Добавить любой RSS - источник (включая журнал LiveJournal) в свою ленту друзей вы можете на странице синдикации.

Исходная информация - http://instaforex.livejournal.com/.

Данный дневник сформирован из открытого RSS-источника по адресу http://instaforex.livejournal.com/data/rss/, и дополняется в соответствии с дополнением данного источника. Он может не соответствовать содержимому оригинальной страницы. Трансляция создана автоматически по запросу читателей этой RSS ленты.

По всем вопросам о работе данного сервиса обращаться со страницы контактной информации.

[Обновить трансляцию]

RUB stuck at historic lows amid havoc in oil market |

In April, the Russian ruble deserves applause for its faint attempts to regain footing. Apart from the COVID-19 pandemic, Russia’s authorities are to blame for the crater in the oil market which sent the ruble into a tailspin. Having hit historic lows, the Russian currency has been creeping upward. An 8-day fragile climb does not mean that the ruble has won back most of its earlier losses. However, the pro-Kremlin media presented this as the ruble’s remarkable resilience amid global market jitters. In fact, the new long-awaited OPEC+ deal on oil production cuts failed to prop up oil prices contrary to market expectations. Both Russian and foreign analysts warn of bleak prospects for the ruble’s recovery. Being vulnerable to the state of affairs in the oil market, the ruble will be able to gain momentum on condition that oil prices rebound at least to $45 – 50 per barrel which might happen only in the medium term. Nowadays, a sharp contraction in global energy demand amid the coronavirus pandemic has generated a glut in the oil market. As most countries are carrying on with lockdown measures, energy demand is set to remain low. Experts at Goldman Sachs predict that Brent crude will pull back to $20 per barrel. To make things worse, Saudi Arabia is not going to terminate the oil price war with Russia. Recently, Riyadh made big discounts on May contracts for its key markets. Against this background, the ruble has got stuck firmly at multi-year lows.

Read more: https://www.mt5.com/forex_humor/image/49060

|

Метки: #forex_caricature |

6 alternative indexes to estimate economic welfare |

As a rule, many people consider the world economy a sophisticated and brain-cracking subject that is full of complex calculations and pyramids of letter equations. However, as it turns out it is not so black as it is painted. The economy even has a sense of humor when it comes to economic indexes that reflect the standard of living. Apart from the well-known indexes, e.g. the Big Mac Index, there are many others that may surprise you and even make you laugh. Read about alternative economic indexes in our article

Latte index

Some people cannot imagine their life without a cup of aromatic coffee. This beverage is recognized as one of the most popular in the world. For this reason, Starbucks, the famous coffee chain, proposed to measure the level of well-being and solvency of the population using the Latte index – the most popular coffee drink.

Borscht index

This is the most famous alternative index in Ukraine. This index with a funny name has become widely known outside the country. The cost of borscht is calculated by the price of the following ingredients: 300 g of pork, 500 g of potatoes, 500 g of beets, 200 g of carrots, 300 g of cabbage, 200 g of onions, 90 g of tomato paste, 30 g of sunflower oil, and 200 g of sour cream. These ingredients will be enough for 5 liters of soup. The cost of all ingredients is summed up and the total amount of money spent on cooking borscht is obtained. Hence, this index measures the cost of food year-on-year.

Khachapuri index

In Georgia, economists measure the well-being of citizens by using the most popular Georgian food, the Khachapuri. They call it the Khachapuri index. The Khachapuri index requires the ingredients that are needed to cook one khachapuri: 250 g of flour, 100 g of cheese, 50 g of yeast, 75 ml of milk, 1 egg, and butter (vegetable and cream), sugar, and salt. The use of gas and electricity is also included in the price. In 2019, the Khachapuri index reached a historic high due to a 12% fall in the exchange rate of the lari (the currency of Georgia) and an increase in food prices.

Bad Habits index

Deutsche Bank quite often creates one of the funniest indexes that offer a non-standard approach to measuring the population welfare. It regularly publishes original and try-not-to-laugh indexes such as the Dating index, the Cappuccino index, the Car rental index, etc. However, most often experts at Deutsche Bank use the Bad Habits index that includes a set of five bottles of beer and two packs of cigarettes.

iPhone index

Experts at the Commonwealth Bank of Australia came up with their own formula for measuring the welfare of citizens. They created a new iPod index based on the iPod Nano 2Gb model. However, by now, this indicator is outdated, and the creators of the index have replaced the iPod with the iPhone index.

Olivier Salad index

Despite its French name, this index is widely used in Russia. Experts took the combined cost of the salad ingredients such as 500 g of canned cucumbers, 380 g of peas, 500 g of potatoes, 200 g of carrots, 4 eggs, 300 g of cooked sausage, 100 g of onions, and 200 g of mayonnaise to measure the inflation. Usually, this index comes in handy when the New Year is around the corner as Olivier salad is a must-have on the Russian New Year table.

