|

|

Techniques For CFD Trading: Enhancing Your Success In A Fluctuating Market SettingВоскресенье, 11 Августа 2024 г. 15:59 (ссылка)

Writer-Hatch Cooper Understanding Volatility and Market PatternsTo trade CFDs successfully, you must grasp the nuances of market volatility and fads. Market volatility describes the level of variation in trading rates in time. Recognizing this principle is critical because it affects the prospective threats and benefits of your professions. High volatility can cause significant rate swings, providing both possibilities and threats for CFD investors. By analyzing historic rate activities and financial indications, you can much better anticipate potential volatility and readjust your trading strategies accordingly. In addition, recognizing market fads is necessary for making educated trading decisions. Patterns reflect the basic instructions in which a property's price is conforming time. Recognizing whether a possession is experiencing a higher (favorable) or downward (bearish) pattern can help you establish one of the most suitable entrance and departure factors for your trades. Making use of technological evaluation devices such as relocating standards or pattern lines can assist in detecting these fads and straightening your trading method to maximize market movements successfully. Leveraging Quit Loss and Take ProfitTake into consideration utilizing quit loss and take revenue orders to handle your risk efficiently when trading CFDs. These order types are crucial devices in helping you safeguard your capital and secure profits. A quit loss order sets a fixed cost at which your trade will automatically close if the marketplace relocates against you. This aids limit potential losses by leaving the profession prior to it worsens. On the other hand, a take revenue order enables you to secure your profits by automatically shutting the profession once it reaches a specified revenue level. By using both quit loss and take revenue orders, you can develop clear threat administration parameters for each profession, ensuring you do not allow emotions dictate your activities in a volatile market. When establishing these orders, it's vital to consider the price fluctuations and total market problems. Changing your quit loss and take earnings levels based on the specific characteristics of each trade can help optimize your risk-reward proportion and boost your overall trading technique. Diversification and Danger AdministrationEfficient diversity and danger management are key parts in effective CFD trading strategies. Expanding your profile across various possession classes can assist spread danger and reduce prospective losses. Instead of placing https://www.forbes.com/sites/laurabegleybloom/2023...ke-money-online-33-best-ideas/ into one trade, consider designating them to various CFDs in different markets such as supplies, products, or money. By spreading your investments, you can reduce the influence of a single market slump on your total portfolio. Along with diversity, executing proper risk administration techniques is crucial. Establishing stop-loss orders and take-profit degrees can help you regulate your losses and protect your earnings. It's vital to specify your risk resistance and develop a risk-reward ratio for each and every trade. By sticking to these fixed levels, you can stay clear of psychological decision-making and remain disciplined in your trading approach. Remember that CFD trading involves intrinsic risks, and no approach can ensure profits. Nevertheless, by expanding best trading platforms and properly handling dangers, you can enhance your chances of success in navigating the unpredictable CFD market. Conclusion Generally, in a volatile market, using effective techniques such as quit loss, take revenue orders, and diversification can help make best use of revenues while managing risks. By staying informed on market patterns and economic signs, investors can make knowledgeable choices to maximize volatility. Bear in mind to always focus on danger administration and adapt your strategies as necessary to navigate the unforeseeable nature of the market successfully.

Advanced Innovations In Monetary Innovation Are Transforming The Sector, Unlocking Remarkable Chances For Growth And Interruption. Discover The Pioneering Advancements That Are On The Verge Of IntroductionВоскресенье, 11 Августа 2024 г. 15:59 (ссылка)

Authored By-Terp Coyne Blockchain and Cryptocurrency TrendsDiscover the most up to date patterns in blockchain and cryptocurrency to remain educated about the developing landscape of economic innovation. As a financier, staying up-to-date with these trends is important for making educated decisions. One substantial fad is the surge of decentralized finance (DeFi) systems, which intend to transform traditional economic systems by supplying services like loaning, loaning, and trading without the requirement for middlemans. An additional pattern to enjoy is the raising fostering of non-fungible tokens (NFTs), which have actually gained appeal in the art and gaming markets. These unique electronic assets are developing brand-new opportunities for developers and collectors alike. Additionally, the integration of blockchain innovation in supply chain monitoring is also making waves, improving openness and traceability in different markets. Additionally, the development of reserve bank electronic currencies (CBDCs) is a pattern well worth complying with, as governments worldwide check out the potential of issuing digital variations of their fiat money. Recognizing and keeping track of these trends will help you navigate the hectic world of blockchain and cryptocurrency with confidence. Rise of Expert System in FinancingThe rise of artificial intelligence in money is changing the method financial institutions run and choose. AI modern technologies are being increasingly utilized to maximize processes, boost client experience, and handle dangers better. Through artificial intelligence formulas, AI systems can examine vast quantities of information in real-time, allowing quicker and even more exact decision-making. In https://anotepad.com/notes/esra4rrx of financial investment monitoring, AI-powered devices can look through enormous datasets to determine fads, assess dangers, and even implement trades autonomously. This automation not just improves efficiency yet also minimizes the margin for human error. Furthermore, chatbots powered by AI are revolutionizing client service by supplying immediate responses to questions, boosting customer fulfillment levels. Threat management is another area where AI is making significant invasions. By leveraging AI algorithms, financial institutions can detect abnormalities in deals, flag potential fraudulent tasks, and improve cybersecurity actions. Advancement of Digital Settlement SolutionsAmidst the quickly altering landscape of monetary technology, electronic payment options have actually gone through an impressive development recently. The convenience and rate of digital settlements have actually transformed exactly how individuals and businesses conduct deals. From the early days of online banking to the prevalent adoption of mobile settlement applications, the advancement has actually been speedy and impactful. Today, electronic purses like Apple Pay and Google Pay have become ubiquitous, allowing you to make safe settlements with simply a faucet of your phone. In https://cristobal-julie.blogbright.net/discover-th...and-prosperity-of-your-venture , peer-to-peer repayment systems such as Venmo and PayPal have simplified splitting expenses and moving cash in between friends and family. With the rise of cryptocurrencies like Bitcoin and Ethereum, blockchain innovation is being checked out for its potential to change the means we make deals. These decentralized digital currencies offer a brand-new frontier in the advancement of digital repayment services, leading the way for a more secure and clear monetary future. Final thought Stay ahead of the curve by accepting the most recent fads in economic innovation. From blockchain and cryptocurrency developments to the assimilation of expert system in money, the future of the industry is full of exciting possibilities. Maintain exploring new electronic settlement services and remain educated about the evolving landscape of fintech to make the most of these innovations. click for info is here, and it's time to adapt and grow in the ever-changing globe of financing.

