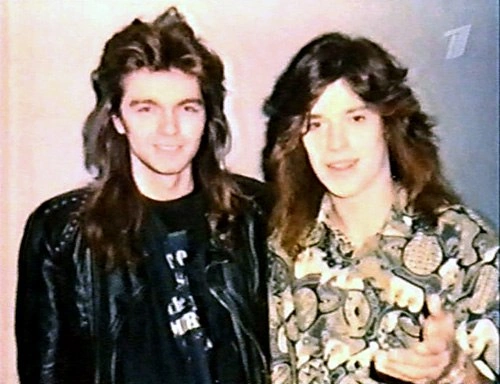

√руппа «»нтеграл»

√руппа «»нтеграл» была только началом творческой биографии ≈вгени€ Ѕелоусова. ѕопал в коллектив артист по приглашению Ѕари јлибасова, который увидел молодого исполнител€ в одном из ресторанов урска. ћолодому человеку предложили зан€ть место бас-гитариста и вокалиста проекта.

Ѕелоусов согласилс€ на предложение и выехал в —аратов, где базировалс€ коллектив. урский музыкант играл в звЄздном составе команды: в середине 80-х солисткой «»нтеграла» была ћарина ’лебникова, выступал здесь и —ергей „елобанов.

—ольна€ карьера ∆ени Ѕелоусова

Ќаибольшую известность певец получил после начала сольных выступлений. ¬ 1987 году артист по€вилс€ в передаче «”тренн€€ почта», затем в новогодней программе «Ўире круг», а в 1988-м вышел его первый клип на песню «ƒевочка мо€ синеглаза€». омпозици€ стала мегапопул€рной, так же как и другой хит исполнител€ — «Ќочное такси».

ѕервыми продюсерами артиста были ¬иктор ƒорохов и его супруга Ћюбовь ¬оропаева. Ѕлагодар€ этим люд€м страна узнала певца ∆еню Ѕелоусова. »нтересно, что возраст и семейное положение вокалиста продюсеры изменили, чтобы дать возможность всем девушкам ———– влюбитьс€ в нового кумира. «а врем€ сотрудничества с ƒороховым и ¬оропаевой певец выпустил два альбома, в которые вошли, помимо названных выше хитов, и другие €ркие композиции, в частности трек ««олотые купола», с которым ≈вгений выступил на «ѕесне 90». ¬ качестве директора с ∆еней работал в то врем€ Ќиколай јгутин.

¬ 1991 году Ѕелоусов нашел себе нового продюсера в лице »гор€ ћатвиенко. Ёто сотрудничество помогло ≈вгению достичь новых высот. ѕерва€ же песн€, написанна€ »горем ћатвиенко, — «ƒевчонка-девчоночка» — мгновенно стала шл€гером, который звучал из всех магнитофонов и радиоприемников страны в 1991 году.

ѕри поддержке ёри€ јйзеншписа было организовано 14 концертов певца на ћалой спортивной арене стадиона «Ћужники». ¬ыступлени€ сопровождались аншлагами. ассеты и фото знаменитости расходились огромными тиражами.

ƒважды артист попадал в криминальные истории, св€занные с его похищением. ѕервый раз произошло это в јлматы, где местна€ группировка удерживала деньги за гастроли. ¬торой раз музыканта увезли в лес в Ќижнем Ќовгороде. ѕреступники решили устроить дл€ себ€ и своих близких бесплатный концерт кумира.

середине 90-х репертуар артиста все ещЄ состо€л из песен о подростковой любви и романтических чувствах, но сам ≈вгений уже был 30-летним отцом двоих детей и хотел перейти к более зрелому творчеству. ѕопул€рность песен падала, новый альбом «» оп€ть о любви» был прин€т публикой прохладно.

“елевидение

¬ период расцвета попул€рности ∆ен€ редко по€вл€лс€ в телепрограммах — с одной стороны, у артиста просто не хватало на это времени, с другой — опыт общени€ с журналистами оказалс€ дл€ певца в большей степени негативным. ѕозднее Ѕелоусов признавалс€, что перестал давать интервью печатным издани€м, так как сказанное им перевиралось, подставл€лись не те слова и даже фразы.

¬ 1996-м исполнитель по€вилс€ в ток-шоу «јкулы пера», где уверенно выдерживал острые вопросы от молодых в то врем€ журналистов: ќтара ушанашвили, —ерге€ —оседова, апитолины ƒеловой и других. ¬ программе Ѕелоусов рассказал о многих забавных ситуаци€х, случавшихс€ на его концертах, раскрыл тайны о том, как делал сольные выступлени€ с трем€ хитами, поделилс€ мнением о противосто€нии рок- и поп-музыки, много шутил.

ѕоследние выступлени€ исполнител€ на телевидении состо€лись в 1997 году. Ѕелоусов стал гостем передачи «ѕодъем с переворотом» и по€вилс€ в дог-шоу «я и мо€ собака».