|

Метки: #photo_news |

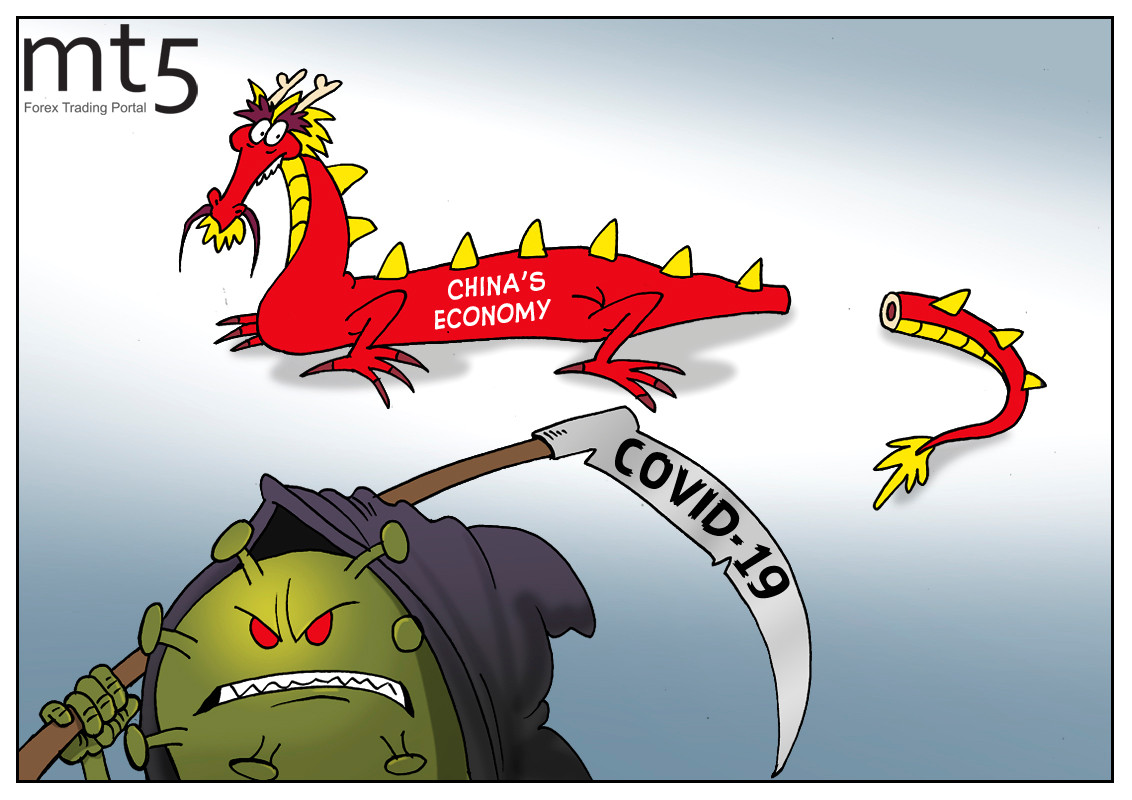

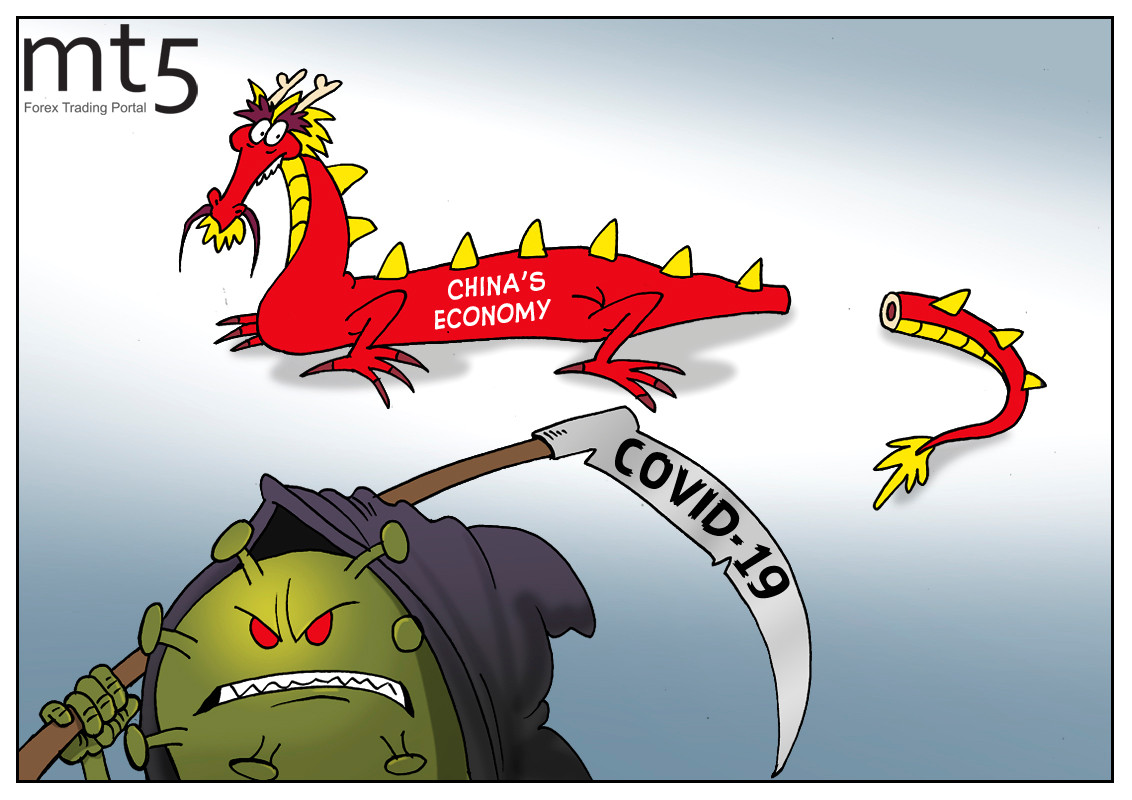

COVID-19 exposes flaws in China’s political system |

The Chinese economy has slowed down abruptly as a result of a trade war with the United States. Meanwhile, the coronavirus has completely destroyed the economic growth. It is a well-known fact that China’s authorities tend to downplay economic problems. According to official data, the country’s economy shrank for the first time in 30 years. Thus, Chinese GDP declined by 6.8% year-on-year in the first quarter of 2020 compared to the last three months of 2019. This has been the first contraction of the economy since 1992 and the worst statistics in 40 years. Against this background, the Chinese authorities are likely to revise the protectionist stance on trade and the political course. For the last couple of years, socialist China has actively promoted its political system sparking a considerable interest among several Asian countries. However, Beijing has confronted a serious problem in the face of the coronavirus which is beyond the Communist Party’s control. At the beginning of the pandemic, when it was possible to prevent the spread of the infection across the world, the Chinese government decided to keep silence about the actual scale of the disaster. As a result, COVID-19 is sweeping through the rest of the world while China’s planned economy which, by the way, has proved to be inefficient several times is on the brink of collapse.

|

Метки: #forex_caricature |

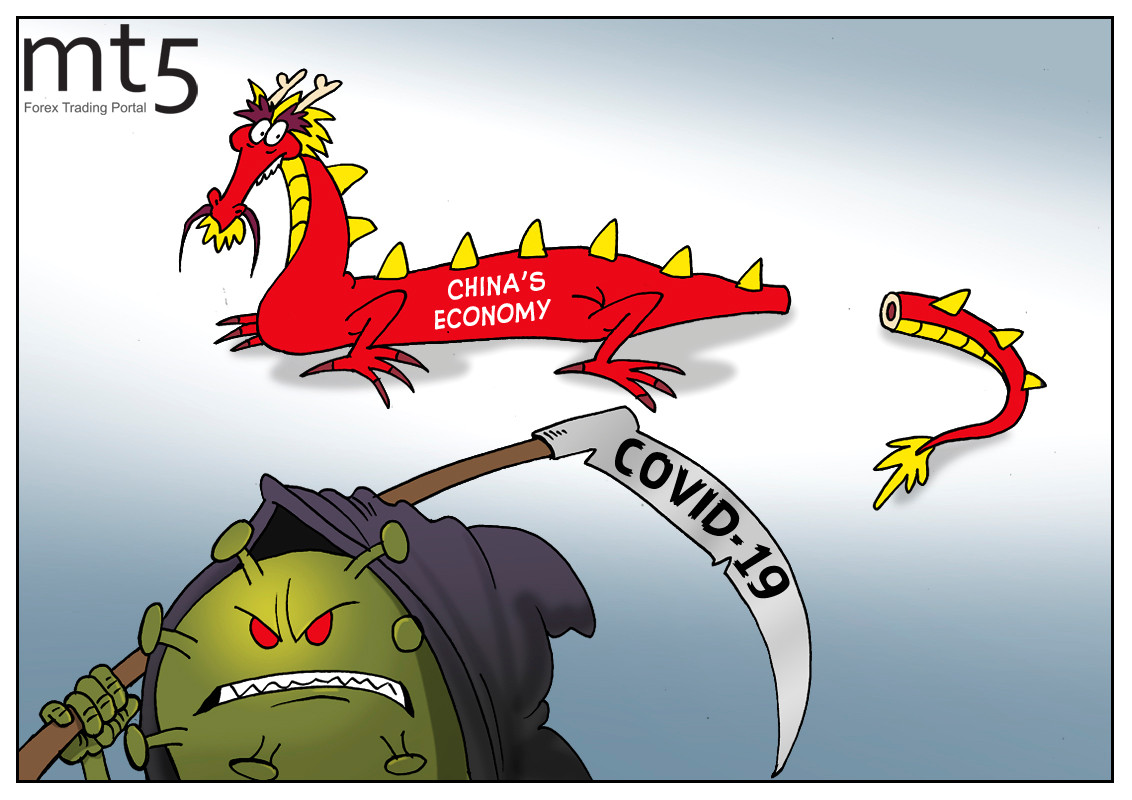

COVID-19 exposes flaws in China’s political system |

The Chinese economy has slowed down abruptly as a result of a trade war with the United States. Meanwhile, the coronavirus has completely destroyed the economic growth. It is a well-known fact that China’s authorities tend to downplay economic problems. According to official data, the country’s economy shrank for the first time in 30 years. Thus, Chinese GDP declined by 6.8% year-on-year in the first quarter of 2020 compared to the last three months of 2019. This has been the first contraction of the economy since 1992 and the worst statistics in 40 years. Against this background, the Chinese authorities are likely to revise the protectionist stance on trade and the political course. For the last couple of years, socialist China has actively promoted its political system sparking a considerable interest among several Asian countries. However, Beijing has confronted a serious problem in the face of the coronavirus which is beyond the Communist Party’s control. At the beginning of the pandemic, when it was possible to prevent the spread of the infection across the world, the Chinese government decided to keep silence about the actual scale of the disaster. As a result, COVID-19 is sweeping through the rest of the world while China’s planned economy which, by the way, has proved to be inefficient several times is on the brink of collapse.

