»рина ќтиева выбрала тернистый путь к успеху, начав исполн€ть «неправильный» дл€ —оветского —оюза джаз. ≈Є не приглашали на конкурсы, игнорировали фестивали, о ней запрещали писать в прессе. ¬ то врем€ »рина јдольфовна высто€ла, продолжила петь джаз и стала одной из лучших. ≈Є звезда сверкнула и на эстрадном небосклоне –оссии, но, не сумев найти необходимую поддержку, артистка ушла в педагогику.

ƒетство и юность

»рина родилась в 1958 году в столице √рузинской ——– “билиси в семье врачей. ќтцовска€ фамили€ певицы — ќти€н, по национальности она арм€нка. ѕо отцу корни уход€т в древнюю кн€жескую династию јматуни.

Ќаталь€, старша€ сестра »рины, пошла по стопам родителей и также поступила в медицинский. ќт младшей ожидали того же, но биографи€ будущей звезды сложилась иначе.

–одители долгое врем€ не обращали внимани€ на талант дочери и еЄ стремление к сцене, однако разрешили помимо классической школы посещать музыкальную. “ам-то стало €сно, что ребЄнок обладает удивительно редким диапазоном голоса в 3,5 октавы. ѕосле окончани€ музыкальной школы »рина начала выступать с разными коллективами в “билиси, дела€ первые шаги к успеху.

ћузыка и фильмы

ѕервым триумфом будущей звезды стала победа на ћосковском фестивале джазовой музыки, тогда »рине было только 17. ƒевушку без экзаменов вз€ли в «√несинку» на эстрадное отделение. »рина часто говорила, что теоретические знани€ играют важную роль, поэтому получила второе высшее педагогическое образование. ‘актически она стала первой на советской эстраде дипломированной певицей.

‘амилию ќти€н »рина преобразила до более привычной русскому слуху ќтиевой. ѕосле окончани€ училища еЄ прин€л джазовый оркестр, которым управл€л ќлег Ћундстрем. ¬ 1984 году была записана совместна€ композици€ «ћузыка — мо€ любовь», которую до сих пор перепевают российские звезды.

Ќесмотр€ на то что к джазу в то врем€ прин€то было относитьс€ настороженно, в составе оркестра певица получила большое количество музыкальных премий и наград. ¬ то же врем€ министерство культуры запретило допускать ќтиеву к международным конкурсам, приглашать на радио и телевидение.

¬ составе ¬»ј «33 и 1/3» вместе с ¬ерой —околовой она исполнила песню «ѕоследн€€ поэма» дл€ фильма «¬ам и не снилось». ѕозднее этот хит стал визитной карточкой артистки. ¬скоре копилка певицы пополнилась картинами «„ародеи», «“ј—— уполномочен за€вить…» и другими.

Ќесмотр€ на козни, в 1982 году ей удалось получить премию на ¬сероссийском конкурсе советской песни, затем — на берлинском фестивале «8 шл€геров в студии». ¬ 1983 году »рина јдольфовна вз€ла первое место ещЄ на одном важном конкурсе артистов эстрады, который проходил в Ўвеции. ¬ возрасте 27 лет ќтиева собрала группу «—тимул-Ѕэнд». јртистка стала более узнаваемой, по€вились еЄ первые сольные альбомы.

¬ начале 90-х звезда эстрады гастролировала по ≈вропе и јзии: еЄ хорошо принимали в ѕольше, ¬ьетнаме, Ѕолгарии, японии и —ловакии. ќколо 10 концертов »рина дала в јмерике и на убе. ¬ эти годы ќтиева попробовала себ€ и в качестве актрисы: она по€вилась в эпизодах фильмов «∆ажда страсти» и «ћесть шута».

¬ 1995 году на суд российского зрител€ был выпущен проект «—тарые песни о главном», который стал неверо€тно попул€рен в стране на долгие годы. ¬ музыкальном фильме »рина вместе с Ћарисой ƒолиной исполнила песню «’орошие девчата». „ерез год ќтиева выпустила последний в еЄ дискографии альбом «20 лет в любви», который посв€тила 20-летию творчества. »м же она поставила жирную точку в гастрольном графике, прекратив концерты.