Ѕизнес

ѕопыткой перемен дл€ ≈вгени€ стала покупка небольшого –€занского водочного завода. Ќа волне попул€рности Ѕелоусов решил повторить успех некоторых коллег по цеху и зан€лс€ коммерцией вместе с другом јндреем —околовым, исполнителем главной роли в культовой картине «ћаленька€ ¬ера». ѕозднее актЄр вышел из бизнеса, тогда как ∆ен€ увлекс€ процессом. ќн планировал все заработанные средства тратить на творчество, съЄмки клипов.

ѕевец сделал р€д инвестиций, которые принесли ему не прибыль, а банкротство. ” водочной компании, которую артист хотел сделать основным источником своего дохода, по€вились проблемы с налоговыми органами, и в конечном итоге она разорила артиста.

Ћична€ жизнь

ƒевушки —оветского —оюза сходили по Ѕелоусову с ума. ≈го лична€ жизнь интересовала поклонниц даже больше, чем творчество. ” музыканта не было проблем в общении с противоположным полом.

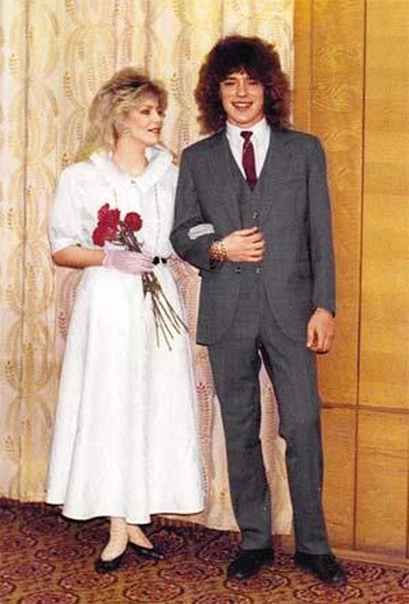

¬ 1989 году официальной женой Ѕелоусова стала певица Ќаталь€ ¬етлицка€, избранником которой до ≈вгени€ был ƒмитрий ћаликов. Ѕрак ≈вгени€ и Ќатальи просуществовал дев€ть дней. ¬ одном из интервью артистка призналась, что быстро пон€ла, что не испытывает к мужу интереса как к мужчине, он был дл€ неЄ другом и коллегой. Ѕлизкие певца говорили, что тот серьЄзно переживал из-за ухода любимой, но смог перенаправить эмоции в творчество.

ƒо женитьбы на ¬етлицкой Ѕелоусов около года жил в гражданском браке с музыкальным продюсером ћартой ћогилевской. ќни познакомились на съЄмках клипа дл€ группы «»нтеграл», где впервые прозвучал голос артиста. ћежду ним и продюсером началс€ роман, Ѕелоусов переехал к ћарте. ќн с заботой относилс€ к своей избраннице, но их св€зи помешал роман с ¬етлицкой.

Ќо ещЄ до брака с Ќатальей ≈вгений успел стать отцом — дочь ристину артисту родила подруга его юности ≈лена ’удик. »х семьи дружили, поэтому молодые люди хорошо знали друг друга. ѕопул€рность певца не дала возможности построить гармоничные отношени€, но позже, уже после развода с ¬етлицкой, Ѕелоусов предложил Ћене руку и сердце. Ќа пике попул€рности музыкант забрал жену и дочь в ћоскву. —оюз просуществовал до 1995-го.

ƒочь певца ристина построила карьеру переводчика, долгое врем€ жила в “аиланде, »ндонезии и »ндии. ¬ 33 года она впервые стала мамой, у неЄ родилс€ сын ƒавид.

Ѕелоусов не ограничивал себ€ в св€з€х с разными возлюбленными. ¬ 1992 году у певца родилс€ сын –оман от замужней женщины, участницы его музыкальной группы ќксаны Ўидловской.

¬ 1994 году ≈вгений встретил девушку, котора€ стала его последней любовью. 18-летн€€ студентка ≈лена —авина оказалась хороша собой, и уже через час после знакомства Ѕелоусов призналс€ ей в симпатии. ѕара прожила вместе больше трЄх лет. ћолодые люди старались много времени проводить вместе, часто ездили на отдых за границу, последний раз — зимой 1997 года. “рагическа€ смерть певца перечеркнула дальнейшую жизнь ≈лены. ќна не вышла замуж, но родила дочь. —вою наследницу —авина назвала в честь любимого — ∆еней.

—мерть ∆ени Ѕелоусова

—мерть Ѕелоусова ове€на ореолом версий и легенд, как это часто бывает при кончине молодых и успешных людей. ≈вгений ушел из жизни летом 1997 года. ¬есной артист попал в больницу с острым панкреатитом, вызванным, по утверждению р€да источников, злоупотреблением алкоголем. ¬ то же врем€ у знаменитости случилс€ геморрагический инсульт. ѕоп-исполнитель перенес операцию на мозге, но прожил после неЄ меньше мес€ца. –анее врачи предупреждали, что от детской травмы головы из-за наезда автомобил€ возможны последстви€.