|

Метки: #forex_caricature |

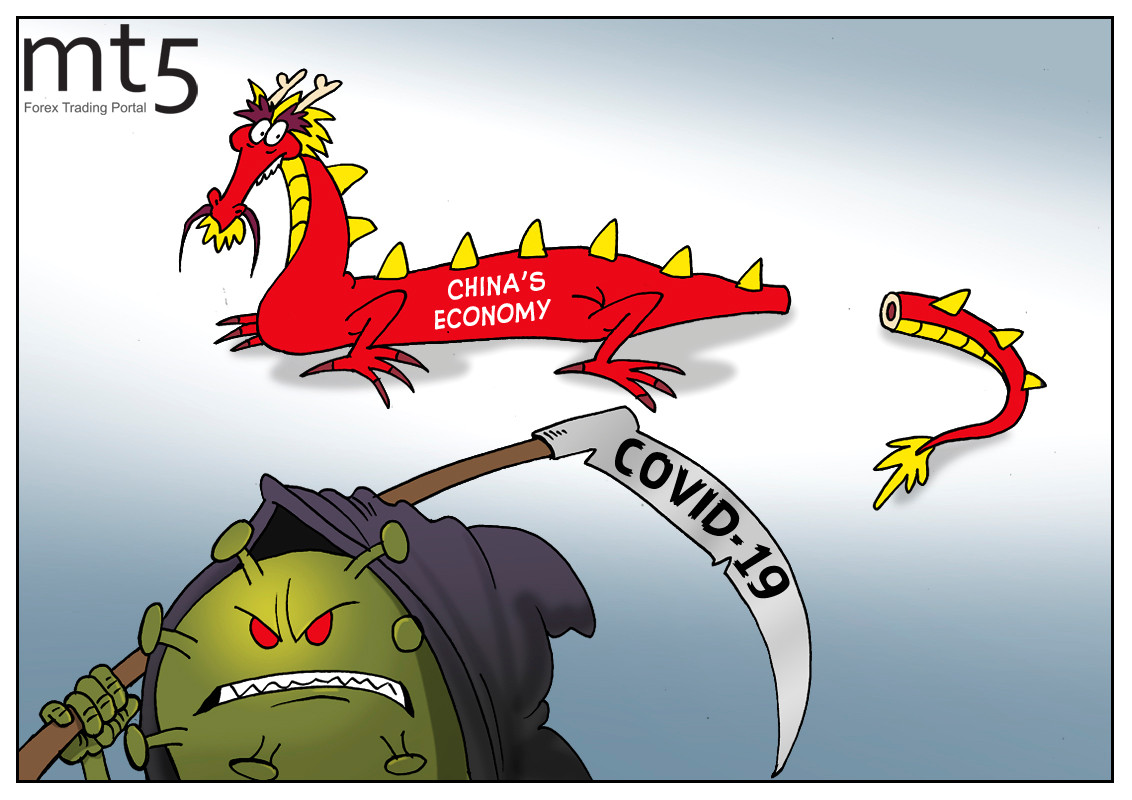

COVID-19 exposes flaws in China’s political system |

The Chinese economy has slowed down abruptly as a result of a trade war with the United States. Meanwhile, the coronavirus has completely destroyed the economic growth. It is a well-known fact that China’s authorities tend to downplay economic problems. According to official data, the country’s economy shrank for the first time in 30 years. Thus, Chinese GDP declined by 6.8% year-on-year in the first quarter of 2020 compared to the last three months of 2019. This has been the first contraction of the economy since 1992 and the worst statistics in 40 years. Against this background, the Chinese authorities are likely to revise the protectionist stance on trade and the political course. For the last couple of years, socialist China has actively promoted its political system sparking a considerable interest among several Asian countries. However, Beijing has confronted a serious problem in the face of the coronavirus which is beyond the Communist Party’s control. At the beginning of the pandemic, when it was possible to prevent the spread of the infection across the world, the Chinese government decided to keep silence about the actual scale of the disaster. As a result, COVID-19 is sweeping through the rest of the world while China’s planned economy which, by the way, has proved to be inefficient several times is on the brink of collapse.

|

Метки: #forex_caricature |

COVID-19 exposes flaws in China’s political system |

The Chinese economy has slowed down abruptly as a result of a trade war with the United States. Meanwhile, the coronavirus has completely destroyed the economic growth. It is a well-known fact that China’s authorities tend to downplay economic problems. According to official data, the country’s economy shrank for the first time in 30 years. Thus, Chinese GDP declined by 6.8% year-on-year in the first quarter of 2020 compared to the last three months of 2019. This has been the first contraction of the economy since 1992 and the worst statistics in 40 years. Against this background, the Chinese authorities are likely to revise the protectionist stance on trade and the political course. For the last couple of years, socialist China has actively promoted its political system sparking a considerable interest among several Asian countries. However, Beijing has confronted a serious problem in the face of the coronavirus which is beyond the Communist Party’s control. At the beginning of the pandemic, when it was possible to prevent the spread of the infection across the world, the Chinese government decided to keep silence about the actual scale of the disaster. As a result, COVID-19 is sweeping through the rest of the world while China’s planned economy which, by the way, has proved to be inefficient several times is on the brink of collapse.

|

Метки: #forex_caricature |

4 medical innovations to expect in next 50 years |

Nowadays, medicine is rapidly developing, and specialists are looking for innovative ways to combat various diseases. The past century has seen many unique discoveries in this field: humanity has eradicated smallpox and has mastered organ transplantation.

There is still a long way ahead for the scientists to achieve new medical breakthroughs. The latest technologies in medicine make it possible to save thousands of lives daily. In our photo gallery, read about 4 medical advances to look forward to in the next 50 years.

Saving premature babies

According to statistics, only 10% of infants in the US are born premature. By contrast in Russia, the number of preterm delivery and newborn mortality is much higher. Medical specialists around the world are working on the solution to tackle this problem and improve the sad statistics.

In 2017, scientists from the Children's Hospital of Philadelphia created an artificial womb to support the development of early born lambs. As the research results showed, the fetus located inside the artificial uterus for 4 weeks displayed positive changes. In the future, these technologies can be applied to premature babies.

Reducing the shortage of donor organs

Currently, there is an acute shortage of donor organs all over the world which is also a reason for increased mortality. To solve this problem, scientists are trying to grow human organs within the pig’s embryos. These animals have organs similar to humans in size and shape. Besides, pig’s organs develop faster than the human ones. At the same time, it is very difficult for cells of one species to take root in another species organism.

In 2016, scientists managed to grow human stem cells inside a pig embryo. This achievement became a real breakthrough in medicine.