¬ 2000-х артистка блеснула на экране, став участницей проекта «—уперстар-2008. оманда мечты». Ўоу проходило на канале Ќ“¬. ¬ телеконкурсе соревновались 2 команды — сборные ———– и –оссии.

ѕозднее информаци€ об артистке редко, но по€вл€лась в —ети. ¬ 2018 году »рина јдольфовна прокомментировала событи€ в личной жизни јлександра —ерова, еЄ давнего друга и коллеги, проблемы которого стали темой передачи «ѕусть говор€т». ќтиева рассказала, что всегда знала јлександра как пор€дочного человека, не склонного к изменам жене.

ќ певице, слава которой гремела в 90-е, заговорили в 2022 году в св€зи с телешоу «ћаска-3». «агадочный ѕончик, который призналс€ члену жюри ‘илиппу иркорову в том, что у них «большое будущее», по мнению судей, мог оказатьс€ »риной јдольфовной. ¬ 5-м выпуске персонаж исполнил песню «»стеричка» группы Artik & Asti, после чего версии разделились между 4 кандидатами, в числе которых оказались Ќаст€ «адорожна€, јнна јрдова, »рина Ќельсон и »рина ќтиева. ќднако в костюпе ѕончика скрывалась »рина ѕонаровска€.

Ћична€ жизнь »рины ќтиевой

ќтиева посто€нно была окружена мужским вниманием, однако официально замуж так и не вышла. Ќевысокого роста брюнетка (157 см) привлекала внимание поклонников. ¬ молодости она состо€ла в отношени€х с композитором јлександром ѕищиковым, который был старше на 15 лет.

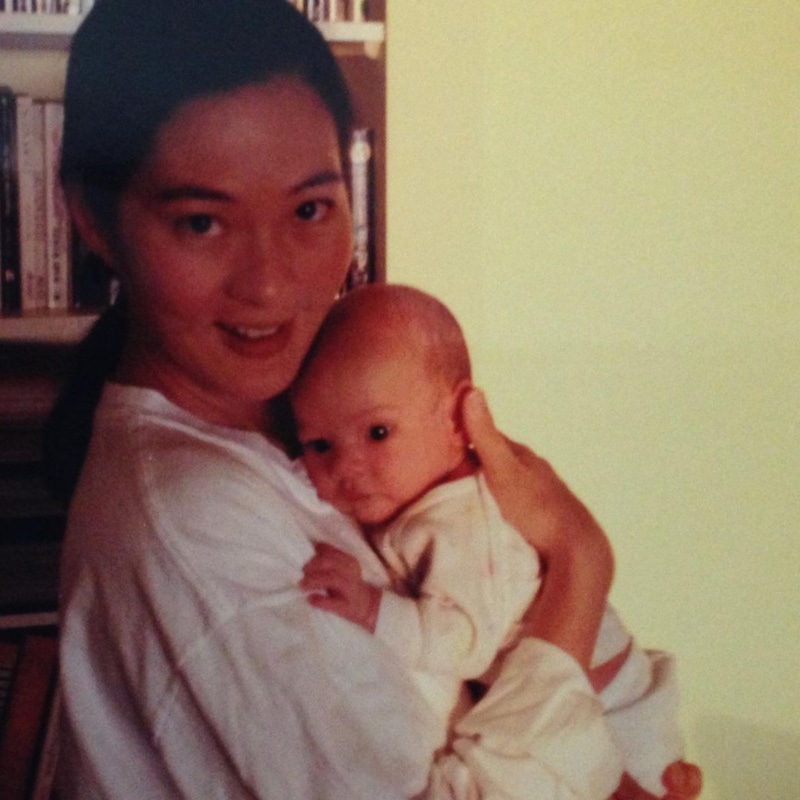

ѕозднее »рина встречалась с јлексеем ƒанченко — концертным директором группы. ¬ 1996 году пара рассталась, сохранив рабочие и дружеские отношени€. ƒолгое врем€ певица мечтала о ребЄнке. ¬ 1996 году у неЄ родилась дочь «лата.

то отец девочки, ќтиева так публике и не раскрыла. “ем не менее рассказала в интервью, что еЄ избранник не хотел разрушать свою семью ради ребЄнка. ќтец видел дочь только на фото, всегда интересовалс€ еЄ успехами у певицы. ѕосле окончани€ школы «лата поступила на факультет журналистики.