Prepare Yourself To Discover The Game-Changing Globe Of Financial Technology And Its Influence On Global Markets, Uncovering Exactly How It Shapes The Future Of FinanceВоскресенье, 11 Августа 2024 г. 15:58 (ссылка)

Created By-Gallegos Abildgaard Evolution of Fintech LandscapeDiscover just how the fintech landscape has swiftly progressed in the last few years, reshaping traditional financial services. The surge of fintech companies has actually transformed the means individuals access and handle their funds. You may have noticed the increasing popularity of mobile payment applications, robo-advisors, and peer-to-peer financing systems. These technologies have made economic solutions more convenient, effective, and obtainable to a broader target market. As a consumer, you now have a lot more options than in the past for handling your cash. Fintech firms have introduced brand-new ways to send cash internationally, invest in stocks, and even get car loans without ever before entering a financial institution. The ease of performing financial deals online or with an application has altered the method people interact with conventional banks. Furthermore, the fintech market has forced traditional financial institutions to adjust or run the risk of lapsing. Banks are now spending heavily in modern technology to boost their solutions and meet the transforming needs of consumers. This competitors has inevitably caused much better products and services for you as a customer. Interruption of Conventional Financial SolutionsThe fintech market is actively improving standard monetary systems by testing established norms and techniques. With the rise of cutting-edge innovations, conventional banks and banks are encountering raising pressure to adjust to a rapidly altering landscape. Fintech business are introducing brand-new ways of conducting financial purchases, taking care of financial investments, and giving accessibility to resources, interfering with the status. One of the key means fintech is interrupting typical monetary systems is with the introduction of on the internet platforms that use smooth and reliable services, such as peer-to-peer financing and electronic settlement services. These platforms provide individuals with greater comfort, reduced costs, and increased accessibility contrasted to typical financial techniques. Furthermore, fintech business are leveraging large information and expert system to streamline procedures like credit rating and take the chance of analysis, enabling much faster decision-making and extra personalized economic services. This data-driven technique is reinventing the way banks run, bring about boosted performance and boosted client experiences. Global Market Effects of FintechFintech's impact on worldwide markets appears through its impact on cross-border transactions and market dynamics. By leveraging innovative modern technologies, fintech companies have changed the method international transactions are carried out. With blockchain and digital settlement systems, cross-border transactions have actually come to be extra effective, economical, and secure. This has brought about enhanced global profession and financial investment opportunities, cultivating economic growth on an international range. Moreover, fintech has actually played https://anotepad.com/notes/cema4d8x in shaping market dynamics by offering innovative remedies for investment, trading, and danger monitoring. Mathematical trading systems powered by artificial intelligence have enhanced market liquidity and rate exploration. In addition, crowdfunding and peer-to-peer loaning systems have actually equalized access to capital, permitting services worldwide to secure moneying even more conveniently. Conclusion In conclusion, fintech has actually changed global markets by introducing cutting-edge services that enhance effectiveness and ease of access in economic solutions. This transformation has actually interfered with traditional financial systems, causing quicker decision-making, individualized services, and boosted profession opportunities. With the proceeded evolution of fintech, we can anticipate to see additional advancements in cross-border deals, democratization of capital gain access to, and the utilization of large data and AI to drive market characteristics. Stay informed and welcome the future of financing with fintech.

Methods To CFD Trading: Magnifying Your Revenues In A Dynamic Market ContextВоскресенье, 11 Августа 2024 г. 15:58 (ссылка)

Authored By-Sanders McIntosh Recognizing Volatility and Market TrendsTo trade CFDs efficiently, you must realize the subtleties of market volatility and trends. Market volatility refers to the level of variation in trading prices in time. Recognizing this principle is important since it impacts the prospective risks and rewards of your professions. High volatility can lead to significant rate swings, providing both opportunities and threats for CFD investors. By assessing historic cost motions and financial signs, you can much better anticipate potential volatility and change your trading techniques as necessary. Furthermore, acknowledging market fads is necessary for making notified trading choices. Trends mirror the basic direction in which a possession's cost is moving over time. Recognizing whether a possession is experiencing a higher (favorable) or downward (bearish) pattern can assist you establish one of the most suitable access and leave points for your professions. Utilizing technological evaluation devices such as moving standards or fad lines can help in detecting these patterns and straightening your trading strategy to maximize market motions properly. Leveraging Stop Loss and Take EarningsConsider making use of quit loss and take profit orders to handle your threat efficiently when trading CFDs. These order types are essential tools in assisting you secure your capital and lock in profits. A stop loss order sets a fixed cost at which your profession will immediately close if the marketplace relocates versus you. This assists restrict potential losses by exiting the profession prior to it worsens. On the other hand, a take revenue order permits you to safeguard your profits by immediately closing the profession once it reaches a specified earnings degree. By making use of both quit loss and take profit orders, you can develop clear risk management criteria for each and every profession, ensuring you do not let emotions determine your activities in an unstable market. When setting these orders, it's necessary to consider the rate changes and overall market conditions. Changing cfd, forex and trading apps and take revenue levels based upon the particular attributes of each profession can help optimize your risk-reward ratio and improve your overall trading technique. Diversification and Threat MonitoringEffective diversification and risk monitoring are vital components in successful CFD trading strategies. Diversifying click here to investigate across various property classes can aid spread danger and decrease prospective losses. Instead of putting all your funds right into one trade, take into consideration designating them to numerous CFDs in various markets such as supplies, assets, or currencies. By spreading your financial investments, you can decrease the impact of a solitary market decline on your overall profile. In addition to diversity, applying appropriate risk administration methods is important. Setting stop-loss orders and take-profit levels can assist you regulate your losses and protect your earnings. It's necessary to specify your risk tolerance and establish a risk-reward proportion for every trade. By adhering to these fixed degrees, you can avoid emotional decision-making and stay disciplined in your trading technique. Bear in mind that CFD trading entails fundamental threats, and no approach can guarantee profits. Nonetheless, by diversifying just click the up coming website and properly handling dangers, you can enhance your chances of success in navigating the volatile CFD market. Verdict Generally, in a volatile market, using reliable methods such as quit loss, take revenue orders, and diversification can help optimize profits while taking care of risks. By remaining informed on market patterns and economic indicators, traders can make well-informed decisions to maximize volatility. Bear in mind to always prioritize danger monitoring and adjust your approaches appropriately to browse the unforeseeable nature of the market efficiently.

Are You Excited To Explore The World Of CFD Trading? Discover The Vital Techniques For Optimizing Possible Earnings And Taking Care Of Risks In This Thorough Overview Developed For NewcomersВоскресенье, 11 Августа 2024 г. 15:57 (ссылка)

Writer-Vargas Bech What Is CFD Trading?If you're new to trading, understanding what CFD trading requires is crucial for your success in the financial markets. CFD means Contract for Distinction, a popular kind of derivative trading that permits you to guess on the rate activities of different financial tools without actually possessing the hidden possession. In CFD trading, you enter into an agreement with a broker to trade the distinction in the price of an asset from the moment the contract is opened to when it's shut. One of the crucial advantages of CFD trading is the capacity to leverage your trades. https://thedefiant.io/news/research-and-opinion/crypto-passive-income suggests you can open positions with just a portion of the overall profession value, called margin. While take advantage of can amplify your earnings, it likewise increases the potential risks involved. It's vital to manage your threat meticulously and comprehend exactly how leverage works prior to diving right into CFD trading. In addition, CFD trading uses the adaptability to go long (buy) or brief (sell) on a possession, permitting you to potentially make money from both rising and falling markets. This versatility makes CFD trading an eye-catching choice for traders wanting to capitalize on numerous market problems. Just How Does CFD Trading Job?Exploring the auto mechanics of CFD trading gives understanding into exactly how traders can hypothesize on property rate movements without owning the underlying properties. When you engage in CFD trading, you basically enter into a contract with a broker to exchange the difference in the rate of a possession from the moment the contract is opened to when it's shut. This allows you to make money not only from price boosts yet additionally from price decreases. CFDs are leveraged products, meaning you just need to deposit a fraction of the complete trade worth to open a setting. This utilize can intensify your revenues, however it also increases the danger of losses. Additionally, CFDs provide the versatility to trade on a large range of markets, including stocks, indices, products, and money. To trade CFDs efficiently, it's critical to comprehend how utilize works, manage your danger efficiently, and remain informed regarding market advancements that could affect your picked possessions. Tips for CFD Trading SuccessBrowsing the complexities of CFD trading effectively calls for a critical approach and a solid understanding of essential concepts. To start with, always conduct thorough research before opening up a placement. Remain educated concerning business loans companies , economic indications, and the possessions you're trading. Second of all, handle your threat effectively by setting stop-loss orders to limit possible losses. It's crucial to have a risk management strategy in position to shield your resources. In addition, prevent emotional decision-making. Trading based upon worry or greed can bring about spontaneous activities that might result in losses. Adhere to your trading strategy and remain self-displined. Additionally, diversification is key to decreasing risk. Spread your financial investments across various possession courses to lessen potential losses. Regularly review and change your trading technique to adapt to changing market conditions. Last but not least, take into consideration utilizing demonstration accounts to exercise trading without taking the chance of real money. This can help you obtain experience and examination various approaches prior to trading with actual funds. By adhering to these tips, you can enhance your opportunities of success in CFD trading. Final thought Finally, CFD trading supplies an one-of-a-kind chance for newbies to benefit from property rate movements without owning the underlying asset. By comprehending just how CFD trading jobs and applying reliable risk management techniques, you can enhance your possibilities of success in the marketplace. Keep in mind to perform extensive research study, remain educated about market trends, and make critical choices to maximize your prospective gains while reducing dangers. Best of luck on your CFD trading trip!