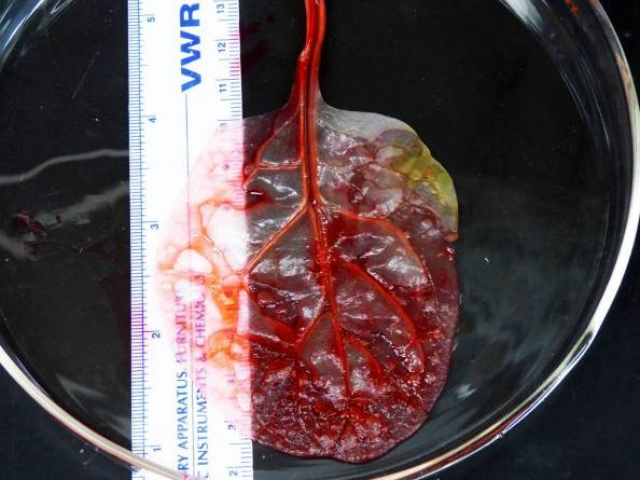

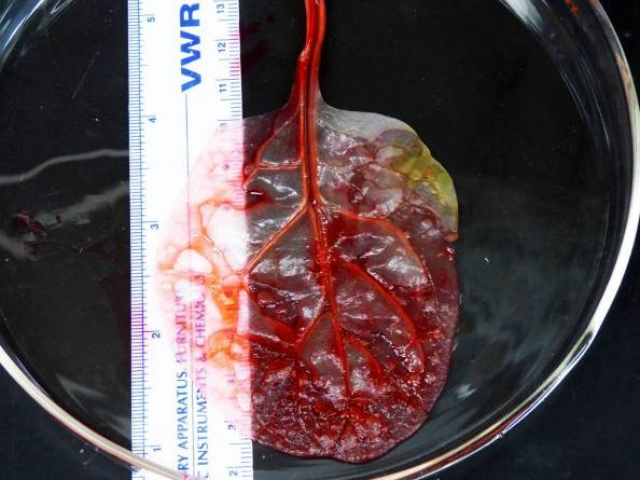

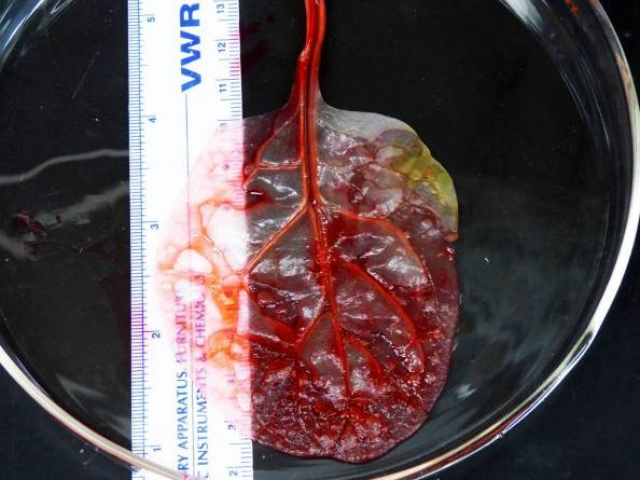

Repairing damaged organs with plants

Recently, scientists from Worcester Polytechnic Institute (WPI) in Massachusetts made a breakthrough step in modern medicine. A team of specialists managed to grow blood vessels from spinach leaves that were able to transport water. After that, the plant cells were replaced with muscle cells from the human heart. In this way, it enabled the plant veins to pump water as they would do it in the real heart.

This discovery gives hope that in the nearest future it will be possible to treat damaged organs with plants, from spinach to broccoli, instead of transplanting them.

Regeneration

Regeneration of the living tissue is another ambitious goal of modern medicine. Every year, 185 thousand amputations are carried out in the United States. The field of prosthetics is rapidly developing now which allows people to use nano-technological prostheses that fully replace the lost limb.

However, scientists want to take a step further. In particular, they have paid special attention to animals, such as axolotl, with the ability to regenerate new parts of their body, including limbs, lungs, and even eyes. Scientists have already identified the genes responsible for regeneration ability in these animals. Perhaps, one day it will be possible to create a medicine that stimulates tissue growth in humans.

|

Метки: #photo_news |

4 medical innovations to expect in next 50 years |

Nowadays, medicine is rapidly developing, and specialists are looking for innovative ways to combat various diseases. The past century has seen many unique discoveries in this field: humanity has eradicated smallpox and has mastered organ transplantation.

There is still a long way ahead for the scientists to achieve new medical breakthroughs. The latest technologies in medicine make it possible to save thousands of lives daily. In our photo gallery, read about 4 medical advances to look forward to in the next 50 years.

Saving premature babies

According to statistics, only 10% of infants in the US are born premature. By contrast in Russia, the number of preterm delivery and newborn mortality is much higher. Medical specialists around the world are working on the solution to tackle this problem and improve the sad statistics.

In 2017, scientists from the Children's Hospital of Philadelphia created an artificial womb to support the development of early born lambs. As the research results showed, the fetus located inside the artificial uterus for 4 weeks displayed positive changes. In the future, these technologies can be applied to premature babies.

Reducing the shortage of donor organs

Currently, there is an acute shortage of donor organs all over the world which is also a reason for increased mortality. To solve this problem, scientists are trying to grow human organs within the pig’s embryos. These animals have organs similar to humans in size and shape. Besides, pig’s organs develop faster than the human ones. At the same time, it is very difficult for cells of one species to take root in another species organism.

In 2016, scientists managed to grow human stem cells inside a pig embryo. This achievement became a real breakthrough in medicine.

Repairing damaged organs with plants

Recently, scientists from Worcester Polytechnic Institute (WPI) in Massachusetts made a breakthrough step in modern medicine. A team of specialists managed to grow blood vessels from spinach leaves that were able to transport water. After that, the plant cells were replaced with muscle cells from the human heart. In this way, it enabled the plant veins to pump water as they would do it in the real heart.

This discovery gives hope that in the nearest future it will be possible to treat damaged organs with plants, from spinach to broccoli, instead of transplanting them.

Regeneration

Regeneration of the living tissue is another ambitious goal of modern medicine. Every year, 185 thousand amputations are carried out in the United States. The field of prosthetics is rapidly developing now which allows people to use nano-technological prostheses that fully replace the lost limb.

However, scientists want to take a step further. In particular, they have paid special attention to animals, such as axolotl, with the ability to regenerate new parts of their body, including limbs, lungs, and even eyes. Scientists have already identified the genes responsible for regeneration ability in these animals. Perhaps, one day it will be possible to create a medicine that stimulates tissue growth in humans.

|

Метки: #photo_news |

4 medical innovations to expect in next 50 years |

Nowadays, medicine is rapidly developing, and specialists are looking for innovative ways to combat various diseases. The past century has seen many unique discoveries in this field: humanity has eradicated smallpox and has mastered organ transplantation.

There is still a long way ahead for the scientists to achieve new medical breakthroughs. The latest technologies in medicine make it possible to save thousands of lives daily. In our photo gallery, read about 4 medical advances to look forward to in the next 50 years.

Saving premature babies

According to statistics, only 10% of infants in the US are born premature. By contrast in Russia, the number of preterm delivery and newborn mortality is much higher. Medical specialists around the world are working on the solution to tackle this problem and improve the sad statistics.

In 2017, scientists from the Children's Hospital of Philadelphia created an artificial womb to support the development of early born lambs. As the research results showed, the fetus located inside the artificial uterus for 4 weeks displayed positive changes. In the future, these technologies can be applied to premature babies.

Reducing the shortage of donor organs

Currently, there is an acute shortage of donor organs all over the world which is also a reason for increased mortality. To solve this problem, scientists are trying to grow human organs within the pig’s embryos. These animals have organs similar to humans in size and shape. Besides, pig’s organs develop faster than the human ones. At the same time, it is very difficult for cells of one species to take root in another species organism.

In 2016, scientists managed to grow human stem cells inside a pig embryo. This achievement became a real breakthrough in medicine.

Repairing damaged organs with plants

Recently, scientists from Worcester Polytechnic Institute (WPI) in Massachusetts made a breakthrough step in modern medicine. A team of specialists managed to grow blood vessels from spinach leaves that were able to transport water. After that, the plant cells were replaced with muscle cells from the human heart. In this way, it enabled the plant veins to pump water as they would do it in the real heart.

This discovery gives hope that in the nearest future it will be possible to treat damaged organs with plants, from spinach to broccoli, instead of transplanting them.

Regeneration

Regeneration of the living tissue is another ambitious goal of modern medicine. Every year, 185 thousand amputations are carried out in the United States. The field of prosthetics is rapidly developing now which allows people to use nano-technological prostheses that fully replace the lost limb.

However, scientists want to take a step further. In particular, they have paid special attention to animals, such as axolotl, with the ability to regenerate new parts of their body, including limbs, lungs, and even eyes. Scientists have already identified the genes responsible for regeneration ability in these animals. Perhaps, one day it will be possible to create a medicine that stimulates tissue growth in humans.

|

Метки: #photo_news |

How to shop cheaper online |

If you are not satisfied with the price of a product or service, do not refuse from the purchase immediately. Knowing a few simple tricks, you can get your product much cheaper. In our review, check out 5 life hacks to reduce your spendings online.

High competition in e-commerce forces sellers to keep regular customers by any means and to attract new ones with promotions, bonuses, and special offers. Today we give you a couple of life hacks about how to get a product or service online at a better price.

1. Do not rush to buy

First, make sure you do not buy the product immediately - other online shops may sell it cheaper or offer more favourable delivery conditions.

Use the service for comparing prices, such is Yandex Market, for example, which allows you to find several offers in different stores. After that, go to the seller’s website to find out where the terms of delivery of goods are more favorable.

Some sellers do not have their own registered shops but place their offers on Avito website. In this case, you face some risks as these shops do not provide any warranty services and the possibility of a refund if you do not like the purchase.

If the product you are looking for does not have a specific name, for example, it is clothing or dishes, use the picture search. To do this, save the image, and then use the appropriate option in the search engine to find similar offers in other online stores.

2. Re-visit the site

Start filling out a registration form to make a purchase or just add your item to the basket, but instead of paying, close the page.

Perhaps you will receive the following message in your mail: "If the goods seemed too expensive, we will give you a special discount of ...".