—емьи артистка не построила, но в личной жизни всегда происходили перемены. ќна неоднократно за€вл€ла в интервью, что предпочитает мужчин младше по возрасту, так как они зар€жают энергией. ѕричЄм речь идЄт о юных јполлонах — самому младшему, по словам певицы, было 20 лет.

–оман с ћартом Ѕаба€ном, который случилс€ у »рины јдольфовны уже в 50-летнем возрасте, наблюдали и еЄ поклонники. ћолодой человек поступил к ќтиевой на курс. ѕервое врем€ оба скрывали влечение друг к другу от себ€ и близких, пока симпати€ не стала очевидной. ƒрузь€ певицы предложили ей не бежать от чувств, что артистка и сделала.

Ќесколько лет пара была счастлива. –одион –оус — такой псевдоним вз€л себе ћарт — записал первый альбом, его карьера налаживалась. Ќесмотр€ на €ркость чувств, этот роман подошел к концу.

ќ жизни »рины сейчас известно мало: она не по€вл€етс€ на публичных тусовках, редко выступает на корпоративах. √оворили, что певица предпочла размеренную и спокойную жизнь, реализовавшись в качестве преподавател€ вокала јкадемии имени √несиных.

—кандал

¬ €нваре 2020 года јндрей ћалахов выпустил скандальную передачу об »рине јдольфовне, котора€, согласно посылу программы, потер€ла востребованность, все св€зи и начала злоупотребл€ть алкоголем. ¬ эфире шоу ќтиева разоткровенничалась, за€вив, что все былые друзь€, в том числе Ћариса ƒолина, јлександр —еров и »горь рутой, давно забыли о еЄ существовании.

«а день до эфира в певица Ќатали€ √улькина поспешила заступитьс€ за коллегу по сцене, за€вив, что современное телевидение делает рейтинг на лжи и сплетн€х. ќтиева даже специально завела страницу в «»нстаграме» (запрещенна€ в –оссии соцсеть, котора€ принадлежит компании Meta, признанной в –‘ экстремистской организацией), чтобы опровергнуть все то, что было показано в программе.

ѕевица призналась, что в день интервью у неЄ была высока€ температура, и сотрудники передачи, воспользовавшись таким состо€нием »рины јдольфовны, €кобы снимали все происход€щее на скрытую камеру.

»рина ќтиева сейчас

¬ 2023 году »рина јдольфовна принимала поздравление с юбилеем — ей исполнилось 65 лет. ак и в прошлые годы, звезда не собиралась делать из своего праздника шоу. ќна признавалась, что неоднократно получала предложени€ сн€тьс€ в очередной передаче, но отказывалась, помн€ печальный опыт сотрудничества с командой ћалахова.

—ейчас ќтиева ведЄт затворнический образ жизни. ќднако в 2023 году она порадовала поклонников новым треком. ¬месте с ћартом Ѕаба€ном она представила композицию « огда ты уйдешь». ‘анаты засыпали аккаунт знаменитости вопросами о возвращении на эстраду, наде€сь воочию увидеть кумира. Ќо певица ничем не порадовала слушателей.

ƒискографи€

- 1984 — «ѕоет »рина ќтиева»

- 1984 — «ћузыка – любовь мо€»

- 1985 — «»рина ќтиева с оркестром ќлега Ћундстрема»

- 1985 — ««везди съветски естради»

- 1987 — «–ок-н-ролл»

- 1988 — «Ќостальги€ по себе»

- 1993 — «Ќе плачь, бэби»

- 1994 — «„то ты думаешь об этом?»

- 1996 — «20 лет в любви»

- 1996 — «—тарые песни о главном. „асть 1»

- 1997 — «—вадьба, свадьба!»

- 2001 — «јнгелочек мой»

»нтересные факты

- »сполнительница участвовала в записи выпуска юмористической передачи «ќ.—.ѕ. – студи€», где исполнила песню «я ненавижу футбол».

- “о, что »рина станет певицей, предсказала ещЄ акушерка. –одившись, девочка сразу про€вила свои способности, закричав что есть мочи.

- јртистка училась у »осифа обзона, позднее музыканты дружили.

- ” ќтиевой развита интуици€, имеютс€ и мистические способности: »рина јдольфовна часто сталкиваетс€ с дежавю и способна пон€ть мотивы поступков других.