Understanding CFD Trading: An In-Depth Handbook For BeginnersВоскресенье, 11 Августа 2024 г. 15:56 (ссылка)

Published By-Pehrson Guldbrandsen What Is CFD Trading?If you're brand-new to trading, understanding what CFD trading involves is essential for your success in the financial markets. CFD represents Contract for Distinction, a preferred kind of derivative trading that allows you to speculate on the price movements of various financial tools without really possessing the underlying property. In CFD trading, you participate in a contract with a broker to trade the distinction in the cost of a property from the moment the contract is opened to when it's shut. Among the essential advantages of CFD trading is the capacity to leverage your professions. This implies you can employment opportunity with only a fraction of the total trade worth, referred to as margin. While take advantage of can magnify your profits, it also raises the prospective risks included. It's vital to handle your danger very carefully and recognize exactly how leverage functions before diving into CFD trading. Additionally, https://www.philstar.com/business/2024/04/04/2345047/invest-generate-passive-income trading uses the versatility to go long (buy) or short (sell) on a possession, permitting you to possibly make money from both fluctuating markets. This adaptability makes CFD trading an attractive alternative for traders aiming to maximize different market conditions. How Does CFD Trading Work?Discovering the auto mechanics of CFD trading offers understanding into how traders can speculate on possession rate movements without having the underlying assets. When you take part in CFD trading, you basically enter into an agreement with a broker to exchange the difference in the price of a property from the moment the agreement is opened to when it's shut. This allows you to profit not just from cost boosts but additionally from price decreases. CFDs are leveraged items, indicating you only require to transfer a portion of the overall profession worth to open a placement. This take advantage of can magnify your earnings, yet it also enhances the threat of losses. Additionally, CFDs offer the adaptability to trade on a variety of markets, consisting of stocks, indices, commodities, and money. To trade CFDs successfully, it's vital to recognize just how take advantage of works, handle your danger properly, and remain notified regarding market advancements that can impact your picked possessions. Tips for CFD Trading SuccessNavigating the intricacies of CFD trading successfully requires a strategic method and a solid understanding of vital concepts. First of all, constantly perform extensive research study before opening a position. Remain notified concerning the economic markets, economic signs, and the possessions you're trading. Secondly, handle your threat effectively by setting stop-loss orders to limit possible losses. It's essential to have a danger monitoring method in place to shield your funding. Additionally, prevent psychological decision-making. Trading based on concern or greed can result in impulsive activities that might lead to losses. Adhere to your trading strategy and remain self-displined. Moreover, diversification is key to decreasing danger. Spread your investments throughout different asset courses to reduce potential losses. Regularly review and change your trading strategy to adjust to altering market problems. Finally, think about utilizing demo accounts to practice trading without risking actual money. trading software can help you obtain experience and test different methods before trading with actual funds. By adhering to these ideas, you can improve your possibilities of success in CFD trading. Verdict To conclude, CFD trading offers a special opportunity for beginners to make money from property price motions without possessing the underlying possession. By understanding how CFD trading jobs and applying effective danger administration strategies, you can increase your chances of success on the market. Keep in mind to carry out complete research study, stay informed regarding market fads, and make strategic choices to optimize your potential gains while minimizing risks. Best of luck on your CFD trading journey!

Futuristic Economic Innovations Are Transforming The Sector, Supplying Unprecedented Opportunities For Growth And Disturbance - Explore The Cutting-Edge Innovations In AdvanceВоскресенье, 11 Августа 2024 г. 15:55 (ссылка)

Produced By-Herman Juarez Blockchain and Cryptocurrency TrendsExplore the most recent trends in blockchain and cryptocurrency to remain informed concerning the advancing landscape of economic innovation. As Read the Full Guide , remaining up-to-date with these trends is important for making educated decisions. One significant pattern is the rise of decentralized finance (DeFi) platforms, which intend to revolutionize conventional economic systems by offering solutions like loaning, borrowing, and trading without the need for intermediaries. Another trend to watch is the enhancing fostering of non-fungible tokens (NFTs), which have obtained appeal in the art and video gaming industries. These one-of-a-kind digital assets are producing new chances for makers and collection agencies alike. Furthermore, the integration of blockchain technology in supply chain monitoring is likewise making waves, enhancing transparency and traceability in various markets. Furthermore, the advancement of reserve bank digital currencies (CBDCs) is a trend worth complying with, as governments worldwide check out the possibility of issuing digital variations of their fiat currencies. Understanding and monitoring these trends will help you browse the fast-paced world of blockchain and cryptocurrency with confidence. Rise of Artificial Intelligence in MoneyThe increase of expert system in financing is changing the means banks operate and choose. AI innovations are being progressively used to optimize processes, boost client experience, and take care of threats more effectively. Via machine learning formulas, AI systems can examine vast quantities of information in real-time, making it possible for quicker and more exact decision-making. In the realm of financial investment management, AI-powered devices can sort through large datasets to recognize fads, analyze threats, and also implement professions autonomously. https://www.acorns.com/learn/earning/how-to-make-money-online/ increases effectiveness but additionally decreases the margin for human mistake. Additionally, chatbots powered by AI are reinventing customer support by offering instantaneous actions to inquiries, enhancing consumer complete satisfaction levels. Risk administration is an additional location where AI is making significant inroads. By leveraging AI formulas, banks can spot abnormalities in transactions, flag prospective fraudulent tasks, and enhance cybersecurity actions. Advancement of Digital Settlement SolutionsIn the middle of the quickly altering landscape of economic modern technology, digital settlement services have actually gone through an amazing advancement over the last few years. The comfort and speed of electronic payments have actually changed just how individuals and organizations conduct deals. From the very early days of online banking to the prevalent fostering of mobile repayment applications, the evolution has been swift and impactful. Today, electronic budgets like Apple Pay and Google Pay have ended up being common, allowing you to make secure payments with simply a faucet of your phone. Furthermore, peer-to-peer repayment platforms such as Venmo and PayPal have simplified splitting bills and transferring money between loved ones. With the increase of cryptocurrencies like Bitcoin and Ethereum, blockchain modern technology is being explored for its potential to revolutionize the method we make transactions. These decentralized electronic money supply a new frontier in the evolution of digital settlement remedies, leading the way for a more safe and secure and transparent financial future. Verdict Remain ahead of the contour by embracing the most up to date fads in monetary innovation. From https://canvas.instructure.com/eportfolios/3049193...ents_Transforming_The_Industry and cryptocurrency advancements to the assimilation of artificial intelligence in financing, the future of the sector is filled with exciting possibilities. Keep exploring new electronic settlement remedies and remain informed concerning the developing landscape of fintech to make the most of these improvements. The future is right here, and it's time to adjust and flourish in the ever-changing world of finance.