Similar algorithms are prescribed in some online stores in order to keep a customer who changed his mind to make a purchase at the last moment.

3. Pretend to be a foreigner

The practice of dynamic pricing in e-commerce depending on the customer’s country is often used on sites for buying airline tickets and making hotel reservations. It is also found in online stores, for example, Amazon.com.

This means that the price will depend on the place of the Internet connection - your IP address.

Use VPN services to check how the price changes in different “places” of the connection. Sometimes the price difference can be rather significant because in different countries the balance of supply and demand for the same product or service may vary.

4. It is my first time here

Some online retailers carry out special promotions to attract new customers, so they give a significant discount for the first purchase in their store.

In addition, sellers give special bonuses for subscribing or reposting on social networks, as well as subscribing to mailing or newsletters.

There are often bonuses for installing a mobile application, and sometimes prices in mobile applications can be lower than on the website.

5. Use aggregator sites

There are many aggregator sites on the Internet that collect discounts, promotions, promotional codes, and special offers in one place.

Some popular resources: Bykers, SkidkaOnline, Cupongid, Promo code, etc. They often post information about discounts, which are not mentioned on official websites.

Some discounts may reach up to 30% or more.

|

Метки: #photo_news |

Eurozone to experience deeper recession than rest of the world |

The eurozone is preparing for the worst and does not exclude the possibility of a deeper recession amid the coronavirus pandemic. Given the extent of the ongoing Covid-19 epidemic, the euro area will most likely face greater economic problems compared to other countries. At the moment, it is difficult to predict the future course of events. Everything will depend on how long the quarantine restrictions are going to last. In case of a drawn-out battle against the coronavirus, the economic consequences for the eurozone may be devastating. According to Luis de Guindos, the Vice President of the European Central Bank, in the most likely scenario, the economic activity in the euro area can show some signs of growth in the third quarter of 2020. However, a genuine recovery in the economy is expected only in 2021. In any case, 2021 will not be able to make up for all of the downturn in 2020. Even with an unprecedented 1 trillion euros stimulus package announced by the regulator, the eurozone has little chance of a quick economic recovery. Apart from that, the economy may require additional monetary injections even after the pandemic is past its peak. Taking into account all these measures, Europe is better equipped to respond to this unprecedented crisis, says Luis de Guindos. The eurozone member countries are likely to experience a more severe recession which will have a huge impact on their public finances. Against this background, the additional government spending is expected to be as high as 1-1.5 trillion euros, an amount the eurozone has probably never seen before.

Read more: https://www.mt5.com/forex_humor/image/48889

|

Метки: #forex_caricature |

Hyperinflation records in history |

Venezuela's Parliament estimated that consumer inflation came in at a whopping 1,698,488% in 2018. The government headed by Nikolas Maduro, who was re-elected for a second 6-year term in early 2019, has not posted any official statistics since 2015. High inflation rates have been recorded in the country since 2014, but the ailing economy has been in grip of the galloping inflation since 2016.

Hyperinflation is the case when inflation jumps 50% and over on month. So, on a daily basis inflation in Venezuela was slightly above 1% in 2018. In fact, prices grew much faster as in the early 2018, inflation was estimated at a few hundred percent on a yearly basis. Amid hyperinflation, shop assistants did not attach price tags at grocery stores because prices could rise significantly within the day. Thus, people and firms found a solution to use eggs as a means of payment. As eggs contain a lot of protein, they are considered a valuable product.

Read about six cases of appalling hyperinflation in our photo gallery. Unlike Venezuela where hyperinflation is assessed in annual terms, inflation rates in other countries are estimated on a monthly basis.

China, 1949, daily inflation of 14%

Hyperinflation struck China in 1947. It reached its peak in 1949 when consumer prices were soaring 5,070% per pay. Hyperinflation flared up during the civil war. China’s national party, Guomindang, decided to print more banknotes to ensure government spending during the military conflict with the Communist Party.

As a result, consumer prices doubled every 3-5 days. Prices of basic consumer goods and food skyrocketed by a hundred thousand times. Printed notes had no more value than waste paper. People were forced to use rice as a means of payment. After China had introduced the yuan, inflation rates were gradually stalling ahead of 1955.

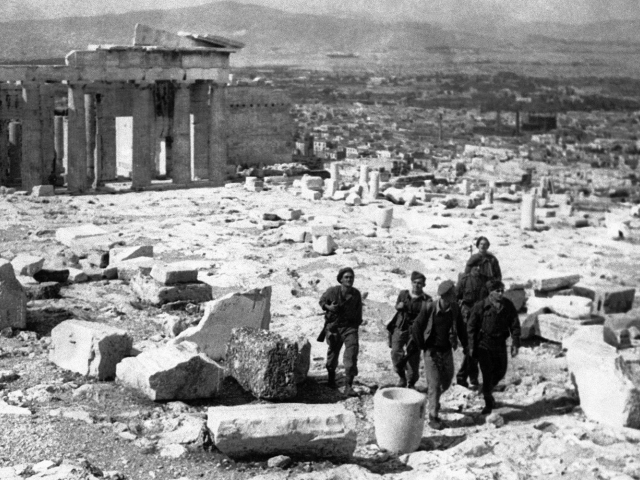

Greece, 1944, daily inflation of 18%

Greece’s economy was devastated by the Nazi’s occupation during World War II.As a result, the collapse in the agriculture entailed serious food shortages. Besides, a relief of tax burden was also to blame for high inflation. Even though it was not as galloping as inflation in post-war Hungary or Germany, Greece needed a longer time to tame it and achieve some stability in the ailing economy.

The Greeks found a solution to spend drahmas within 4 hours. Before, the natives used to keep a drahma banknote for up to 40 days. According to the hyperinflation chart composed by Steve Hanke and Nicholas Krus, consumer prices doubled every 4.3 days. The highest rate on month, recorded in October 1944, was estimated at 13,800%.

Germany, 1923, daily inflation of 21%

This is the most odious case in history. Following World War I, Germany’s economy was crippled by an enormous public debt and reparations. The government decided to print Deutsche Mark notes aiming to buy the reserved currency and to repay its debts. The national currency was losing in value at the same pace as the central bank printed more and more Deutsche Mark bills. Consumer prices doubled every 3.7 days. Inflation reached its peak in October 1923 that was 29,500% month-on-month.

A loaf of bread had a price tag of 250 Deutsche Marks in January 1923, but the price skyrocketed to 200 billion Deutsche Marks in November. Banknotes were burnt instead of fuel or logs to heat furnaces and were used instead of wallpaper. People were paid so huge packs of notes which did not fit into a suitcase. The Germans rushed to spend their wages on the day of their receipt as this money would lose virtually all of its value next day.

The BBC cited someone’s memoirs that once this person left his suitcase stuffed with wages unattended. Later, the man found out that the suitcase had been stolen, but the money had been left. Another man went to Berlin to buy a pair of new shoes. However, on his arrival that money was enough to buy a cup of coffee and a return ticket by bus. In late 1923, the government introduced annuity bonds which were backed by agricultural resources. This move propped up consumer prices. Besides, Germany’s lenders agreed to restructure wartime payments.

Yugoslavia, 1994, daily inflation of 65%

By 1992, Yugoslavia consisted only of Serbia and Montenegro remained in after other countries had withdrawn from it. The state treasury was depleted by armed conflicts and the collapse in the domestic market. So, the government set about printing banknotes. Erratic public spending, corruption, and the UN sanctions slapped in 1992/93 triggered hyperinflation. Its peak was recorded in January 1994 – 313,000,000%.

Prices were swelling every 34 hours. The nationals of the Balkan country had to spend money as soon as they were paid wages. Some people went to Hungary to buy basic goods. The inflation problem was worsened by maladministration which disabled the work of all public institutions. As a result, people failed to pay utility bills in a due time as the amount stated there lost its value in a flash.

Pushing ahead with the idea of terminating sanctions, Serbia’s leader Slobodan Milosevic adopted a new currency, the new dinar, secured by the gold and forex reserves.

Zimbabwe, 2008, daily inflation of 98%

After Zimbabwe had gained independence in 1980, the new national currency valued at nearly $1.25 was introduced. In early 2000-ies, President Robert Mugabe launched the land reform which in fact was the redistribution of land by compulsory seizure of the farmland belonging to ethnic Europeans in favor of the Zimbabwean folks. Actually, the authorities wrecked prosperous farms. Besides, the domestic economy suffered the US and EU sanctions imposed in 2002.