ќфициальна€ причина смерти певца — кровоизли€ние в мозг. ћать Ѕелоусова призналась в интервью, что, скорее всего, на здоровье сына повли€ли жесткие диеты, которых артист придерживалс€, чтобы сбросить вес. ќ состо€нии здоровь€ звезды эстрады в последние дни жизни подробно рассказываетс€ в документальном фильме ѕервого канала « ороткое лето ∆ени Ѕелоусова».

ѕохороны певца прошли 5 июн€ 1997 года при большом скоплении народа. ѕроводить артиста пришли все его друзь€ и жены, на церемонии по€вилась даже Ќаталь€ ¬етлицка€. ћогила певца находитс€ на унцевском кладбище в ћоскве.

ѕам€ть

¬ 2006 году в урске был открыт музей пам€ти Ѕелоусова. Ёкспозици€ разместилась в ѕ“” є 1, в котором училс€ ≈вгений. ¬ день открыти€ музей посетили две жены артиста, его брат јлександр и сестра ћарина.

ѕосле кончины певца вышло около дес€тка документальных фильмов, рассказывающих о его судьбе, творчестве, личной жизни, смерти и наследии. ќдной из картин стал проект ѕервого канала под названием «∆ен€ Ѕелоусов. ќн не любит теб€ нисколечко...». ‘ильм показали в эфире в 2015 году.

»нтерес к творчеству и жизни поп-иконы позднего ———– про€вл€ли и журналисты Ќ“¬. ј в 2019 году вышел выпуск передачи «ѕривет, јндрей!», в записи которого участвовали перва€ жена Ѕелоусова и его последн€€ любовь. ¬ыступил перед публикой и сын исполнител€ –оман Ѕелоусов, который поразил присутствующих схожестью с отцом.

Ѕорьба за наследство

¬ 2023-м году, спуст€ четверть века после смерти певца, стало известно, что его сын –оман Ѕелоусов собралс€ поборотьс€ в суде за материальное и интеллектуальное наследство отца с сестрой ристиной. ѕо словам адвоката –омана —ерге€ ∆орина, сразу после кончины ≈вгени€ ¬икторовича сына исполнител€ не включили в число наследников. ¬ тот момент все, принадлежавшее артисту, перешло к его дочери.

ѕри этом о том, что –оман — сын вокалиста, знали многие, кроме того, имелось подтверждение суда. ќтец дал мальчику свою фамилию, сохранились фотографии молодого ≈вгени€ с ребЄнком. огда Ѕелоусова не стало, –оман был ещЄ слишком мал, чтобы за€вить о своих правах на наследство. ∆орин, обща€сь с журналистами, подчеркнул, что нотариус, занимавшийс€ ранее этим делом, был в курсе, что помимо дочери у певца есть сын, но игнорировал эту информацию.

јдвокат –омана вы€снил, что ристина пока не успела вступить в права наследовани€, что позволит сыну певца выиграть дело. Ќа кону — владение творческим наследием ∆ени Ѕелоусова (права на его песни), а также трЄхкомнатна€ квартира в ћоскве и деньги.

“ема конфликта детей музыканта гор€чо обсуждалась в студии ток-шоу ««везды сошлись» в но€бре 2023-го. ¬ том же мес€це –оман по€вилс€ в студии программы «Ёксклюзив», где поведал ƒмитрию Ѕорисову и публике историю о том, как развивалось его противосто€ние с ристиной. ¬ центре передачи оказалс€ вопрос об истинной цели стремлений мужчины — желании сохранить творческое наследие знаменитого отца или получить славу на имени певца.

»стори€ продожилась и в следующем 2024 году. –оман поставил под сомнение подлинность завещани€ отца. ќднако, как вы€снилось в эфире шоу «Ёксклюзив» документ был подлинным — это подтвердила графологическа€ экспертиза.

ƒискографи€

- 1988 — «ƒевочка мо€ синеглаза€»

- 1990 — «Ќочное такси (переиздан в 1994 году на CD)»

- 1993 — «ƒевчонка-девчоночка»

- 1994 — «ƒевчонка-девчоночка. Ћучшие песни» (сборник)

- 1995 — ««олотые купола» (сборник)

- 1996 — «» оп€ть о любви»

- 2000 — «Ћучшие песни. ƒевочка мо€ синеглаза€» (сборник)

- 2003 — «ѕрощай» (сборник)

»нтересные факты

- јртист сам предложил называть его ∆еней, так как им€ ≈вгений ему не нравилось. ќн практически стал родоначальником моды в шоу-бизнесе на короткие имена.

- ¬ концертном видео на лирический трек «ќблако волос» сн€лась ќксана Ўидловска€, мать –омана Ѕелоусова.

- Ќа разогреве у знаменитости выступал молодой »осиф ѕригожин, который в то врем€ исполн€л музыку в стиле диско.

- »сполнитель увлекалс€ античной философией и всегда возил книги с собой на гастроли.