Financial Technology And Its Effects On Global Financial Markets: Vital Details For ConsiderationВоскресенье, 11 Августа 2024 г. 15:51 (ссылка)

Authored By-Kang Valencia Development of Fintech LandscapeExplore just how the fintech landscape has swiftly developed in recent years, improving traditional monetary solutions. The surge of fintech business has actually transformed the method individuals access and handle their financial resources. You might have seen the raising popularity of mobile repayment applications, robo-advisors, and peer-to-peer financing platforms. These advancements have actually made economic services easier, effective, and obtainable to a broader target market. As https://rentry.co/mrifqeny , you now have much more choices than in the past for handling your cash. Fintech business have presented new means to send cash internationally, invest in stocks, and even acquire loans without ever before setting foot in a bank. The benefit of carrying out economic purchases online or via an application has altered the means people engage with standard financial institutions. In addition, the fintech sector has forced traditional financial institutions to adapt or risk becoming obsolete. Banks are currently spending heavily in technology to improve their solutions and fulfill the altering demands of consumers. This competition has inevitably resulted in better products and services for you as a consumer. Disturbance of Standard Financial SystemsThe fintech market is proactively improving traditional economic systems by challenging recognized norms and techniques. With the rise of cutting-edge modern technologies, typical banks and banks are dealing with enhancing pressure to adjust to a quickly altering landscape. Fintech firms are introducing new ways of performing monetary deals, handling financial investments, and giving access to capital, interrupting the status quo. Among the key methods fintech is disrupting typical monetary systems is through the intro of on-line platforms that use seamless and effective services, such as peer-to-peer lending and digital settlement remedies. These platforms give customers with better benefit, reduced expenses, and raised accessibility contrasted to conventional financial approaches. In addition, fintech firms are leveraging large information and artificial intelligence to simplify procedures like credit history and risk evaluation, enabling quicker decision-making and extra individualized monetary solutions. This data-driven method is revolutionizing the means banks run, leading to raised efficiency and improved client experiences. Global Market Impacts of FintechFintech's effect on international markets is evident through its influence on cross-border deals and market characteristics. By leveraging https://www.cnbc.com/2024/05/12/graham-cochrane-be...me-and-side-hustle-advice.html , fintech companies have actually transformed the way global purchases are performed. Through blockchain and digital settlement systems, cross-border transactions have become extra reliable, cost-efficient, and safeguard. Learn Additional Here has actually led to boosted international profession and financial investment chances, cultivating economic development on a worldwide scale. Additionally, fintech has actually played a considerable function in shaping market dynamics by providing innovative services for financial investment, trading, and danger monitoring. Mathematical trading systems powered by artificial intelligence have actually improved market liquidity and price exploration. Additionally, crowdfunding and peer-to-peer lending platforms have democratized access to resources, permitting businesses worldwide to safeguard moneying even more quickly. Verdict In conclusion, fintech has revolutionized global markets by introducing innovative remedies that improve performance and ease of access in economic services. This makeover has actually interfered with traditional monetary systems, resulting in quicker decision-making, personalized services, and increased profession chances. With the continued advancement of fintech, we can expect to see additional advancements in cross-border purchases, democratization of resources gain access to, and the usage of huge information and AI to drive market dynamics. Remain educated and welcome the future of money with fintech.

The Financial Industry Is Being Revolutionized By Innovative Technologies, Offering Distinct Chances For Growth And Disturbance. Engage With The Cutting-Edge Improvements That Are ForthcomingВоскресенье, 11 Августа 2024 г. 15:51 (ссылка)

Created By-Eriksson Dreier Blockchain and Cryptocurrency TrendsCheck out the current fads in blockchain and cryptocurrency to stay informed about the advancing landscape of financial technology. As a financier, staying updated with these trends is essential for making informed decisions. One considerable pattern is the rise of decentralized finance (DeFi) platforms, which intend to transform typical financial systems by using services like loaning, loaning, and trading without the demand for middlemans. Another fad to watch is the raising adoption of non-fungible tokens (NFTs), which have gained popularity in the art and pc gaming markets. These unique digital possessions are producing brand-new chances for creators and collection agencies alike. In addition, the combination of blockchain modern technology in supply chain monitoring is also making waves, enhancing transparency and traceability in numerous industries. Moreover, the growth of central bank digital money (CBDCs) is a trend well worth adhering to, as governments worldwide discover the capacity of providing electronic variations of their fiat money. Comprehending and tracking these patterns will help you navigate the busy globe of blockchain and cryptocurrency with confidence. Increase of Expert System in MoneyThe surge of expert system in financing is changing the method banks operate and make decisions. AI innovations are being progressively used to optimize procedures, enhance customer experience, and manage dangers better. Through machine learning formulas, AI systems can evaluate huge amounts of data in real-time, allowing quicker and more accurate decision-making. In best financial software, brokers and guides of financial investment administration, AI-powered tools can sort through large datasets to determine fads, analyze threats, and even perform professions autonomously. This automation not just increases performance however additionally reduces the margin for human error. In addition, chatbots powered by AI are changing customer service by supplying instantaneous reactions to questions, enhancing client complete satisfaction degrees. Danger monitoring is another location where AI is making significant invasions. By leveraging AI formulas, financial institutions can find anomalies in transactions, flag possible illegal tasks, and improve cybersecurity actions. Evolution of Digital Payment SolutionsAmidst the rapidly transforming landscape of monetary technology, digital settlement options have undergone a remarkable advancement over the last few years. https://notes.io/wbLdj and speed of digital payments have changed just how individuals and organizations conduct deals. From the early days of electronic banking to the extensive adoption of mobile repayment applications, the evolution has been speedy and impactful. https://writeablog.net/dolly0veda/small-business-l...or-getting-financial-resources , electronic pocketbooks like Apple Pay and Google Pay have actually ended up being ubiquitous, permitting you to make protected payments with simply a tap of your phone. Additionally, peer-to-peer payment systems such as Venmo and PayPal have simplified splitting costs and moving cash in between friends and family. With the increase of cryptocurrencies like Bitcoin and Ethereum, blockchain technology is being checked out for its prospective to transform the way we make deals. These decentralized digital currencies supply a brand-new frontier in the advancement of digital repayment remedies, paving the way for an extra secure and clear financial future. Conclusion Remain ahead of the contour by embracing the latest trends in economic innovation. From blockchain and cryptocurrency technologies to the combination of expert system in money, the future of the market is filled with exciting opportunities. Maintain checking out new electronic repayment services and remain educated regarding the progressing landscape of fintech to take advantage of these improvements. The future is right here, and it's time to adapt and thrive in the ever-changing globe of money.