In 2007, landlords had to charge the rent by groceries. A room rent was paid as follows: 10 kilos of corn flour, 2 kilos of baking flour, 4 liters of oil, 10 packs of toilet paper, and 2 kilos of sugar. In 2008, a bunch of 10 bananas cost 10 billion Zimbabwean dollars. Banknotes were virtually worthless, so they were used as bookmarks or stickers.

In November 2008, inflation came in at 79 billion percent. Prices grew twice every 25 hours. A loaf of bread in the capital city cost 200 billion Zimbabwean dollars. In the same year, the authorities shifted to US dollars to stamp out rampant inflation.

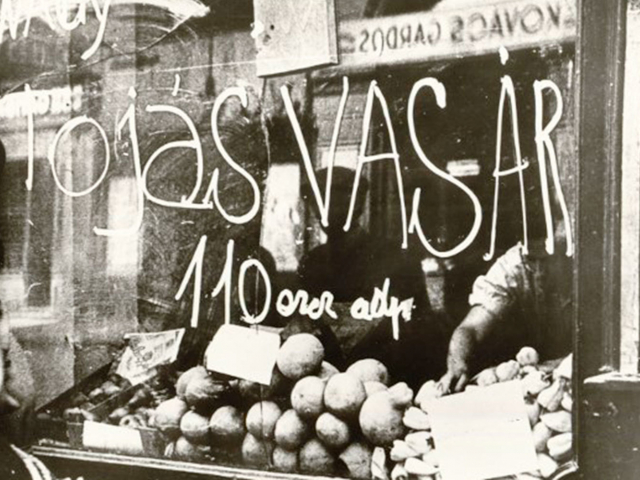

Hungary, 1946, daily inflation of 207%

The worst case of hyperinflation was recorded in Hungary. In 1927, the government launched a new currency unit, the peng"o, to revive the national economy after World War I and tame inflation. The Great Depression devastated Hungary’s economy. The swelling public debt forced the central bank to devalue the national currency in an effort to cover public spending.

By the start of World War II, the domestic economy was in dire straits. The central bank gave in to the government which ordered to print bank bills without any limits.

Hyperinflation reached appalling rates as prices spiked twice every 15 hours. In July 1946, the inflation was 41.9 quadrillion percent! The authorities came up with the only solution. They introduced a new currency – the forint.

When this happened in August 1946, the total amount of all Hungarian banknotes in circulation equaled 0.001 of the US dollar.

|

Метки: #photo_news |

RUB to recover on condition of uptrend in oil market |

The Russian ruble has been plumbing new depths amid a nosedive of oil quotes. Nevertheless, one of the weakest currencies arouses some interest among foreign investors. It is the common practice on Forex to buy an asset at its extreme lows, betting on its further increase. Strike while the iron is hot. The Bank of Russia was the first to grasp this opportunity. In April, the regulator set about selling big volumes of foreign currency within the framework of forex interventions. At present, some foreign speculators are planning to profit from the collapse of the Russian ruble. “It's the best time to buy emerging markets in over 20 years,” Charles Robertson, the chief economist at Renaissance Capital, said in an interview. “This is the cheapest opportunity since the last time everyone hated EM after the Asian crisis and Russian default.” The EM currencies’ rates are very low nowadays, thus offering lucrative investment opportunities. Charles Robertson advises traders to consider investment in the South African rand, Mexican peso, and Brazilian real. These currencies have been the worst hit this year. However, they have better prospects for recovery than the Russian ruble. The expert from London is cautious about the ruble which could come under the spotlight in the medium term on condition that oil prices will rebound at least up to $45 – 50 per barrel. To sum up, sell-offs of EM currencies will end soon because the IMF and the World Bank want to shore up a lot of ailing developing countries. Besides, the US President advocates for a cheaper dollar. For these reasons, it makes sense to include EM currencies in a portfolio.

Read more: https://www.mt5.com/forex_humor/image/48843

|

Метки: #forex_caricature |

Holy Fire Easter ceremony in Jerusalem: seven curious facts |

Easter is a movable holiday. This year, Catholics celebrate Easter on April 12, while the Orthodox Сhurch on April 19. On this day, Christians pay special attention to their spiritual values as they mark the resurrection of Jesus Christ from the tomb on the third day after his crucifixion. Orthodox Christians consider the Holy Fire a miracle that occurs every year at the Church of the Holy Sepulchre. Every Christian is allowed to touch the flames as the Holy Fire supposedly does not burn the flesh. Find out seven other peculiar facts about the ceremony in this article

Holy Fire occurs every Easter Saturday

The descent of the Holy Fire every Holy Saturday is the miraculous event that takes place each year on the eve of Orthodox Easter. In 2020, it will be held on April 18 since Resurrection Sunday will take place on April 19.

It takes roots in early Christianity

This time-honored tradition dates back to the beginning of Christianity. The descent of the Holy Fire is first mentioned in the 4th century AD. Curiously enough, the Holy Fire may appear within five minutes but sometimes Christians await it around several hours. Before the descent of the Holy Fire, the Church of the Holy Sepulchre is illuminated by flashes of light.

Church of Holy Sepulchre opens gate to thousands of people

The Church of the Holy Sepulchre where the Holy Fire ceremony takes place is very spacious. It is able to accommodate 10 thousand believers. What is more, the church symbolizes the unity of various branches of Christianity as five Orthodox churches - Armenian, Greek, Coptic, Syrian, and Ethiopian- hold services there. Catholic masses also occur in the church. The keepers of the keys to the church are Muslims.

Pilgrims light 33 candles

Before the appearance of the Holy Fire, the pilgrims who gather in the church hold 33 candles in their hands. Each candle symbolizes every year of Christ’s life on Earth. In the tomb of Jesus Christ, the Holy Fire descends on a lamp of olive oil and 33 candles that are placed in the tomb by the priests.

Priests are searched before entering Jesus’s tomb

Before the descent of the Holy Fire, priests take off all their clothes and remain in their inner cassocks. Then, they are awaiting the appearance of the Holy Fire inside Jesus Christ’s tomb. During the whole procedure, the tomb remains sealed

Holy Fire ascends within whole year

One of the most stunning things about the Holy Fire is that it flares up throughout the year. However, the Holy Fire that descended on Orthodox Easter is brought annually by special flights to churches in Russia, Greece, Ukraine, Serbia, Georgia, Moldova, Belarus, Poland, and Bulgaria.

Holy Fire possess miraculous qualities

The Holy Fire is a true miracle of the church. It has several unique qualities that science has failed to explain. Believers who were able to touch the fire immediately after its descent note that the flame burned neither the skin nor the hair within the first 10 minutes. Notably, in the entire history of the descent of the Holy Fire, it has never caused a fire. Many people have tried to solve this mystery albeit with no success.

|

Метки: #photo_news |

US inflation rate down to 1.5% in March |

According to experts, the US economy was strongly hit by the coronavirus pandemic as the inflation rate in the country slowed down drastically. In March 2020, consumer prices (CPI) in the US were up by 1.5% as compared to the same period last year. The US Labour Department reported that prices rose by 2.3% in February this year. As a result, the inflation rate dropped to the lowest level since February 2019.In March, the consumer price index dipped by 0.4% on a monthly basis after edging up by 0.1% in January and February 2020. Analysts expected a rise of 1.6% year-on-year and a decline of 0.3% on a monthly basis. In addition, food prices rose by 1.9% in March. At the same time, the Core CPI, which measures the changes in the price of goods and services, excluding food and energy, was lower by 0.1%. According to experts, this was the first biggest drop of the CPI since 2010. In March 2020, the average hourly earnings in the US rose by 0.8% adjusted for inflation.

Read more: https://www.mt5.com/forex_humor/image/48801

|

Метки: #forex_caricature |

US inflation rate down to 1.5% in March |

According to experts, the US economy was strongly hit by the coronavirus pandemic as the inflation rate in the country slowed down drastically. In March 2020, consumer prices (CPI) in the US were up by 1.5% as compared to the same period last year. The US Labour Department reported that prices rose by 2.3% in February this year. As a result, the inflation rate dropped to the lowest level since February 2019.In March, the consumer price index dipped by 0.4% on a monthly basis after edging up by 0.1% in January and February 2020. Analysts expected a rise of 1.6% year-on-year and a decline of 0.3% on a monthly basis. In addition, food prices rose by 1.9% in March. At the same time, the Core CPI, which measures the changes in the price of goods and services, excluding food and energy, was lower by 0.1%. According to experts, this was the first biggest drop of the CPI since 2010. In March 2020, the average hourly earnings in the US rose by 0.8% adjusted for inflation.

Read more: https://www.mt5.com/forex_humor/image/48801

|

Метки: #forex_caricature |

Famous insider trading cases |

Insider trading in the US has been a part of the market since 18 century. As a result, numerous traders and bankers got rich. However, similar incidents occasionally lead to scandals.

Read about famous insider trading cases in our photo gallery

The Wall Street Journal/R. Foster Winans

R. Foster Winans had been a columnist for The Wall Street Journal for three years. He was convicted of insider trading and mail fraud.

In 1985, he was accused of giving information to two stockbrokers about stocks he was planning to write about in his column. Traders used this information and earned about $690 thousand. Winans’ cut was $31 thousand.

As a result, Winans was sentenced to 18 months in prison. Other conspirators were also convicted.

ENRON/JEFFREY SKILLING

Jeffrey Skilling, the former Enron president, became the most famous business criminal who managed to serve his sentence and get out of jail.

Skilling was indicted on 35 cases of fraud, insider trading, and other crimes related to the Enron scandal.

Skilling pleaded not guilty of all charges. However, prosecution managed to bring Skilling to justice when he sold almost $60 million of Enron's shares after quitting the company.

Prosecutors said that Jeffrey knew about the company's imminent insolvency and used this against all laws on foreign exchange operations.

As a result, Skilling was sentenced to 292 months in prison.

IVAN BOESKY

Ivan Boesky, a son of a Russian immigrant, became one of the wealthiest people in the US thanks to insider information. However, shocking trading scandal that occurred in 1986 completely ruined his reputation.

Boesky’s company was engaged in insider trading. Using both public and insider information, Boesky found corporate takeovers and bought their shares shortly before the release of public information. Then, he sold the shares a few days before corporations announced a takeover.

Boesky’s success attracted attention of the US Securities and Exchange Commission. In 1986, the prosecution revealed that Boesky was passing insider information to Dennis B. Levine, a managing director of Drexel Burnham Lambert, who was taken into custody in May. Boesky had been under surveillance since that day.

In 1986, federal investigators offered Boesky a secret agreement instead of a longtime prison term. According to the agreement, Boesky was forbidden from security trading for life. Moreover, he had to uncover other traders who used takeover information for illegal purposes.

As a result, Boesky met dozens of his former partners in crime with a listening device attached to him. In the aftermath, 14 traders were arrested.

Business Week

In 1990, printing company worker William Jackson and stockbroker Brian Callahan were convicted of using stock information in Business Week magazine before it was distributed to the public.

According to the Court, Jackson and Callahan made over $19 thousand each. As a result, they had to pay $37,445.

GALLEON GROUP/RAJ RAJARATNAM

The District Court of New York convicted former billionaire and the head of the hedge fund firm Galleon Group of insider trading.

Once a successful billionaire and the hedge fund manager of the Galleon Group, Raj Rajaratnam, was found guilty of conspiracy and securities fraud by the District Court of New York.

According to the Court, the billionaire had been using insider information he received from executives, bankers, traders, and directors of such companies as Goldman Sachs, Intel, and Hilton Hotels for seven years.

As a result, Rajaratnam made some $45 million. On May 11, 2011, he was sentenced to 11 years in prison.

KEEFE, BRUYETTE & WOODS/MCDERMOTT JR.

James McDermott Jr., CEO of investment bank Keefe, Bruyette & Woods, was convinced of insider trading in 2000.

He gave the information about pending bank merger to his mistress Marilyn Star, an adult-movie actress.

McDermott Jr. was sentenced to 8 months in prison. His mistress received a 3-months term. Moreover, McDermott Jr. was ordered to pay a fine of $25 thousand.

ImClone

Former ImClone CEO Samuel Waksal was sentenced to 87 months in prison and paid $3 million after he was found guilty of insider trading and fraud.

ImClone developed a new type of cancer drug, Erbitux. However, regulators rejected the application. Despite this fact, Samuel Waksal sold the company’s stock. Later, the drug was approved.

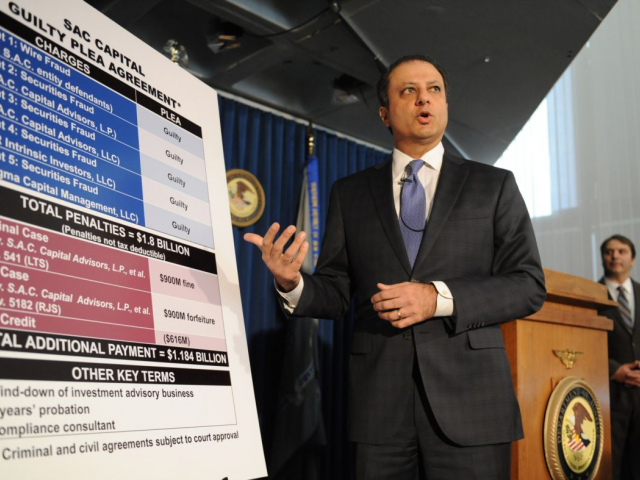

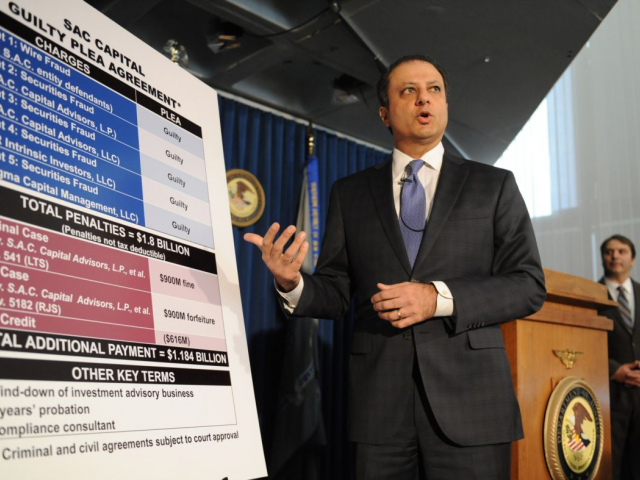

SAC GROUP/STEVEN A. COHEN

Steven Cohen is the founder of SAC Capital Partners. He became known for his phenomenal ability to make money regardless of market conditions. BusinessWeek called Cohen the most influential trader on Wall Street.

Cohen had been closely watched by the US Attorney Office and regulatory authorities for a couple of years. The investigation of the SAC Capital case became one of the major and long-term processes in the history of Wall Street. The first suspicions among regulators and prosecutors arose more than ten years ago.

However, the SEC was the only government department that dared to publicly accuse Steven Cohen. The company was accused of encouraging its employees to insider trading since 1999 and ignoring signs of illegitimacy of such practice. Several cases of fraud and insider trading were uncovered.

According to the SEC, SAC Capital illegally earned more than $275 million on insider trading.

In November 2013, the hedge fund SAC Capital pleaded guilty to securities fraud as part of the insider trading case and agreed to pay a record $1.8 billion. At the same time, New York District Attorney announced that SAC Capital would stop its investment consulting activity.

|

Метки: #photo_news |

Famous insider trading cases |

Insider trading in the US has been a part of the market since 18 century. As a result, numerous traders and bankers got rich. However, similar incidents occasionally lead to scandals.

Read about famous insider trading cases in our photo gallery

The Wall Street Journal/R. Foster Winans

R. Foster Winans had been a columnist for The Wall Street Journal for three years. He was convicted of insider trading and mail fraud.

In 1985, he was accused of giving information to two stockbrokers about stocks he was planning to write about in his column. Traders used this information and earned about $690 thousand. Winans’ cut was $31 thousand.

As a result, Winans was sentenced to 18 months in prison. Other conspirators were also convicted.