Small Business Loans Demystified: Steps To Successfully Secure Funding For Your TaskВоскресенье, 11 Августа 2024 г. 15:50 (ссылка)

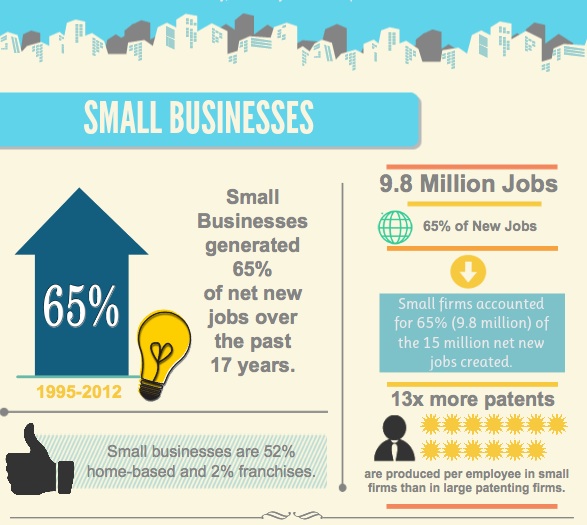

Authored By-Padgett Foldager Sorts Of Small Business LoansThere are 5 major kinds of bank loan that accommodate various monetary needs and circumstances. The first type is a term loan, where you obtain a round figure of money that's settled over a set duration with a taken care of or variable rates of interest. This is suitable for long-term investments or big purchases for your business. Next off, we have actually a business line of credit report, which offers you with a revolving credit line that you can draw from as required. It's a versatile choice for taking care of cash flow fluctuations or covering unanticipated costs. After go to this web-site , there's the SBA loan, guaranteed by the Small company Management, supplying competitive terms and lower deposits. It appropriates for companies trying to find affordable funding. https://www.nerdwallet.com/article/finance/how-to-make-money-amazon is devices financing, where the tools you're buying acts as collateral for the loan. Finally, we've invoice funding, where you receive bear down impressive invoices to boost cash flow. Pick the car loan type that best aligns with your service objectives and financial demands. Credentials and Eligibility CriteriaTo qualify for a bank loan, your credit rating and financial background play a crucial role in identifying eligibility. Lenders utilize these factors to examine your capability to pay off the financing. Usually, an excellent credit history, ideally above 680, shows your creditworthiness. Your financial history, including your organization's revenue and productivity, will certainly additionally be reviewed to ensure your service can maintain financing settlements. In addition to credit rating and economic history, lenders may think about various other qualification criteria. https://notes.io/wbZY1 may include the size of time your business has actually been operating, its industry, and the objective of the finance. Some lenders may need a minimum yearly income or cash flow to qualify for a car loan. Providing exact and in-depth financial info regarding your company will certainly aid lenders assess your qualification better. It's necessary to assess the particular certifications and qualification criteria of different lenders before requesting a bank loan. Recognizing these demands can assist you prepare a strong financing application and increase your possibilities of securing the financing your endeavor requires. Tips to Boost Funding Authorization OpportunitiesTo boost your opportunities of protecting approval for a bank loan, consider applying strategies that can reinforce your car loan application. Begin by ensuring your organization and individual credit report remain in great standing. Lenders usually use credit history to evaluate your credit reliability and establish the funding terms. Furthermore, prepare an in-depth service strategy that outlines your company's goal, target market, monetary forecasts, and how you plan to use the car loan funds. A well-thought-out service plan shows to lenders that you have a clear strategy for success. Moreover, gather all needed documents, such as income tax return, financial declarations, and legal papers, to support your financing application. Supplying total and precise information can aid accelerate the authorization process. It's additionally beneficial to develop a solid relationship with the lending institution by communicating openly and immediately replying to any type of requests for added information. Finally, think about using security to safeguard the lending, which can reduce the lender's threat and boost your approval opportunities. Conclusion Now that you understand the different sorts of small business loans and exactly how to boost your approval chances, you're ready to safeguard financing for your venture. Keep in mind to maintain great credit rating, have a strong organization plan, and construct partnerships with lending institutions. By following these pointers, you'll be well on your way to getting the financial backing you need to expand and expand your organization. All the best!

Unravel The Intricacies Of Small Business Loans And Uncover Crucial Strategies To Secure Funding For Your Venture'S Development And SuccessВоскресенье, 11 Августа 2024 г. 15:49 (ссылка)

Post Created By-Elgaard Hewitt Types of Local Business LoansThere are five main types of bank loan that satisfy different monetary demands and situations. The initial type is a term funding, where you obtain a round figure of money that's paid off over a collection duration with a repaired or variable interest rate. This is ideal for long-lasting investments or large acquisitions for your organization. Next, we have actually a business line of credit, which provides you with a revolving credit line that you can draw from as needed. It's a versatile choice for taking care of cash flow fluctuations or covering unanticipated costs. After that, there's the SBA finance, assured by the Local business Management, offering affordable terms and reduced deposits. https://anotepad.com/notes/59ckf6fp appropriates for companies looking for budget friendly financing. An additional kind is devices financing, where the equipment you're acquiring serves as security for the funding. Lastly, we have actually invoice funding, where you get bear down superior billings to improve cash flow. Select the lending kind that best straightens with your service objectives and economic needs. Certifications and Qualification RequirementsTo get a small business loan, your credit report and economic background play a critical role in determining qualification. Lenders use these factors to examine your capability to pay off the car loan. Usually, a good credit report, preferably above 680, shows your creditworthiness. informational resources for financial technology , including your organization's profits and productivity, will certainly additionally be evaluated to guarantee your service can sustain funding payments. Along with credit history and financial background, loan providers might think about other qualification criteria. These might consist of the size of time your company has actually been running, its market, and the objective of the loan. Some lenders may call for a minimum yearly income or capital to qualify for a funding. Providing exact and comprehensive financial details concerning your business will assist loan providers assess your qualification better. It's vital to evaluate the details qualifications and eligibility standards of various lenders prior to requesting a bank loan. Understanding these demands can assist you prepare a solid car loan application and enhance your chances of protecting the financing your venture requires. Tips to Enhance Financing Approval PossibilitiesTo improve your possibilities of securing approval for a bank loan, take into consideration carrying out approaches that can enhance your financing application. Begin by guaranteeing your service and individual credit rating are in great standing. Lenders commonly utilize credit scores to examine your credit reliability and identify the financing terms. Additionally, prepare a comprehensive business plan that describes your company's mission, target market, financial estimates, and just how you prepare to utilize the lending funds. A well-thought-out organization plan demonstrates to lending institutions that you have a clear method for success. Moreover, collect all necessary documentation, such as tax returns, financial declarations, and lawful documents, to support your finance application. Supplying https://blogfreely.net/claudine9rodolfo/methods-fo...tivity-in-a-fluctuating-market and precise information can assist expedite the approval procedure. It's likewise beneficial to develop a solid relationship with the lender by interacting openly and quickly replying to any type of requests for added information. Lastly, think about using collateral to protect the financing, which can minimize the loan provider's threat and enhance your approval possibilities. Conclusion Since you understand the various types of bank loan and how to improve your authorization possibilities, you prepare to secure funding for your venture. Bear in mind to keep excellent debt, have a solid company strategy, and construct partnerships with loan providers. By complying with these ideas, you'll be well on your means to obtaining the financial support you require to expand and expand your company. All the best!