ENRON/JEFFREY SKILLING

Jeffrey Skilling, the former Enron president, became the most famous business criminal who managed to serve his sentence and get out of jail.

Skilling was indicted on 35 cases of fraud, insider trading, and other crimes related to the Enron scandal.

Skilling pleaded not guilty of all charges. However, prosecution managed to bring Skilling to justice when he sold almost $60 million of Enron's shares after quitting the company.

Prosecutors said that Jeffrey knew about the company's imminent insolvency and used this against all laws on foreign exchange operations.

As a result, Skilling was sentenced to 292 months in prison.

IVAN BOESKY

Ivan Boesky, a son of a Russian immigrant, became one of the wealthiest people in the US thanks to insider information. However, shocking trading scandal that occurred in 1986 completely ruined his reputation.

Boesky’s company was engaged in insider trading. Using both public and insider information, Boesky found corporate takeovers and bought their shares shortly before the release of public information. Then, he sold the shares a few days before corporations announced a takeover.

Boesky’s success attracted attention of the US Securities and Exchange Commission. In 1986, the prosecution revealed that Boesky was passing insider information to Dennis B. Levine, a managing director of Drexel Burnham Lambert, who was taken into custody in May. Boesky had been under surveillance since that day.

In 1986, federal investigators offered Boesky a secret agreement instead of a longtime prison term. According to the agreement, Boesky was forbidden from security trading for life. Moreover, he had to uncover other traders who used takeover information for illegal purposes.

As a result, Boesky met dozens of his former partners in crime with a listening device attached to him. In the aftermath, 14 traders were arrested.

Business Week

In 1990, printing company worker William Jackson and stockbroker Brian Callahan were convicted of using stock information in Business Week magazine before it was distributed to the public.

According to the Court, Jackson and Callahan made over $19 thousand each. As a result, they had to pay $37,445.

GALLEON GROUP/RAJ RAJARATNAM

The District Court of New York convicted former billionaire and the head of the hedge fund firm Galleon Group of insider trading.

Once a successful billionaire and the hedge fund manager of the Galleon Group, Raj Rajaratnam, was found guilty of conspiracy and securities fraud by the District Court of New York.

According to the Court, the billionaire had been using insider information he received from executives, bankers, traders, and directors of such companies as Goldman Sachs, Intel, and Hilton Hotels for seven years.

As a result, Rajaratnam made some $45 million. On May 11, 2011, he was sentenced to 11 years in prison.

KEEFE, BRUYETTE & WOODS/MCDERMOTT JR.

James McDermott Jr., CEO of investment bank Keefe, Bruyette & Woods, was convinced of insider trading in 2000.

He gave the information about pending bank merger to his mistress Marilyn Star, an adult-movie actress.

McDermott Jr. was sentenced to 8 months in prison. His mistress received a 3-months term. Moreover, McDermott Jr. was ordered to pay a fine of $25 thousand.

ImClone

Former ImClone CEO Samuel Waksal was sentenced to 87 months in prison and paid $3 million after he was found guilty of insider trading and fraud.

ImClone developed a new type of cancer drug, Erbitux. However, regulators rejected the application. Despite this fact, Samuel Waksal sold the company’s stock. Later, the drug was approved.

SAC GROUP/STEVEN A. COHEN

Steven Cohen is the founder of SAC Capital Partners. He became known for his phenomenal ability to make money regardless of market conditions. BusinessWeek called Cohen the most influential trader on Wall Street.

Cohen had been closely watched by the US Attorney Office and regulatory authorities for a couple of years. The investigation of the SAC Capital case became one of the major and long-term processes in the history of Wall Street. The first suspicions among regulators and prosecutors arose more than ten years ago.

However, the SEC was the only government department that dared to publicly accuse Steven Cohen. The company was accused of encouraging its employees to insider trading since 1999 and ignoring signs of illegitimacy of such practice. Several cases of fraud and insider trading were uncovered.

According to the SEC, SAC Capital illegally earned more than $275 million on insider trading.

In November 2013, the hedge fund SAC Capital pleaded guilty to securities fraud as part of the insider trading case and agreed to pay a record $1.8 billion. At the same time, New York District Attorney announced that SAC Capital would stop its investment consulting activity.

|

Метки: #photo_news |

Moody’s downgrades ExxonMobil credit outlook after virus hits energy market |

A collapse in the oil market has weighed heavily on major oil companies, and ExxonMobil is no exception. America’s largest oil company is in a steady decline now. The company has been operating since 1866 and got its actual name after the merger of two oil companies in 1999. ExxonMobil is considered an industry titan and has a long history of ups and downs. According to some media reports, the oil giant was on the verge of bankruptcy several times, it almost stopped its operation once, and was occasionally posting huge losses. Recently, the oil giant’s profit has plunged to a record low and its once-perfect credit rating has been downgraded. For instance, Moody’s Investors Service has lowered the company’s debt rating from Aaa to Aa1. However, Moody’s explained this decision mainly by a number of negative external factors that the company has faced. According to Moody’s, “the company’s very high growth capital investment combined with muted oil and gas prices and low earnings in its downstream and chemicals segments resulted in substantial negative free cash flow and rising debt in 2019. ” What is more, analysts at Moody’s noted that “the large drop in oil prices and continued weakness in downstream and chemicals performance leaves the company poised to incur sizable negative free cash flow funded with debt.”

Read more: https://www.mt5.com/forex_humor/image/48766

|

Метки: #forex_caricature |

Holy Fire Easter ceremony in Jerusalem: seven curious facts |

Easter is a movable holiday. This year, Catholics celebrate Easter on April 12, while the Orthodox Сhurch on April 19. On this day, Christians pay special attention to their spiritual values as they mark the resurrection of Jesus Christ from the tomb on the third day after his crucifixion. Orthodox Christians consider the Holy Fire a miracle that occurs every year at the Church of the Holy Sepulchre. Every Christian is allowed to touch the flames as the Holy Fire supposedly does not burn the flesh. Find out seven other peculiar facts about the ceremony in this article

Holy Fire occurs every Easter Saturday

The descent of the Holy Fire every Holy Saturday is the miraculous event that takes place each year on the eve of Orthodox Easter. In 2020, it will be held on April 18 since Resurrection Sunday will take place on April 19.

It takes roots in early Christianity

This time-honored tradition dates back to the beginning of Christianity. The descent of the Holy Fire is first mentioned in the 4th century AD. Curiously enough, the Holy Fire may appear within five minutes but sometimes Christians await it around several hours. Before the descent of the Holy Fire, the Church of the Holy Sepulchre is illuminated by flashes of light.

Church of Holy Sepulchre opens gate to thousands of people

The Church of the Holy Sepulchre where the Holy Fire ceremony takes place is very spacious. It is able to accommodate 10 thousand believers. What is more, the church symbolizes the unity of various branches of Christianity as five Orthodox churches - Armenian, Greek, Coptic, Syrian, and Ethiopian- hold services there. Catholic masses also occur in the church. The keepers of the keys to the church are Muslims.

Pilgrims light 33 candles

Before the appearance of the Holy Fire, the pilgrims who gather in the church hold 33 candles in their hands. Each candle symbolizes every year of Christ’s life on Earth. In the tomb of Jesus Christ, the Holy Fire descends on a lamp of olive oil and 33 candles that are placed in the tomb by the priests.

Priests are searched before entering Jesus’s tomb

Before the descent of the Holy Fire, priests take off all their clothes and remain in their inner cassocks. Then, they are awaiting the appearance of the Holy Fire inside Jesus Christ’s tomb. During the whole procedure, the tomb remains sealed.

Holy Fire ascends within whole year

One of the most stunning things about the Holy Fire is that it flares up throughout the year. However, the Holy Fire that descended on Orthodox Easter is brought annually by special flights to churches in Russia, Greece, Ukraine, Serbia, Georgia, Moldova, Belarus, Poland, and Bulgaria.

Holy Fire possess miraculous qualities

The Holy Fire is a true miracle of the church. It has several unique qualities that science has failed to explain. Believers who were able to touch the fire immediately after its descent note that the flame burned neither the skin nor the hair within the first 10 minutes. Notably, in the entire history of the descent of the Holy Fire, it has never caused a fire. Many people have tried to solve this mystery albeit with no success.

|

Метки: #photo_news |