Financial Modern Technology And Its Effects On Global Financial Markets: Important Information For Factor To ConsiderВоскресенье, 11 Августа 2024 г. 15:46 (ссылка)

Composed By-Hoover Perez Advancement of Fintech LandscapeCheck out how the fintech landscape has actually swiftly developed in the last few years, reshaping typical financial services. The increase of fintech companies has reinvented the method individuals gain access to and manage their funds. You may have seen the enhancing appeal of mobile settlement applications, robo-advisors, and peer-to-peer borrowing platforms. These advancements have actually made monetary solutions more convenient, effective, and accessible to a larger target market. As a customer, you now have a lot more options than ever before for handling your money. Fintech companies have actually presented brand-new ways to send cash globally, buy stocks, and also obtain car loans without ever entering a bank. https://www.nasdaq.com/articles/mark-cubans-5-best-passive-income-ideas of conducting monetary purchases online or through an app has actually changed the way people communicate with conventional banks. In Recommended Resource site , the fintech market has forced traditional banks to adjust or run the risk of becoming obsolete. Financial institutions are now investing heavily in innovation to boost their solutions and meet the changing needs of customers. This competitors has eventually brought about better products and services for you as a customer. Disruption of Conventional Financial SolutionsThe fintech industry is actively reshaping typical economic systems by challenging well established norms and practices. With the surge of ingenious technologies, typical financial institutions and banks are facing raising stress to adjust to a swiftly changing landscape. Fintech business are presenting brand-new means of conducting financial purchases, handling investments, and supplying accessibility to funding, interrupting the status. One of the key means fintech is interfering with standard financial systems is through the introduction of online systems that supply smooth and effective services, such as peer-to-peer borrowing and digital repayment remedies. cfd, forex and other types of trading supply individuals with greater benefit, lower costs, and enhanced availability compared to traditional banking approaches. Additionally, fintech business are leveraging huge data and expert system to enhance processes like credit rating and risk assessment, enabling faster decision-making and a lot more customized financial solutions. This data-driven strategy is changing the means banks operate, leading to boosted effectiveness and improved client experiences. Global Market Impacts of FintechFintech's effect on worldwide markets is evident with its impact on cross-border purchases and market dynamics. By leveraging innovative modern technologies, fintech companies have revolutionized the way worldwide purchases are performed. Via blockchain and digital payment systems, cross-border transactions have actually become much more efficient, cost-effective, and secure. This has caused boosted international profession and financial investment opportunities, cultivating financial growth on an international range. In addition, fintech has actually played a significant duty in shaping market characteristics by giving cutting-edge solutions for investment, trading, and danger administration. Mathematical trading platforms powered by expert system have improved market liquidity and price exploration. Additionally, crowdfunding and peer-to-peer financing systems have equalized accessibility to funding, permitting organizations worldwide to protect funding more conveniently. Final thought To conclude, fintech has actually reinvented global markets by presenting innovative options that boost effectiveness and availability in monetary solutions. This improvement has actually interfered with traditional financial systems, causing faster decision-making, tailored services, and boosted trade chances. With the continued advancement of fintech, we can anticipate to see further developments in cross-border transactions, democratization of capital access, and the use of huge information and AI to drive market characteristics. Keep notified and welcome the future of finance with fintech.

Understanding CFD Trading: A Comprehensive Guide For BeginnersВоскресенье, 11 Августа 2024 г. 15:46 (ссылка)

Web Content Create By-Lambert Muir What Is CFD Trading?If you're brand-new to trading, comprehending what CFD trading involves is essential for your success in the financial markets. CFD means Contract for Difference, a preferred type of derivative trading that allows you to guess on the price activities of numerous financial instruments without actually possessing the hidden possession. In CFD trading, you enter into an agreement with a broker to exchange the distinction in the cost of a possession from the time the agreement is opened to when it's shut. One of the essential benefits of CFD trading is the ability to utilize your trades. This indicates you can employment opportunity with only a portion of the total profession worth, called margin. While leverage can intensify your profits, it also increases the possible dangers included. It's important to handle your threat carefully and recognize exactly how leverage functions before diving right into CFD trading. Furthermore, CFD trading supplies the adaptability to go long (buy) or brief (sell) on an asset, enabling you to possibly make money from both rising and falling markets. This flexibility makes CFD trading an attractive alternative for traders looking to capitalize on different market problems. How Does CFD Trading Work?Discovering the auto mechanics of CFD trading provides insight right into exactly how traders can speculate on property price activities without owning the underlying assets. When you take part in CFD trading, you essentially participate in an agreement with a broker to trade the difference in the cost of an asset from the moment the agreement is opened to when it's shut. This permits you to profit not only from price increases yet likewise from rate declines. CFDs are leveraged items, implying you just need to deposit a fraction of the overall trade value to open a position. This utilize can enhance your revenues, however it additionally enhances the danger of losses. Additionally, CFDs offer the versatility to trade on a variety of markets, including stocks, indices, commodities, and money. To trade CFDs successfully, it's essential to comprehend how utilize functions, handle your danger successfully, and stay notified regarding market developments that might impact your chosen properties. Tips for CFD Trading SuccessBrowsing the intricacies of CFD trading efficiently needs a critical approach and a strong understanding of key principles. First of https://blogfreely.net/vincenzo75fannie/a-review-o...or-obtaining-financial-support , always carry out comprehensive study prior to opening a setting. Keep notified about the economic markets, economic signs, and the assets you're trading. Second of all, manage your risk properly by setting stop-loss orders to limit potential losses. It's critical to have a risk monitoring strategy in place to safeguard your capital. Furthermore, stay clear of psychological decision-making. Trading based on fear or greed can lead to impulsive activities that might lead to losses. Adhere to your trading plan and stay disciplined. In https://www.businessinsider.com/personal-finance/w...-monthly-passive-income-2021-9 , diversity is key to lowering threat. Spread your investments across various asset classes to lessen potential losses. Routinely review and adjust your trading method to adapt to altering market problems. Lastly, think about using best small business loans and apps accounts to practice trading without risking real money. This can help you acquire experience and test various strategies before trading with actual funds. By following these suggestions, you can boost your possibilities of success in CFD trading. Conclusion Finally, CFD trading uses an one-of-a-kind chance for newbies to benefit from property cost movements without owning the underlying possession. By recognizing just how CFD trading jobs and implementing effective threat administration techniques, you can raise your possibilities of success in the market. Bear in mind to carry out comprehensive research study, remain educated regarding market patterns, and make strategic decisions to maximize your prospective gains while minimizing risks. Best of luck on your CFD trading trip!

Achieve A Competitive Advantage In CFD Trading Throughout Durations Of Market Volatility By Understanding Strategic Methods That Boost Profit Potential And Efficiently Handle UncertaintiesВоскресенье, 11 Августа 2024 г. 15:45 (ссылка)

Published By-Liu Mathiasen Comprehending Volatility and Market FadsTo trade CFDs effectively, you should grasp the subtleties of market volatility and trends. Market volatility describes the degree of variation in trading rates over time. Comprehending this principle is critical because it impacts the potential risks and benefits of your professions. High volatility can bring about significant cost swings, using both chances and threats for CFD traders. By analyzing historical rate motions and economic indicators, you can better predict prospective volatility and adjust your trading approaches as necessary. Furthermore, recognizing top platforms and brokers fads is vital for making notified trading decisions. Trends reflect the general direction in which a possession's cost is moving over time. Identifying whether a possession is experiencing a higher (favorable) or down (bearish) pattern can assist you identify one of the most ideal access and exit factors for your trades. Using technical evaluation devices such as moving standards or pattern lines can help in identifying these patterns and aligning your trading approach to maximize market movements successfully. Leveraging Quit Loss and Take ProfitConsider utilizing quit loss and take profit orders to handle your threat successfully when trading CFDs. These order types are important tools in aiding you safeguard your capital and lock in earnings. A stop loss order establishes a predetermined cost at which your profession will automatically shut if the marketplace relocates versus you. This assists restrict possible losses by exiting the profession before it worsens. On the other hand, a take earnings order allows you to secure your profits by immediately closing the profession once it reaches a given revenue level. By utilizing both quit loss and take earnings orders, you can establish clear risk management specifications for each and every trade, ensuring you don't let emotions determine your activities in an unstable market. When establishing these orders, it's necessary to take into consideration the cost fluctuations and total market conditions. Adjusting your quit loss and take revenue degrees based upon the details qualities of each trade can assist maximize your risk-reward ratio and improve your total trading technique. Diversity and Danger ManagementEffective diversity and threat monitoring are crucial parts in effective CFD trading strategies. Expanding click the up coming website throughout different property courses can assist spread threat and lessen potential losses. Rather than placing all your funds right into one trade, think about assigning them to various CFDs in various markets such as stocks, commodities, or money. By spreading https://writeablog.net/ferdinand97jacinda/cfd-trad...ial-gains-in-a-volatile-market , you can decrease the effect of a single market slump on your total profile. In addition to diversity, executing proper risk management methods is important. Establishing stop-loss orders and take-profit degrees can assist you control your losses and secure your profits. It's necessary to define your risk tolerance and develop a risk-reward proportion for every trade. By adhering to these fixed degrees, you can avoid emotional decision-making and remain disciplined in your trading strategy. Bear in mind that CFD trading entails integral threats, and no method can guarantee profits. Nonetheless, by expanding your financial investments and efficiently handling risks, you can boost your chances of success in browsing the unpredictable CFD market. Final thought On the whole, in a volatile market, using reliable approaches such as quit loss, take revenue orders, and diversity can assist make the most of earnings while managing threats. By remaining informed on market trends and financial indications, traders can make well-informed choices to profit from volatility. Bear in mind to always focus on risk administration and adapt your methods as necessary to browse the unpredictable nature of the market effectively.

Strategies For CFD Trading: Enhancing Your Earnings In A Fluctuating Market EnvironmentВоскресенье, 11 Августа 2024 г. 15:44 (ссылка)

Article Created By-Sellers Cooper Comprehending Volatility and Market FadsTo trade CFDs effectively, you have to understand the subtleties of market volatility and fads. Market volatility describes the degree of variation in trading rates over time. Recognizing this principle is critical because it influences the potential threats and incentives of your professions. cfd, forex and trading apps can bring about considerable cost swings, offering both chances and threats for CFD traders. By analyzing https://www.noradarealestate.com/blog/how-to-make-money-online-for-beginners/ and financial signs, you can better forecast prospective volatility and adjust your trading strategies as necessary. In addition, identifying market fads is necessary for making notified trading decisions. Trends show the basic direction in which an asset's rate is conforming time. Recognizing whether a possession is experiencing an upward (bullish) or down (bearish) pattern can assist you identify the most appropriate entrance and exit factors for your professions. Making use of technological analysis devices such as moving averages or trend lines can help in detecting these fads and straightening your trading technique to profit from market movements efficiently. Leveraging Stop Loss and Take RevenueTake into consideration using quit loss and take earnings orders to handle your risk properly when trading CFDs. These order types are vital tools in assisting you shield your funding and lock in earnings. A quit loss order establishes a predetermined price at which your trade will automatically shut if the marketplace moves against you. This assists restrict potential losses by exiting the trade prior to it aggravates. On the other hand, a take revenue order allows you to protect your profits by automatically shutting the trade once it reaches a specific revenue degree. By utilizing both quit loss and take revenue orders, you can develop clear threat administration parameters for every profession, guaranteeing you don't allow feelings determine your activities in an unpredictable market. When setting https://carman-loreen93edwardo.blogbright.net/comp...u-should-understand-1723281562 , it's important to think about the price fluctuations and general market conditions. Readjusting your stop loss and take revenue degrees based on the specific qualities of each trade can help optimize your risk-reward ratio and improve your total trading method. Diversity and Danger ManagementReliable diversity and danger management are essential parts in effective CFD trading methods. Diversifying your portfolio throughout different possession courses can assist spread out risk and decrease potential losses. As opposed to putting all your funds right into one profession, consider alloting them to numerous CFDs in various markets such as supplies, assets, or currencies. By spreading your investments, you can reduce the effect of a solitary market downturn on your general portfolio. In addition to diversification, implementing correct risk monitoring techniques is vital. Establishing stop-loss orders and take-profit levels can assist you regulate your losses and safeguard your earnings. It's necessary to specify your risk tolerance and establish a risk-reward ratio for each trade. By adhering to these fixed levels, you can avoid psychological decision-making and stay disciplined in your trading method. Bear in mind that CFD trading entails inherent dangers, and no approach can ensure profits. However, by diversifying your financial investments and successfully managing dangers, you can boost your chances of success in navigating the unstable CFD market. Final thought In general, in an unstable market, making use of reliable approaches such as quit loss, take earnings orders, and diversity can aid make the most of profits while managing risks. By remaining informed on market fads and financial indications, traders can make knowledgeable decisions to maximize volatility. Keep in mind to constantly focus on risk management and adjust your methods appropriately to browse the unpredictable nature of the market effectively.

A Thorough Introduction To CFD Trading: A Comprehensive Overview For NovicesВоскресенье, 11 Августа 2024 г. 15:44 (ссылка)

Created By-Vargas Fitch What Is CFD Trading?If you're new to trading, recognizing what CFD trading requires is critical for your success in the financial markets. CFD means Contract for Difference, a preferred form of derivative trading that enables you to speculate on the cost movements of various financial tools without in fact having the hidden property. In CFD trading, you participate in an agreement with a broker to exchange the difference in the price of an asset from the moment the agreement is opened to when it's closed. Among the key advantages of CFD trading is the capacity to take advantage of your trades. This implies you can employment opportunity with only a fraction of the complete trade value, called margin. While take advantage of can enhance your profits, it also increases the possible risks involved. It's necessary to manage your risk thoroughly and understand how take advantage of works before diving into CFD trading. In addition, CFD trading offers the versatility to go long (buy) or short (sell) on an asset, permitting you to possibly benefit from both rising and falling markets. https://www.shopify.com/sg/blog/passive-income makes CFD trading an appealing choice for investors seeking to capitalize on numerous market conditions. How Does CFD Trading Job?Exploring the mechanics of CFD trading gives understanding right into exactly how traders can speculate on possession rate activities without having the underlying properties. When you take part in CFD trading, you essentially participate in a contract with a broker to exchange the difference in the cost of a property from the time the contract is opened to when it's closed. click web page permits you to benefit not only from cost boosts yet also from price reductions. CFDs are leveraged items, meaning you just need to deposit a portion of the complete trade worth to open a setting. This utilize can amplify your profits, however it also raises the threat of losses. In addition, CFDs offer the versatility to trade on a vast array of markets, consisting of supplies, indices, commodities, and currencies. To trade https://postheaven.net/darnell0lakia/a-considerabl...view-for-those-new-to-the-area , it's vital to recognize how leverage functions, handle your risk properly, and remain notified regarding market developments that can influence your chosen assets. Tips for CFD Trading SuccessNavigating the intricacies of CFD trading effectively calls for a tactical method and a solid understanding of crucial concepts. First of all, always perform complete research prior to opening a position. Keep notified concerning the financial markets, economic signs, and the assets you're trading. Secondly, handle your threat efficiently by establishing stop-loss orders to limit potential losses. It's important to have a risk management strategy in place to shield your funding. In addition, avoid psychological decision-making. Trading based upon fear or greed can result in spontaneous actions that may result in losses. Stick to your trading strategy and remain regimented. Moreover, diversity is essential to decreasing danger. Spread your financial investments throughout various property classes to lessen possible losses. On a regular basis review and change your trading method to adjust to transforming market problems. Finally, think about making use of trial accounts to exercise trading without risking genuine money. This can help you acquire experience and test various methods prior to trading with real funds. By following these suggestions, you can improve your possibilities of success in CFD trading. Verdict Finally, CFD trading provides an one-of-a-kind possibility for novices to profit from asset rate activities without having the underlying asset. By recognizing how CFD trading jobs and carrying out effective threat monitoring methods, you can increase your possibilities of success on the market. Bear in mind to conduct detailed study, remain educated about market trends, and make strategic choices to maximize your possible gains while decreasing risks. All the best on your CFD trading journey!

Do You Desire Explore The World Of CFD Trading? Reveal The Crucial Understandings Into Achieving Potential Earnings And Reliable Threat Monitoring Through This Extensive Overview Tailored For BeginnersВоскресенье, 11 Августа 2024 г. 15:41 (ссылка)

Post Composed By- simply click the following website page What Is CFD Trading?If you're brand-new to trading, comprehending what CFD trading entails is critical for your success in the monetary markets. CFD means Contract for Difference, a popular type of acquired trading that enables you to hypothesize on the cost movements of various financial tools without really possessing the hidden property. In CFD trading, you enter into an agreement with a broker to exchange the difference in the rate of an asset from the moment the contract is opened to when it's closed. One of the essential benefits of CFD trading is the capacity to utilize your professions. This implies you can open positions with just a portion of the complete trade worth, known as margin. While cfd, forex and trading brokers can enhance your revenues, it additionally increases the possible dangers involved. It's vital to manage your threat carefully and comprehend exactly how leverage works prior to diving right into CFD trading. Furthermore, CFD trading provides the flexibility to go long (buy) or short (sell) on a property, allowing you to potentially profit from both fluctuating markets. This adaptability makes CFD trading an attractive choice for investors wanting to maximize different market conditions. How Does CFD Trading Job?Discovering the auto mechanics of CFD trading offers insight into exactly how investors can guess on possession price motions without possessing the underlying assets. When you participate in CFD trading, you basically become part of a contract with a broker to trade the difference in the cost of a possession from the moment the contract is opened to when it's closed. This enables you to make money not just from price rises yet additionally from price declines. https://clark.com/make-money/rev-review/ are leveraged products, indicating you just require to transfer a portion of the total profession value to open a placement. This take advantage of can enhance your revenues, however it additionally boosts the risk of losses. In addition, CFDs supply the flexibility to trade on a large range of markets, including supplies, indices, assets, and currencies. To trade CFDs effectively, it's critical to recognize how leverage works, manage your risk effectively, and remain informed about market developments that can affect your selected properties. Tips for CFD Trading SuccessNavigating the intricacies of CFD trading successfully needs a tactical method and a solid understanding of key concepts. First of all, constantly perform thorough research before opening up a placement. Stay informed about the financial markets, economic indications, and the assets you're trading. Second of all, manage your threat successfully by establishing stop-loss orders to restrict possible losses. It's vital to have a danger management technique in place to secure your resources. In addition, prevent emotional decision-making. Trading based upon fear or greed can bring about impulsive activities that might result in losses. Stick to your trading strategy and stay disciplined. Moreover, diversification is key to reducing risk. Spread your financial investments across various asset courses to minimize possible losses. On a regular basis testimonial and change your trading approach to adapt to transforming market problems. Lastly, think about utilizing demonstration accounts to exercise trading without running the risk of actual money. This can help you obtain experience and test different techniques before patronizing genuine funds. By complying with these suggestions, you can improve your possibilities of success in CFD trading. Conclusion To conclude, CFD trading supplies a special possibility for newbies to profit from property rate motions without possessing the hidden property. By understanding how CFD trading jobs and executing efficient risk monitoring strategies, you can raise your chances of success on the market. Bear in mind to conduct complete study, remain notified regarding market fads, and make critical choices to optimize your prospective gains while reducing risks. All the best on your CFD trading journey!

An Introduction Of Local Business Loans: Approaches For Acquiring Financial Support For Your BusinessВоскресенье, 11 Августа 2024 г. 15:40 (ссылка)

Content Author-Carney Dominguez Kinds Of Small Company LoansThere are 5 primary types of bank loan that cater to different financial demands and circumstances. The initial type is a term financing, where you obtain a lump sum of cash that's paid off over a collection duration with a taken care of or variable rates of interest. simply click the following internet site is perfect for lasting financial investments or large acquisitions for your organization. Next off, we have actually a business line of credit scores, which gives you with a revolving credit line that you can draw from as required. https://notes.io/wbLPX 's a flexible option for handling capital changes or covering unforeseen expenditures. Then, there's the SBA funding, assured by the Local business Management, using competitive terms and reduced deposits. It's suitable for businesses trying to find cost effective financing. An additional kind is devices financing, where the tools you're acquiring works as security for the car loan. Finally, we have actually invoice financing, where you obtain bear down impressive billings to enhance capital. Pick the lending type that best straightens with your service objectives and financial demands. Qualifications and Qualification CriteriaTo receive a small business loan, your credit history and financial background play a crucial function in identifying eligibility. Lenders make use of these factors to evaluate your capability to pay off the funding. Normally, a good credit rating, preferably over 680, shows your credit reliability. Your monetary background, including your organization's earnings and profitability, will also be evaluated to guarantee your organization can sustain financing repayments. In addition to credit rating and monetary history, loan providers may take into consideration various other qualification criteria. These may include the length of time your business has actually been operating, its sector, and the objective of the financing. Some lenders may need a minimum annual revenue or capital to receive a loan. Supplying exact and comprehensive economic details concerning your organization will aid lenders examine your qualification better. It's necessary to assess the certain credentials and eligibility criteria of different lenders prior to requesting a bank loan. Understanding these requirements can help you prepare a solid funding application and enhance your possibilities of safeguarding the funding your endeavor requires. Tips to Improve Funding Approval PossibilitiesTo enhance your possibilities of protecting approval for a small business loan, consider carrying out approaches that can strengthen your lending application. Beginning by guaranteeing your business and individual credit rating are in great standing. Lenders typically use credit history to evaluate your credit reliability and establish the lending terms. In addition, prepare a thorough company plan that outlines your firm's mission, target audience, monetary forecasts, and exactly how you intend to make use of the loan funds. A well-balanced organization plan demonstrates to loan providers that you have a clear strategy for success. Moreover, gather all needed paperwork, such as tax returns, economic declarations, and legal papers, to support your car loan application. Supplying total and precise information can assist expedite the authorization process. It's additionally beneficial to build a strong connection with the loan provider by communicating honestly and immediately responding to any ask for additional information. Lastly, take into consideration providing collateral to protect the funding, which can alleviate the loan provider's threat and improve your approval opportunities. apps to help with investments that you understand the different kinds of bank loan and how to enhance your authorization possibilities, you prepare to secure financing for your venture. Keep in mind to maintain great credit rating, have a strong business strategy, and build partnerships with lenders. By complying with these suggestions, you'll be well on your method to obtaining the financial support you require to grow and increase your service. All the best!

Financial Modern Technology And Its Effects On Global Financial Markets: Important Info For Factor To ConsiderВоскресенье, 11 Августа 2024 г. 15:39 (ссылка)